-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By André Casterman, Founder and Managing Director, Casterman Advisory and Chair of Fintech Committee, ITFA

Predominant financial institutions have taken the lead on the TFD Initiative and recently outlined how digital trends, new ecosystems and regulations are impacting trade distribution practices. This is a strategic theme for the ITFA membership which is why I invited the following early adopters of TFD Initiative: Davide Guidicelli, Swiss Re Corporate Solutions, Theo Korver, ING and Silja Calac, Banco Santander. Adolfo Tunon, McKinsey & Company also joined the debate:

Where is the distribution space heading to? How can interests of stakeholders be aligned? Where are the new opportunities for credit insurers? Will new liquidity providers such as institutional investors engage more in trade in the future? What is the impact of increased distribution on net interest income and return on equity?

Here are the key take-aways from this intense panel debate:

1. Global trade is a business of 17 trillion USD on the product side and 5 trillion USD on the services side. The major challenge in this market is to close the well-known trade finance gap of 1.5 trillion USD; various community initiatives and commercial solutions have been launched over the last 4 years, each trying to contribute to this objective.

2. Balance sheet management is the key driver of many activities in the distribution space as Basel IV heavily impacts originators. The global banks are organising themselves with dedicated teams around active balance sheet management, and this trend is expanding to local originators (e.g., factoring companies, alternative lenders) too.

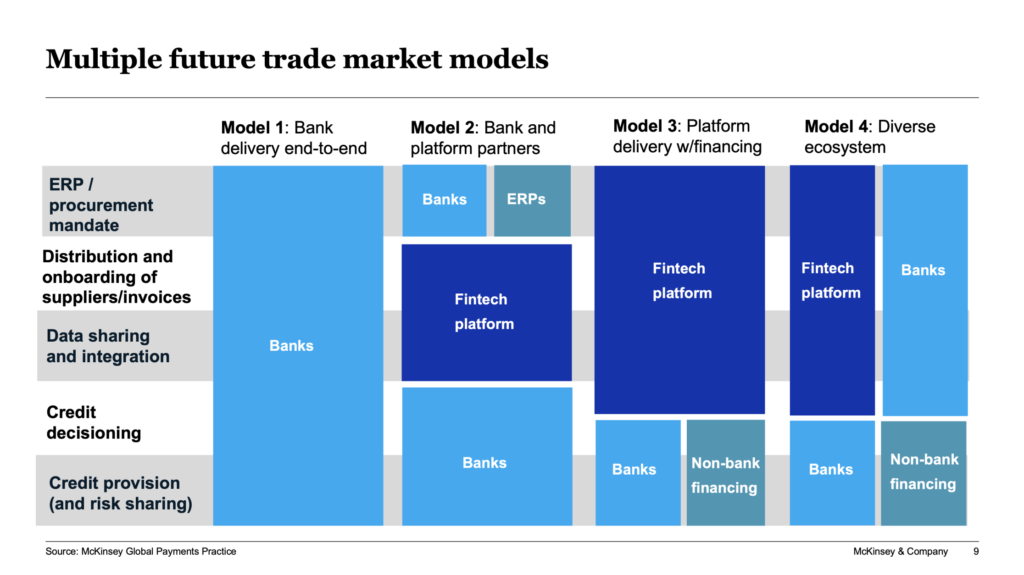

3. As fintechs increase their value propositions in the trade space and with banks starting to adopt new technology platofmrs, a multitude of trade market models integrating fintech capabilities within banks’ traditional services are emerging and co-existing. In addition, non-bank financing players and ERPs (e.g., SAP) are starting to form new ecosystems (see below picture).

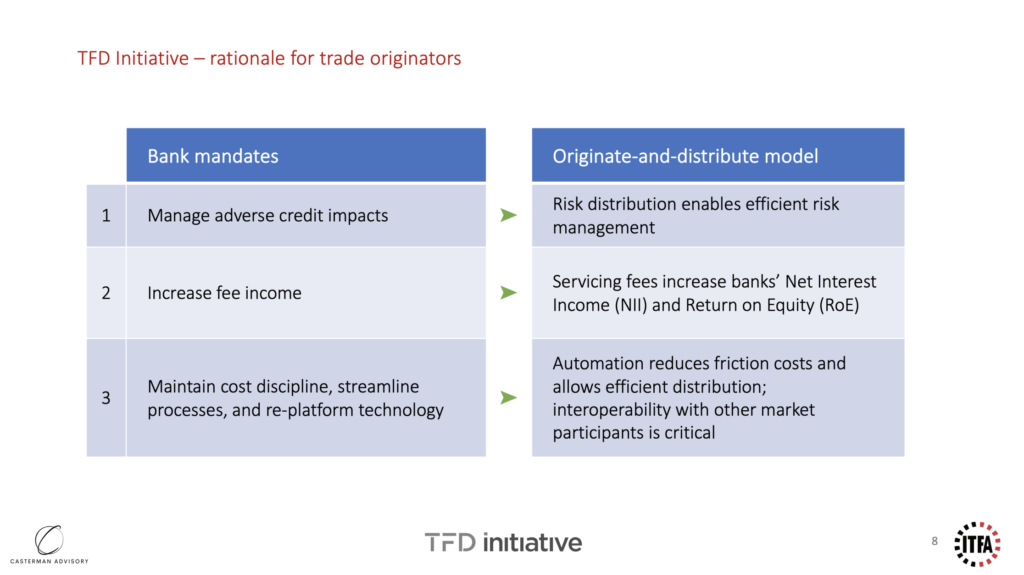

4. Cost efficiency is another key priority. Less margins on the table, higher transactional costs due to regulations are today’s realities for trade banks which means that maintaining a global trade network is very costly. The more sophisticated banks are looking at monetising their franchise more efficiently through active balance sheet management. This is where the originate-and-distribute (O&D) model comes into play. Process automation is a key part of the solution. Servicing fees are a key driver for banks to increase their Net Interest Income (NII) and Return on Equity (RoE).

5. Technology is now available off-the-shelf to many more banks, not only the top ones. Thanks to fintech developments and use of cloud computing, any bank can take advantage of advanced off-the-shelf technology propositions, i.e., avoiding large and risky project-specific capital expenditures. Time-to-market in terms of adoption of such new technology propositions makes the difference, not the deep pockets to invest in the development of any proprietary tool as it was still the case a few years ago. This is very beneficial to the global trade community.

6. Credit insurers need to prepare for increased distribution volumes – the opportunities for credit insurers are to offer meaningful capacity on a broad range of asset classes whilst offering timely responses to distribution enquiries. The client expectations are evolving and faster decision making is key as well as access to services via APIs.

7. The originate-and-distribute model increases capacity in the extended lending system. With the O&D model, originators can grow their client financing activities, reduce risk weighted assets (RWAs), and handle more volumes. Originators favour to increase volume and limit the time spent on individual transactions, this is where technology helps through automated processing.

8. The industry needs to work on the root causes of the trade finance gap such as transparency, risk appetite and cost; those issues are predominant in the SME space (e.g., risk transparency). We need new approaches to credit assessment, new ways to score counter-parties and their transactions, … technology has a major role to play in this area and should help bring more capacity (risk & funding) to SMEs in particular.

9. Institutional investors represent a new distribution channel to make it happen as they bring the needed liquidity to originators.

10. Early adopters of TFD Initiative such as ING demonstrated in 2020 how technology makes it possible to bring short-term trade assets to non-bank liquidity investors in a digital and automated way. Whereas most non-bank investors (e.g., asset managers, pension funds and family offices) are still discovering trade as an alternative investment class, banks have openly voiced their willingness to expand their relationships with those new types of parties.

11. Institutional investors represent an opportunity for credit insurers too but, clearly, each distribution channel has pros and cons. Sophisticated banks will rely on various channels to decrease dependency on the one or the other. Also those various options address various needs of originators, so it is up to them to pick and choose. There is also an opportunity for credit insurers to further enhance the risk profile of the invested assets which will attract more institutional funding.

12. Institutional investors need to demonstrate their new role in trade is not just cyclical; there is a risk that institutional funders be attracted by trade until such time when interest rates rise again. So long-term partnerships need to be established to ensure originators can confidently rely on this new source of liquidity.

13. Getting the new investors familiar with the asset class is a priority for the industry. This is why TFD Initiative aims to attract more of such liquidity investors as they recognise the opportunity to work with transaction banks rather than directly with individual corporate and SME clients.

14. Standardisation of market practices and the underlying technology infrastructure is a key deliverable of TFD Initiative and this will accelerate the adoption of the originate-and-distribute model. The goal is to offer a harmonised access to all parties: originators to easily access risk and funding capacity and investors (risk and/or funding) to easily access originators through a common hub platform.

The above take-aways collected during this TFD Initiative webinar of 28 October contribute to the thought leadership of the initiative, and it also helps shape its future. We thank the members of TFD Initiative – ING, Santander and Swiss Re – as well as McKinsey & Company for their contributions.

Watch out for the next TFD Initiative webinars. More sessions are planned till year-end. Make sure you spot the ITFA invite and register via ITFA secretariat.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio