-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By Andre Casterman, Chair Fintech Committee, ITFA , Founder at Casterman Advisory and Member of ICC UK Legal Reforms Steering Group

The first half of 2021 revealed a new set of early adopters of TFD Initiative.

In June, we invited some of those early adopters for sharing their experience around the digitisation of trade credit insurance distribution flows. The following experts got on the ITFA stage:

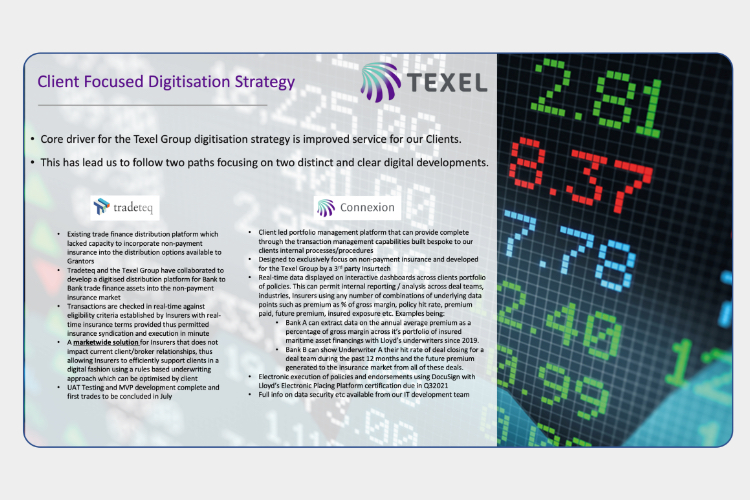

Simon Bessant kicked off by sharing the path chosen by Texel which led to a partnership with Tradeteq as announced in January. “Tradeteq offers an automated platform where underwriters define their rules around issuing banks, pricing, concentration in countries/industries, … Trades submitted by banks on Tradeteq are checked in real time against eligibility criteria established by connected underwriters such as Liberty Specialty Markets”, explained Simon. In 2020, Texel took the decision to adopt Tradeteq’s market-wide solution (i.e. multi-bank and multi-investor) to digitise credit insurance flows with trade originators, and to combine it with a proprietary solution (called Connexion) that focuses on portfolio and data management across their clients insurance book. Simon shared more on Texel’s strategy based on below:

Both N L N Swaroop and Natasa Ruiter explained how important credit insurance is to the trade finance business at their institutions, HSBC and ING. Banks view credit insurers and brokers as long-term partners, and such relationships span various types of trade finance products. The objectives for banks include capital relief, concentration risk, risk mitigant, …

Huw then expanded on the direct benefits of digitising credit insurance flows as follows:

Additional benefits emerged from the panel discussion:

The risk related to the transaction is not changing however.

The panel identified three major opportunities as the industry continues to digitise credit insurance flows:

The digitisation of the credit insurance flows will also benefit the intermediaries as brokers have the opportunity to move up the value chain and provide strategic advisory on market trends, counterparties and initiatives, rather than spending most time processing transactions.

The main legal challenge that the panel debated is around cross-border data sharing which requires more industry work and regulatory clarity.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio