-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

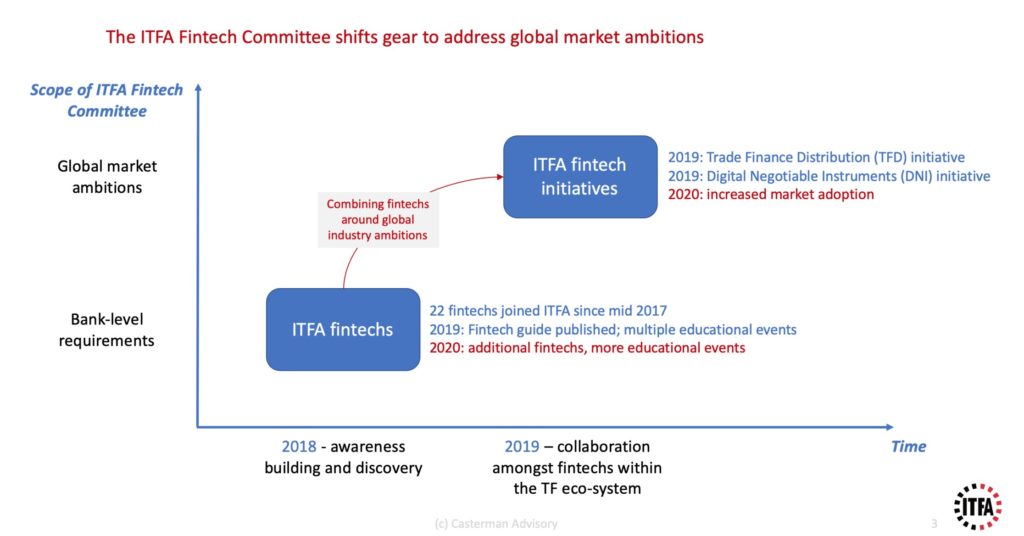

Following an initial educational phase of 2 years, the ITFA Fintech Committee is shifting gear with two strategic initiatives that tackle industry-wide ambitions. By facilitating collaboration amongst multiple fintechs and contributing through its expertise in defining new market practices, the ITFA Board demonstrates again it is best positioned to deliver more value to its core membership.

London, 4 February 2020

By André Casterman, Board Member and Chair of Fintech Committee, ITFA; CMO at INTIX and NED at Tradeteq

The ITFA fintechs – strong partners for the ITFA core membership

Since 2017, a multitude of fintechs demonstrated their willingness and ability to help incumbent financial institutions address most-pressing needs in trade finance. To date, a total of 22 fintechs joined ITFA as pictured below:

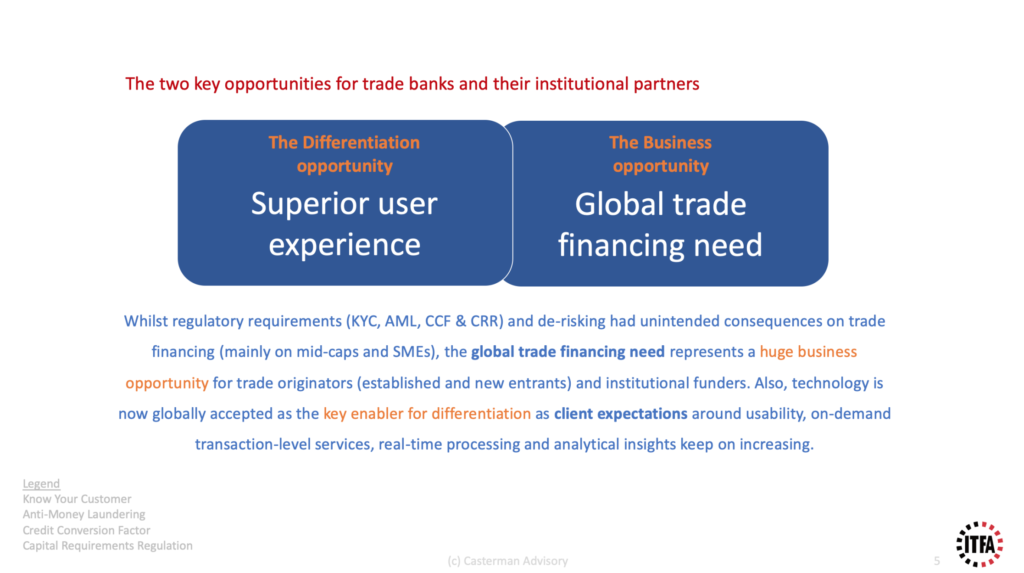

Those 20+ fintechs – as well as additional ones – provide a growing set of value propositions to the ITFA member banks in order (1) to improve user experience and (2) to address the global trade finance need.

ITFA shifts the fintech gear to address global market ambitions

During 2019, the ITFA Fintech Committee expanded its activities beyond the initial educational activities. The committee established technology-centric collaboration initiatives to accelerate adoption of infrastructure-level value propositions in both primary and secondary trade spaces. ITFA’s recognised role as convenor and its established ability in legal and regulatory matters, community-building and lobbying position the 300-member strong association as the ideal forum to forward such developments.

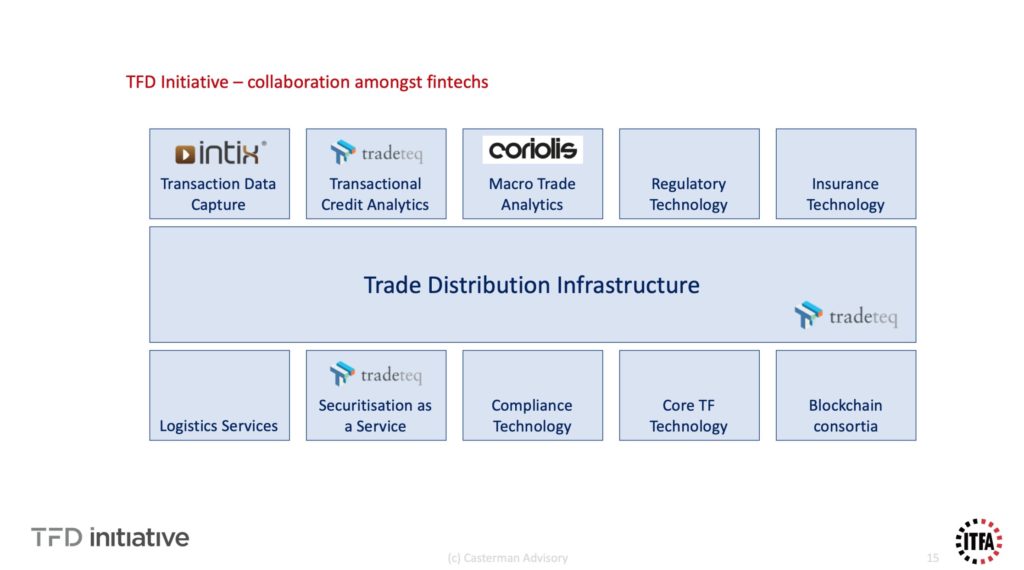

Given the high degree of specialisation of its 20+ fintech members, ITFA also identified the need to facilitate collaboration amongst those. As an example, when machine learning algorithms need to be fed with transaction data captured from banks’ internal systems, ITFA fintech member INTIX is best combined with ITFA fintech member Tradeteq for transaction-level credit scoring, with Coriolis for macro-level business development insights and with Traydstream for document trade flow processing. Check out the INTIX Insight of April 2019 for more details.

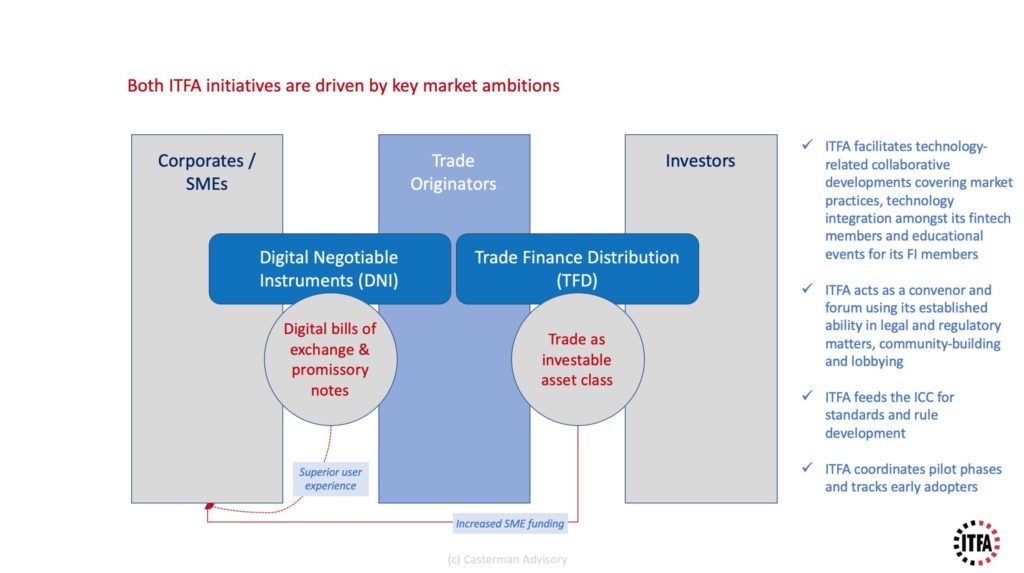

As a consequence, ITFA has established the following two initiatives: the Digital Negotiable Instruments (DNI) initiative and the Trade Finance Distribution (TFD) initiative.

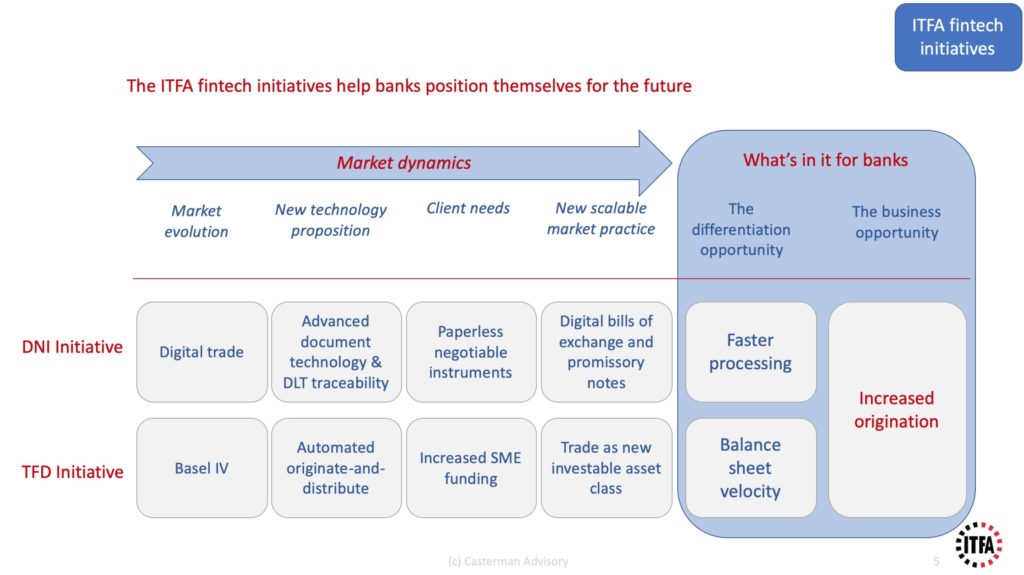

Whilst the first one concentrates on increased document digitisation in the primary space, the second one aims to grow institutional funding in the distribution space. As outlined on below chart, both initiatives are helping incumbent financial institutions – as well as new entrants – increase origination capacity (e.g., with increased balance sheet velocity) and service levels (e.g., with improved user experience) towards their corporate, mid-cap and SME clients.

Both initiatives serve the interests of the core ITFA membership as they address global industry needs such as (1) digitising negotiable instruments such as the bill of exchange and promissory note and (2) increasing institutional access to and understanding of the trade asset class. In both cases, the business opportunity for the core ITFA membership is to increase origination.

The Digital Negotiable Instruments Initiative

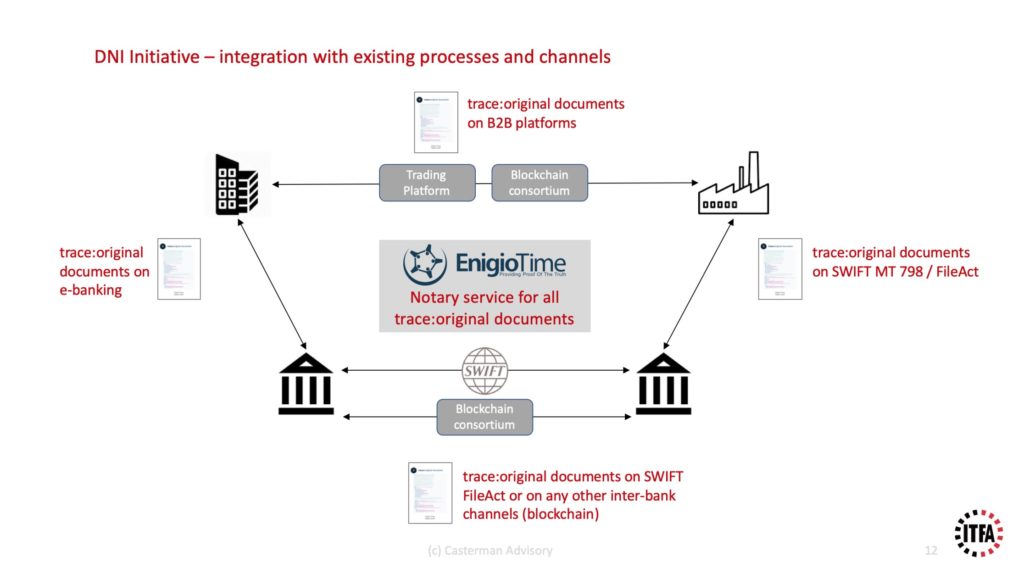

The DNI Initiative leverages an advanced DLT-based document technology solution that integrates seamlessly with existing and emerging channels. It is designed to be compatible with new buyer- and/or seller-centric brokerage platforms, pricing discovery platforms and blockchain infrastructures.

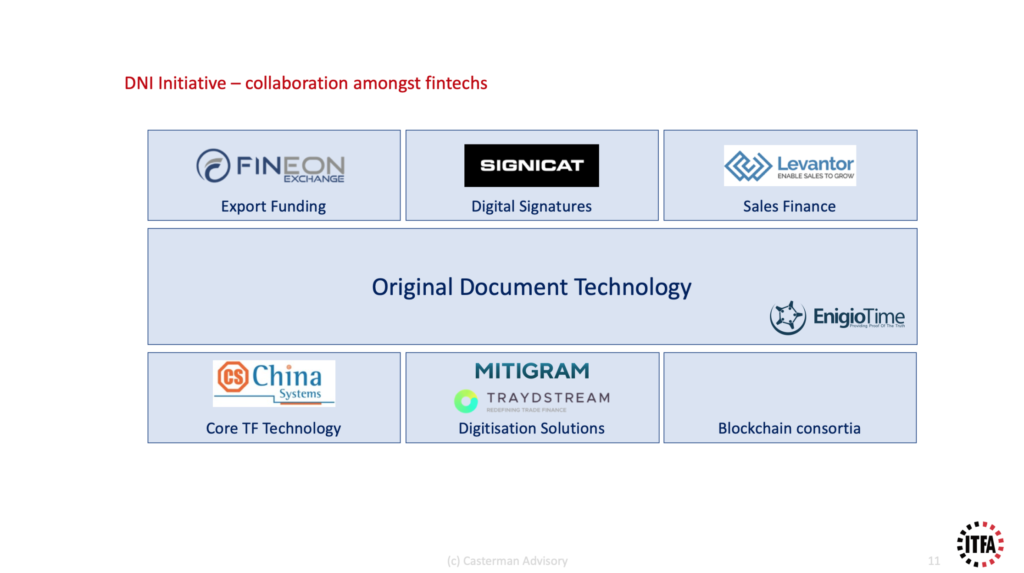

The DNI Initiative is attracting complementary technology players as depicted below and more will join in the coming months.

The Trade Finance Distribution Initiative

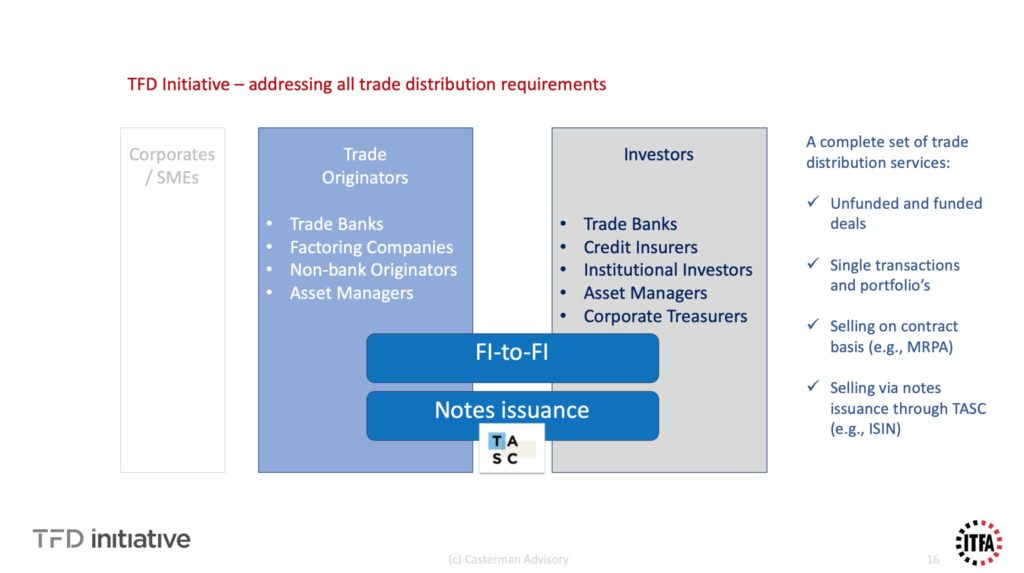

The TFD Initiative aims to establish Trade Finance as a new investable asset class for institutional investors. It enables bank- and non-bank originators to connect, interact and transact with bank- and non-bank funders such as capital market institutions.

The TFD Initiative is attracting complementary technology players as depicted below and more will be added in the coming months:

The TFD Initiative is attracting a growing community of originators, funders and complementary fintechs as outlined below:

More info

Contact us for a complete deck on on-going pilot phases and participants, as well as early adopters. Contact andre.casterman AT icloud.com for more information or contact any member of the fintech committee.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio