-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

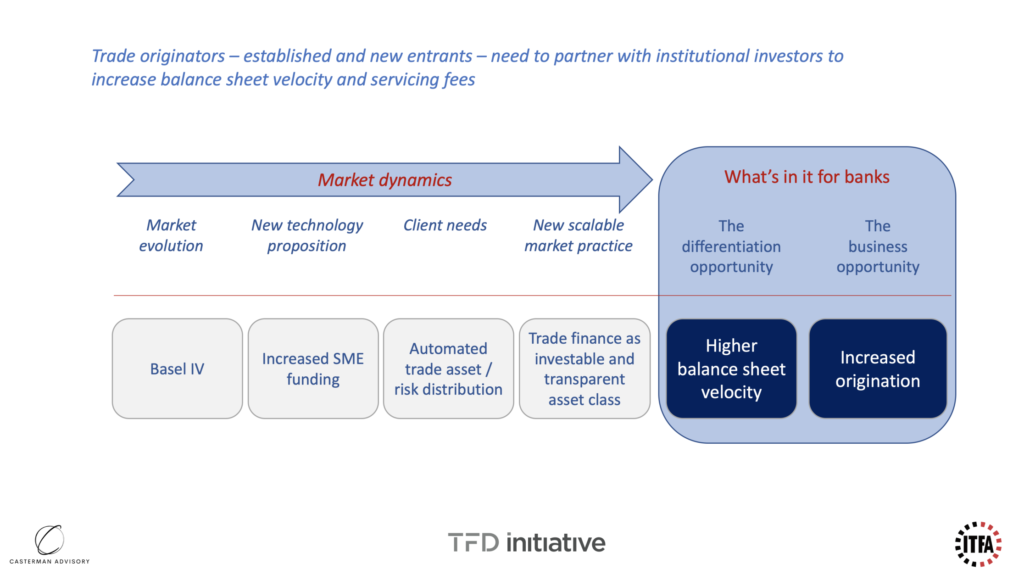

Much has been written about the impacts of Basel IV on trade originators. Similarly, the opportunities offered by the so-called originate-and-distribute model and the growing role of institutional investors have been clearly outlined in various industry papers and articles. How should originators prepare themselves to engage with new funders? Which are the key capabilities originators should expect from technology providers active in the secondary space? What is required to engage with new types of funders?

By André Casterman, Founder Casterman Advisory and Chair of Fintech Committee, ITFA and Christoph Gugelmann, Founder and CEO, Tradeteq

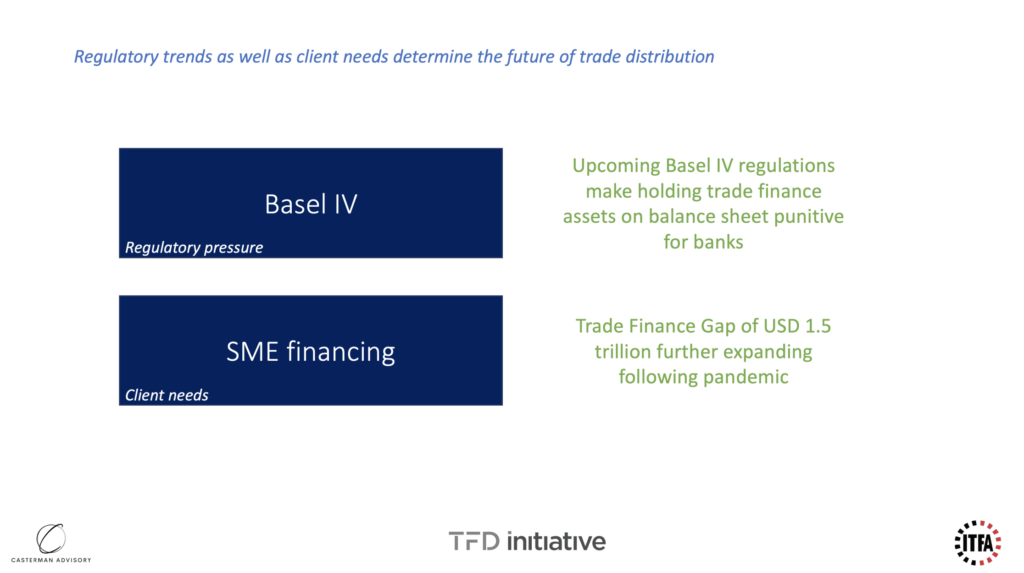

The secondary trade space is getting increasingly digital and new funders are discovering the benefits of the asset class with much enthusiasm. The regulatory trends as well as pressing client needs – in particular on the SME side – are determining the future of this space, as depicted on below chart:

A first consequence for originators – whether representing incumbent banks or alternative lenders – is the need to increase distribution volumes, i.e., including lower value open account transactions, which often implies the adoption of a technology solution to digitise and automate as many processes as possible. Before embarking on the selection of such solution and distributing larger flows, it is vital for sellers of assets to understand how this market is evolving and the related technology implications. This first step is key to define functional requirements in view of building or selecting a technology solution.

As reported in The Wall Street Journal of 22 January 2020 in an article entitled “Money managers, Lured by Rich Returns, Venture Into Risky World of Trade Finance“:

In a 2018 Euromoney article, Daniel Schmand, head of trade finance at Deutsche Bank, confirmed the trend: “Smaller or regional banks without a global origination network may want to hold on to their assets, but it is in our DNA as a trade finance bank to originate to distribute.” He added: “Demand is very strong; so far we have had absolutely no difficulty in finding investors and distributing assets at reasonable prices.”

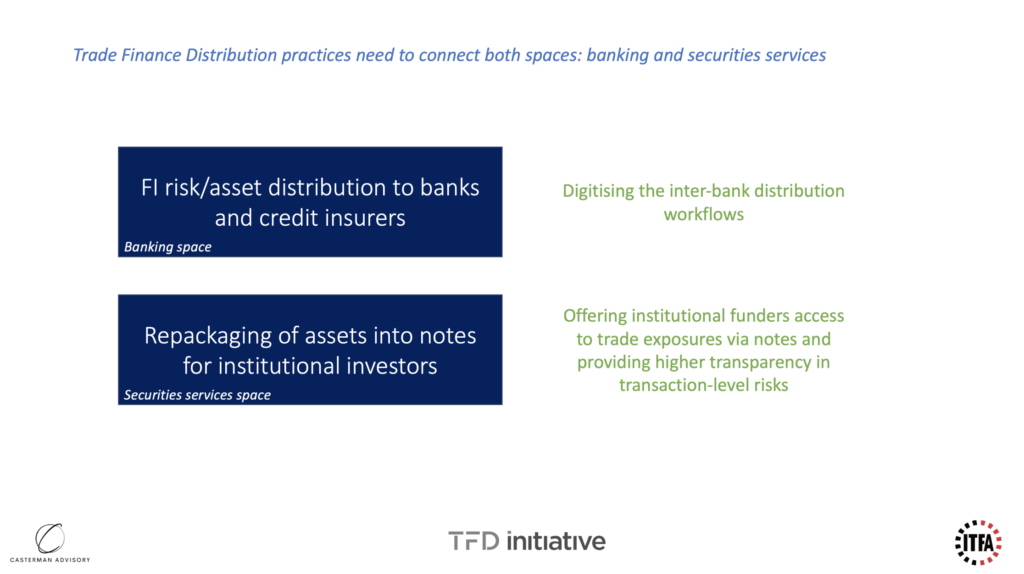

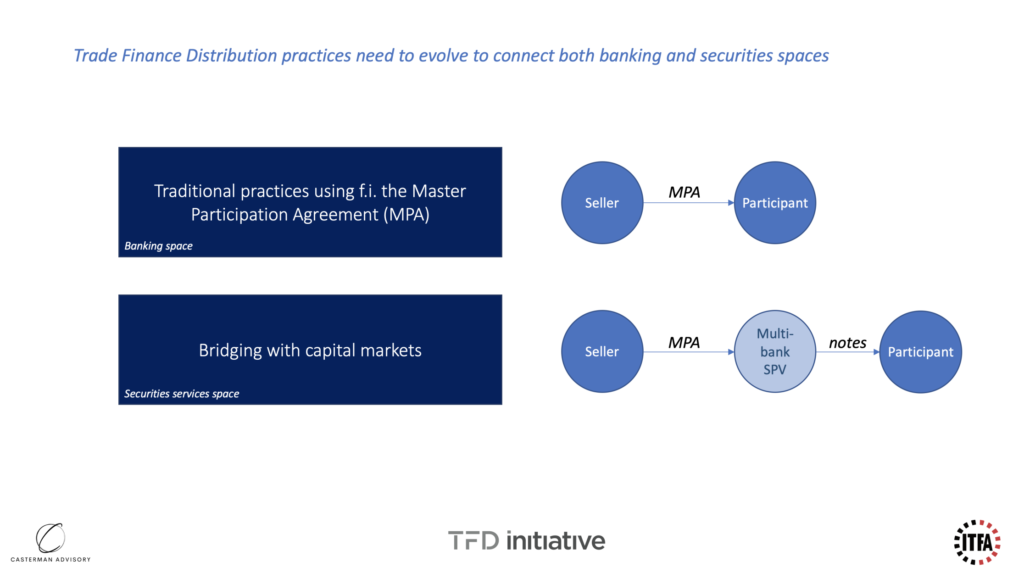

Those statements depict what I consider as the most important market trend: the growing role of institutional investors in funding trade flows originated by transaction banks. It also implies that trade distribution practices need to evolve beyond the current inter-bank distribution practices (e.g., based on the MPA). New practices need to be adopted by originators – of any size – to make those assets accessible to institutional funders in the way that they favour (e.g., notes). This is illustrated below. Whereas the inter-bank distribution practices may be adopted by some institutional funders, banks should not expect this to become the norm for that category of funders. This means the banking space needs to adapt to those operational practices as developed and regulated over the last half century for the securities services space.

Bridging trade finance with capital markets is easier said than done. It can be achieved by repackaging assets into notes to establish the appropriate bridge with the capital markets space. Repackaging effectively transforms trade assets into notes which is an instrument that investors active in various asset classes are comfortable dealing with (via their own custodians and regulated infrastructures such as Euroclear and Clearstream). Repackaging is achieved through a Special Purpose Vehicle (SPV) as suggested by the below chart.

Some platforms embed such repackaging capabilities in their value propositions whilst others limit themselves to facilitating person-to-person workflow features.

“Whereas the inter-bank distribution practices may be adopted by some institutional funders, banks should not expect this to become the norm for that category of funders.” André Casterman

Whereas message-based communication is usually one of the ancient – but still predominant – communication tools, the evolution of financial messaging has evolved beyond such paradigm which reminds the use of Telex. Providing visibility and analytics on end-to-end transactions is now considered as a pre-requisite by parties engaged in those transactions. This is why recent Internet-based platforms offer transaction-centric workflow management tools. This evolution was first witnessed in the corporate-to-bank about a decade ago where transaction management platforms were adopted by multi-bank corporates to manage trade flows. Since 2017, a limited number of platforms dedicated to the inter-bank distribution space emerged as well. Such functionality is relevant to digitise person-to-person trading activities but their functional scope is however incomplete for originators to sell portfolio’s of trade assets to institutional investors.

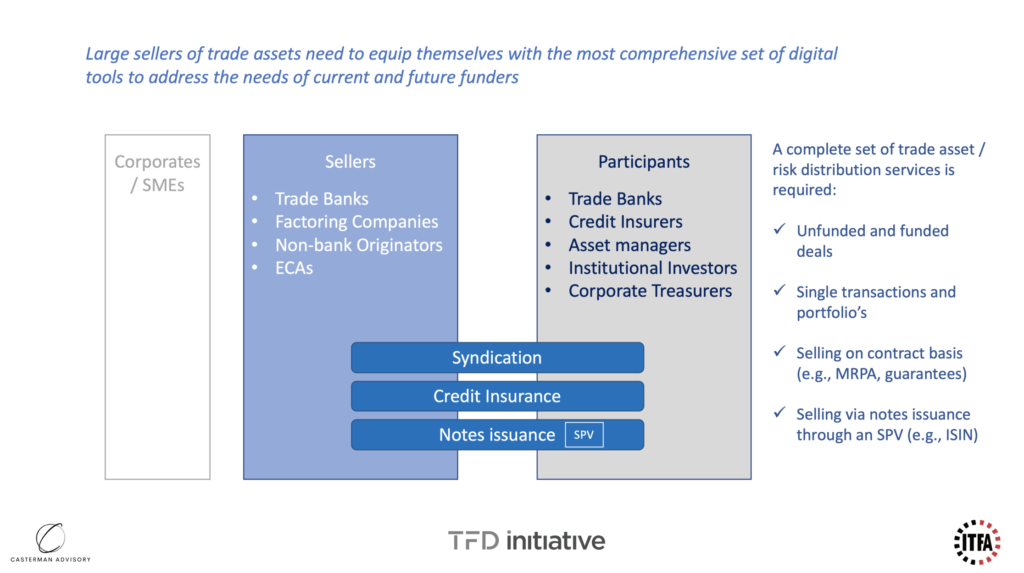

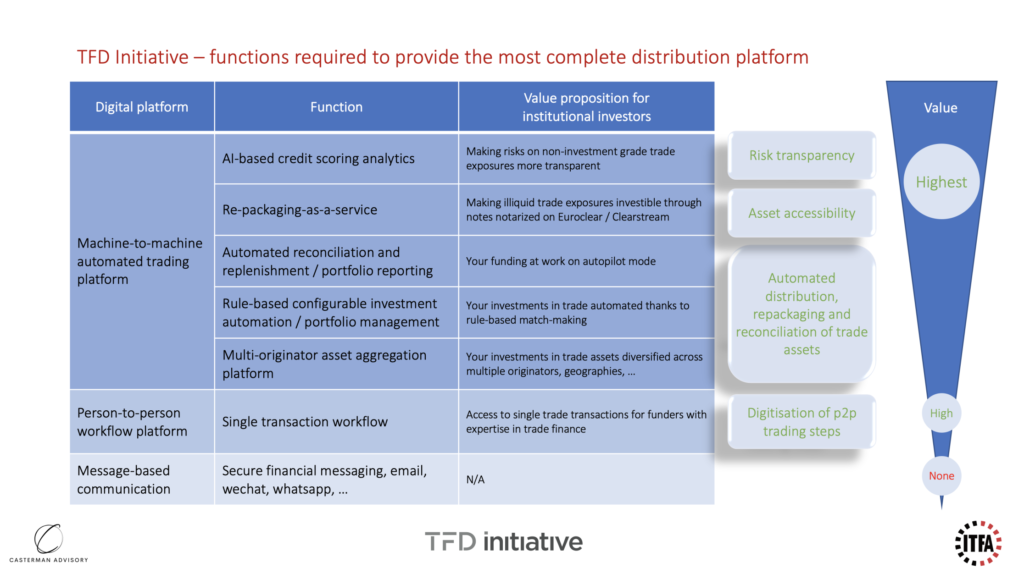

As the below chart suggests, digitising person-to-person distribution workflows is only part of the target technology solution which is why TFD Initiative developed additional market practices to engage with institutional investors. Those are highlighted below:

This means advanced functionalities are required for originators to make trade assets accessible to capital market firms such as rule-based matching to automate investments, automated reconciliation and replenishment, portfolio management and re-packaging through a shared SPV. Such capabilities deliver an automated distribution process to originators and their funders and enable an optimal (continuous) allocation of funds to trade assets. Offering risk transparency through AI-based credit scoring further increases the value for funders. The functional breakdown is outlined below:

As I wrote in a blog on the future role of platforms in 2017, “online market places offer superior value propositions” and “online market places bring all involved parties together and enable to re-invent trade business processes“. Three years later, I can only emphasise the superiority of those very platforms that facilitate machine-to-machine process automation. This is one of the key determining factor when assessing the value of a platform as suggested by the scale of value (see right hand side on above chart). This is what TFD Initiative brings to originators so they can benefit from a complete set of distribution capabilities.

Automation is of paramount importance when distributing (hundreds of) thousands of receivable and/or payable transactions on a continuous basis, a task that no one would consider handling manually. Automation of distribution processes is – in my view – a must-have capability given the high volumes of open account trade assets that originators will distribute as part of their originate-and-distribute strategies.

“The assets, in the form of trade receivables, could be bundled in a portfolio of possibly thousands of individual assets, which revolve every 30 days, explains Gugelmann. In risk terms, bundling would not be tranched, as CDOs are, but would instead aim for simplicity. It requires a lot of automation to make this an efficient proposition for institutional investors.” Christoph Gugelmann in TreasuryToday

The automation of trade distribution will help originators increase balance sheet velocity and expand origination whilst reducing risks through 3rd party risk takers and funders. Originators will also benefit by increasing (1) revenues related to servicing and origination fees on distributed risk, (2) return over regulatory capital and (3) risk diversification.

As Natalie Blyth, global head of trade at HSBC said in the 2018 Euromoney article, “SMEs are the backbone of economic growth, but as things stand [in 2018], I don’t believe regulators or banks are providing them with all the tools they need to access finance”. Much changed in two years than to TFD Initiative and its early adopters.

“With bank-intermediated trade finance measured in trillions of dollars (the exact number is not known), even with a few hundred billion in outstanding investment flowing into trade finance from institutional investors, money market funds, wealth funds, family offices and so on (even retail, one day), it will not just be a game changer for global trade but also for many economies” Christoph Gugelmann in TreasuryToday

Thanks to automation-focused market practices introduced through TFD Initiative, banks are now far better equipped to address the Basel IV challenges and the SME financing opportunities. The global economy will benefit from broader access to cheap and affordable working capital via both incumbent institutions and new entrants.

Reach out to us for more insights on the TFD Initiative and other fintech activities on “Trade as Investment Class” delivered through ITFA and WOA. Check out the list of institutions involved in the TFD Initiative as published on www.tradefinancedistribution.com.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio