-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Written by Clarissa Dann and published by flow on 5th February 2024

While investors in trade finance assets were on an education journey, panellists at the 49th ITFA Annual Conference in Abu Dhabi discussed what this means for originators and distributors.

With around 80% of global trade financed by some form of trade credit, and 50% of it is in emerging markets, the ability to distribute trade finance assets is key to liquidity. On Trade Finance TV, 27 November 2023 show explored how the “originate-to-distribute” model has evolved; not only between banks, but also originators and investors, and how it has been shaped by regulation and technology.

However, seeds of this discussion were sown two months earlier at the International Trade & Forfaiting Association’s ITFA 49th Annual Conference, Abu Dhabi held 11–13 October 2023. The panel, confidently entitled, Bank to bank (and alternative investors) distribution – the state of the art, picked up the theme of trade asset distribution and talked about how innovations in documentation and digitalisation – and new investors – are changing the landscape.

Moderator: Clarissa Dann, Editorial Director, Marketing, Deutsche Bank (left)

How can trade finance distribution flows scale up?

A backdrop to the discussion was helpfully summarised by ITFA Fintech Committee Chair Andre Casterman two years earlier in 20211:

Returning to 2023, the panel discussed how not only bank balance sheet considerations were driving trade finance asset distribution – but also a sustained appetite from non-bank financial institutions (NBFIs) and private credit debt investors for the asset class.

“Trade has grown immensely in terms of regions and scales,” opened LiquidX’s Capolongo, a former banker whose trade career had started in 1986. He added “While banks have and still do dominate, we have seen a growing pool of non-bank investors joining the network.” Investors are attracted to the asset class because of the short-dated tenor of the assets acquired and the general yield that can be earned over and above public securities. Now that interest rates have risen there is, he continued, “floods of new money coming in”. This new and expanding pool of alternative investors not only supports the industry in terms of expansion of available capital, “but can also support the banks in their efforts to be nimble in terms of their effort to manage their balance sheet and distribute assets”.

Turning to the types of assets that are distributed, Komgo’s Izabela Czepirskia reminded delegates of the ITFA/Komgo Trade Finance Taxonomy2 published in 2022. Its aim was to “put the whole ecoysystem of trade finance on a single page – and that comprises many techniques, instruments and areas”. She explains that the taxonomy attempted to deal with primary and secondary markets that were “quite siloed” and that the benefits of the Taxonomy were that “you are able to see all the risk mitigation techniques, including insurance, and be more aware of how all the synergies work together”. In addition, it helps users understand how funded and unfunded participation can work and what the structures are on the secondary market.

According to Nishit Kumar of Mashreq Bank, distribution to banks is just one part of this Middle Eastern bank’s distribution book – with insurance companies and multilateral financial institutions being a big part of the mix. As a bank servicing emerging markets, macroeconomic challenges and adverse country ratings results in banks and insurance companies reducing their exposure here, but this is where Mashreq is “seeing a lot of support from multilaterals”.

The need to scale up is also driven by increasing trade in the India to UAE and India to US corridors, said 360tf’s Pankaj Mundra. Another accelerant was the first G20 Summit held in India on 9–10 September in New Delhi. His company (which helps banks without local branch offices) has seen a lot of demand from banks to help them support this.

Drivers of increased risk distribution

Capolongo said that banks needed to be nimbler – he recalled that during his time as a younger banker he would get calls from the credit department requesting that reduction in exposure to certain borrowers. This would mean calling the syndication group and, because of timing issues, sometimes selling at a loss. In other words, the impact of new prudential regulation means being able to manage exposure to certain clients quickly – inflationary pressures and interest rates rises always create credit issues with certain clients hence the continual need to reevaluate exposure.

“We have seen, across the board, spread compression”

Dominic Capolongo, Chief Revenue Officer, LiquidX

As global trade has expanded – along with the number of participants, “we have seen, across the board, spread compression,” he observed. In his view this is impacting the earnings of bank trade departments looking to offset these reductions – distribution being an additional source of basis points that would otherwise not be booked. “All these things are driving banks to be more thoughtful about how they manage the book – its not just ‘buy an asset and hold it for its life’.” Of course, he explained, the distribution model expands the challenge of managing the information that goes with all these relationships. “We need technology to provide the ability to get information out on a real-time basis in a readable format to the participants. That is the next fronter.”

Mashreq’s Kumar added the emerging market perspective that “the amount of trade finance needed has gone up for the same shipment volumes”. This, together with bank country limits coming under pressure because of poor country ratings, is another driver of distributing trade finance risk. “This means getting more investors into the ecosystem,” he said. Pankaj Mundra from 360tf confirmed this, citing changes in supply chains after the pandemic, and inflation in emerging markets increasing the demand for trade finance. “Because of downgrades of currency and country ratings of the emerging markets such as Africa and Bangladesh the need for risk distribution has grown.”

Non-bank investor appetite

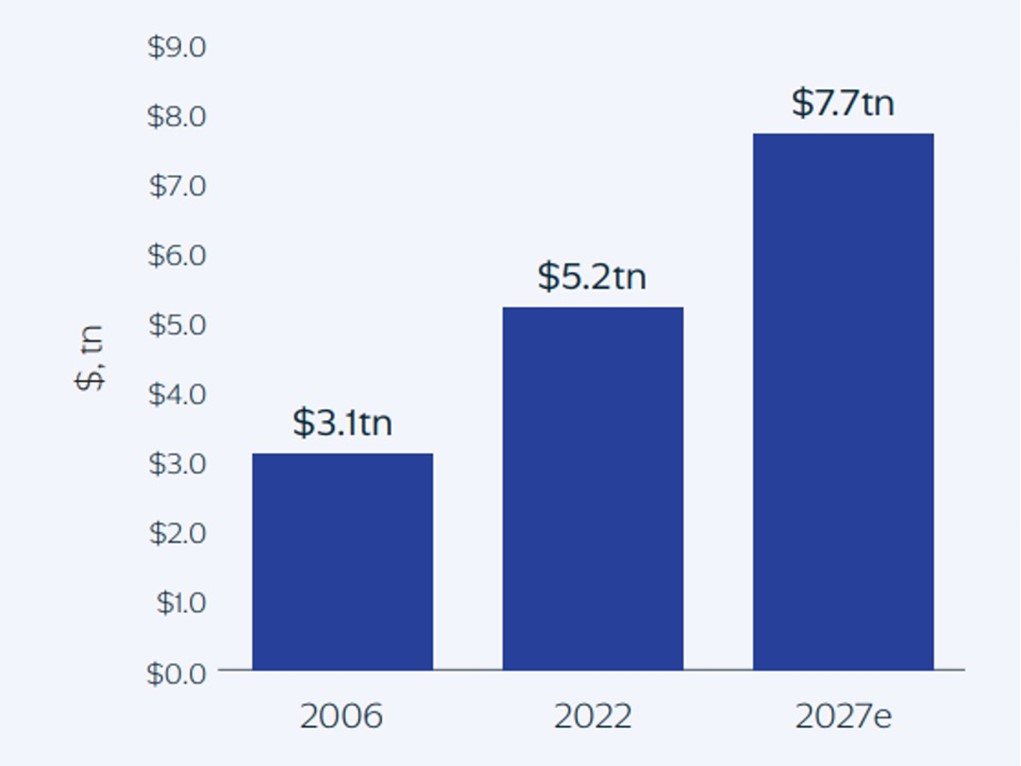

At the end of 2022, the private asset-backed finance (ABF) class was, noted US global investment company KKR in their report, Asset-Based Finance: A Fast-Growing Frontier in Private Credit (May 2023), 67% bigger than in 2006 and 15% larger than in 2020.3 KKR expects the market to grow from US$5.2trn to US7.7trn by 2027. “Higher inflation, the pullback of traditional lenders in response to rising interest rates, and the outbreak of volatility in the banking system are all likely to increase the need for private ABF”, says the report (see Figure 1).

Figure 1: the private ABF market’s rapid growth seems set to continue

Source: Integer Advisors forecasts and KKR research estimates as at October 31, 2022.

This provides a useful reminder of how investor interest in trade finance assets is also growing. At the 2022 ITFA Annual Conference in Porto, the ‘Has Asset Management embraced trade finance and what more is left to be done?’ panel concluded that investor understanding of trade finance funds and how they fitted into a balanced portfolio had some way to go. A year on, this panel agreed that a lot of progress on the education front had been made and investors are very much part of a broader distribution landscape. Mundra said he is seeing “a lot of private and retail banking customers investing in trade finance funds”.

“At Bank of America, NBFIs are becoming an increasingly important part of a wider cross-sell relationship strategy”

Khilola Turaeva, Head of Trade Risk Distribution and SCF Program Management, EMEA, Bank of America

Komgo’s Izabela Czepirska remarked that in emerging markets, where financial institution funding is less available, ongoing education of non-bank investors is still important as they step into this gap.

As NBFIs become more knowledgeable about trade – and they are hiring top trade finance talent into their organisations– more partnerships will evolve, reflected Khilola Turaeva. “Not all NBFIs require transformation of assets into the capital markets products – such as notes – and they do accept traditional risk distribution techniques using the Master Risk Participation Structure.”4 At Bank of America, NBFIs are becoming an increasingly important part of a wider cross-sell relationship strategy, she said.

Dominic Capolongo added that when he was on the US-based Trade Finance Advisory Council (TFAC),5 “the big topic was expanding trade finance reach to SMEs and the role non-bank investors could play – we have seen it on the insurance side of the trade market and the funding side. There is a pool of capital that has yet to be tapped”.

The panel did agree that NBFIs generally do not have the operational capabilities of banks. “This is an asset class well understood and operational protocols have been in place for a long time,” said Capolongo. While NBFIs can deploy the capital and understand the risk and evaluate the credit they are less likely to have the back-office equivalent to what the banks have built and appreciate the banks operating as the lead.

Outlook for trade finance distribution

In emerging markets, Mashreq’s Nishit Kumar is not seeing much appetite from trade finance funds and their main go to for support are the development finance institutions, multilaterals and insurance companies. “It would be great if more NBFIs came into this market, he said. Komgo’s Izabela Czepirska agreed and added “there are a lot of funders in the US, but we might not see that in emerging markets.” She stressed the importance of the multilateral agencies in bridging the liquidity gap. It is, however, a key market for “growing the book on the corporate asset side. “You can only assess something region-by-region and asset-by-asset,” she concluded. Mundra developed this point with the observation that regional GCC banks are building up their lines for new markets and trade corridors and that foreign banks were seeking strong relationships with local GCC issuing banks.

Turning to structuring, it was Kumar who reminded delegates how short-term trade finance is and packaging it into specific structures creates the need for continuous replenishment bringing with it a whole new set of legal and KYC processes. Bank of America’s Turaeva returned to the theme of partnerships and the need to explore what collaborations were possible to meet client needs – cost-effectively.

At the end of the day, banks, said Capolongo, “are not asset managers” and the syndication team is not there to build a portfolio. That is why partnerships with asset managers are so important – and partnerships are in place to expand capabilities and funding reach.

Sources

1 See itfa.org

2 See itfa.org

3 See kkr.com

4 See baft.org

5 See trade.gov

Privacy Policy | Cookie Policy

Designed and produced by dna.studio