-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By André Casterman, Founder Casterman Advisory and Chair Fintech Committee, ITFA

Q2 2020 will be remembered as an exciting quarter for the ITFA Fintech Committee as we actively engaged with the trade community through a series of webinars. We report on those sessions below.

We had much progress to share on the two Fintech Initiatives: DNI and TFD – both initiated in 2019. During the same period, some ITFA fintechs progressed their collaborative work and were offered the opportunity to share their thoughts on the future outcome of both initiatives via a total of 6 webinars. Debates between some fintech members taking place in April and May triggered the set-up of the Technology Experts for Regulatory Action (TERA) task force which we announced in June.

TFD Initiative webinar on COVID-19 relief efforts

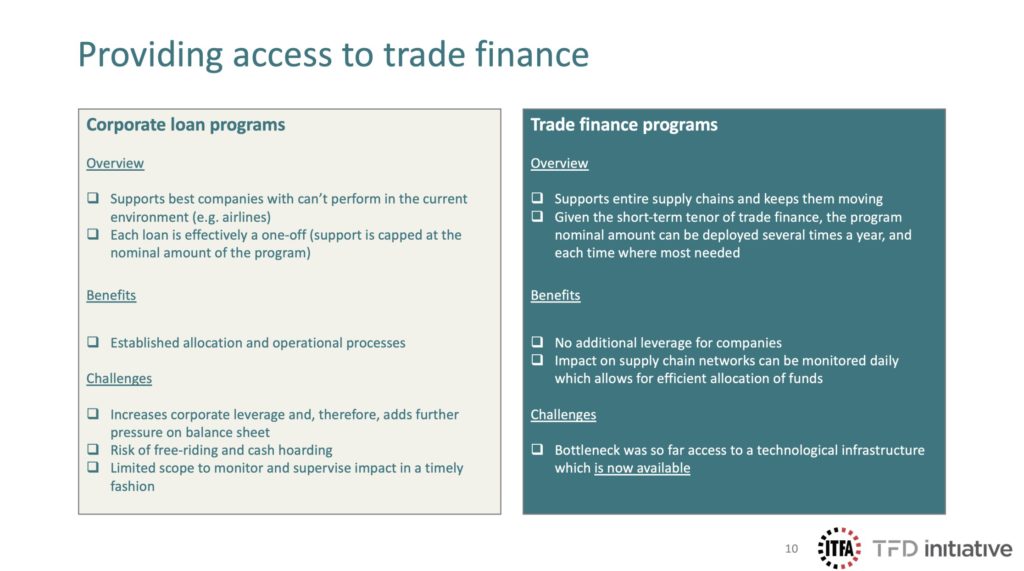

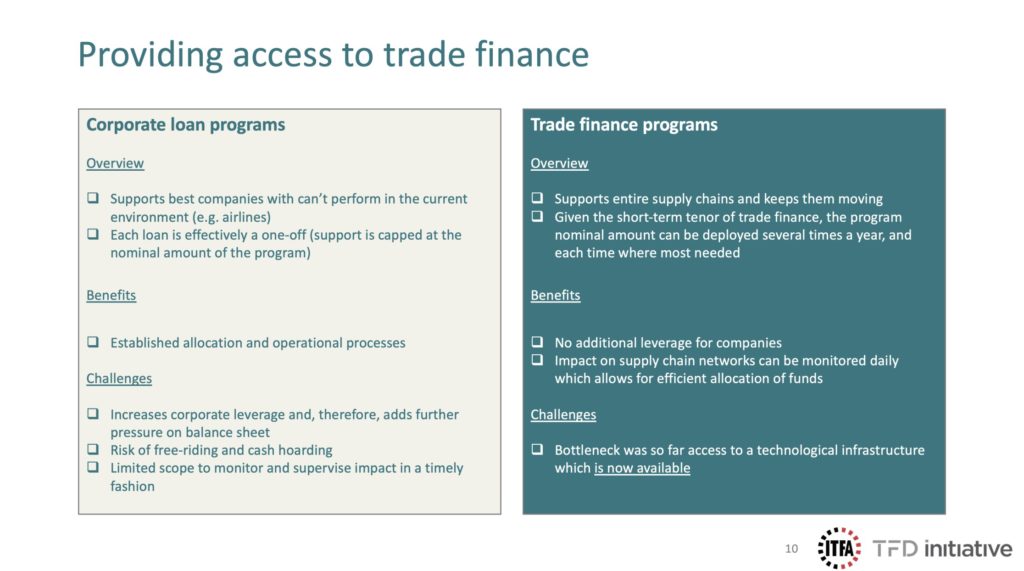

Starting on April 2nd, we outlined ways in which governments and central banks around the world can take advantage of new market practices introduced by the TFD Initiative. By acting as risk takers and/or funders in the secondary market, governments have the possibility to extend public relief efforts to the real economy. Working through their current financiers, SMEs and corporates can benefit from COVID-19 relief efforts on an automated basis. In this way, trade finance assets such as payables and receivables are financed on a revolving basis. This brings many benefits to both banks and governments in terms of traceability, re-usability, reporting and analytics.

During that webinar, Christoph Gugelmann, CEO, Tradeteq raised a call to action to the UK Government stating: “Future decisions from Number 10 need to take into account alternative methods to ensure trade and commerce can continue. Providing funds to banks, specifically for trade finance lending, will help support trade, retain jobs and maintain supply chains at a time when these areas are most at risk. To help exporters, I would urge the Government to explore the possibility of buying or guaranteeing banks’ trade finance exposure.”

During that very initial COVID-19 webinar, Bhavna Saraf, MD, Head of Trade Product, Lloyds Banking Group added: “On trade vs. loan, the visibility and transparency of use of funds, short-term tenor, often self-liquidating, low loss given default, all these attributes lead to a more favourable capital treatment. Banks can maintain their client relationship whilst not having to carry the burden of figuring out the whole end-to-end distribution mechanism; the ability to recycle capital through automated replenishment is key as well given the high volume of receivables and payables banks originate.”

Take-away #1: Regulators need market guidance to understand how technology-based trade finance practices can facilitate COVID-19 related financing, next to extending loans.

Webinar on COVID-19 challenges in documentary trade ops

During the April 9th webinar on trade operations, we outlined the challenges faced by the whole industry with regards to documentary credits following the COVID-19 impacts. We heard from trade finance banks – Citi, Standard Chartered Bank, Standard Bank and SMBC – as well as from ITFA Fintech members Bolero and Traydstream.

Sameer Sehgal, CEO of Traydstream, an ITFA Fintech member, summarised the issues: “With bankers now forced to work from home, their dependence on traditional, office-based systems is slowing down the volumes of trade finance documents that can be processed. This is negatively impacting liquidity for corporates”. There is a need to move documents such as bills of exchange, bills of lading, warehouse receipts, … to full digital solutions.

Take-away #2: Regulations are lagging behind as recent technologies such as DLT-based document technology now offer more opportunities for digitisation but regulatory action holds the key to scale adoption

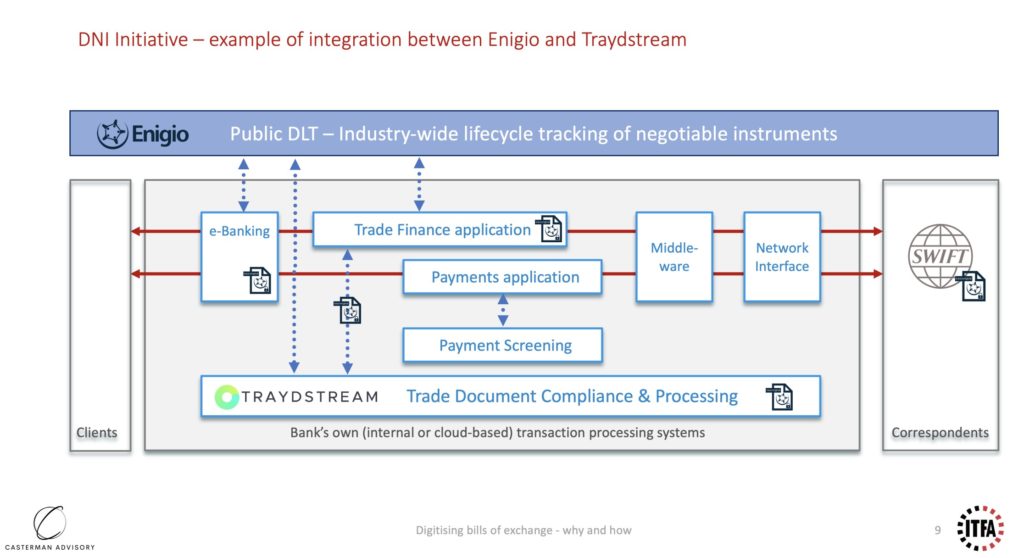

DNI Initiative webinar on bills of exchange and demand guarantees

During the DNI Initiative webinars of May 12th and May 19th, we introduced the DNI Initiative which aims to offer an interoperable technology and legal solution for digitising bills of exchange and promissory notes. We outlined the legal options (i.e., contract law vs. common English law) and presented how DLT-based document technology enables counterparties to exchange original documents such as guarantees, bills of exchange, bills of lading, … in a fully digital way. China Systems was again the first core application vendor integrating new technology options as Joel Schrevens, Solutions Director, China Systems demoed the combined China Systems / Enigio value proposition which is a perfect example of collaborative innovation as part of DNI Initiative.

During that session, Sean Edwards, Chair of ITFA, said: “The principal obstacles we have encountered have been legal and not technical. It is unlikely that digital negotiable instruments would be valid under the current English law. ITFA has therefore lobbied the UK Government for a change in the law and is working with the Law Commission and ICC UK to achieve this. As a practical, but hopefully only interim, solution we have therefore, working with our legal advisers, Sullivan, created digital equivalents of the Bill of Exchange and Promissory Note that operate as a functional equivalent of the same instruments under the English Bills of Exchange Act 1882.”

Also, Göran Almgren, CEO, Enigio – an ITFA Fintech member said: “We are confident that our DLT-based trace:original solution provides the most effective upgrade path from physical documents to digital originals, as our technology not only mimics today’s physical document flows but also offers the highest levels of security, integrity and traceability. Similarly to paper, trace:original documents can be stored on any media and transmitted via any existing or future channel as the solution is open to all and doesn’t require participants to join an ecosystem or digital island.”

Take-away #3: Regulators around the world have mandated e-invoicing to enforce VAT compliance – it is now time to mandate use of digital original trade documents to increase security and combat well-known fraud such as double invoice financing

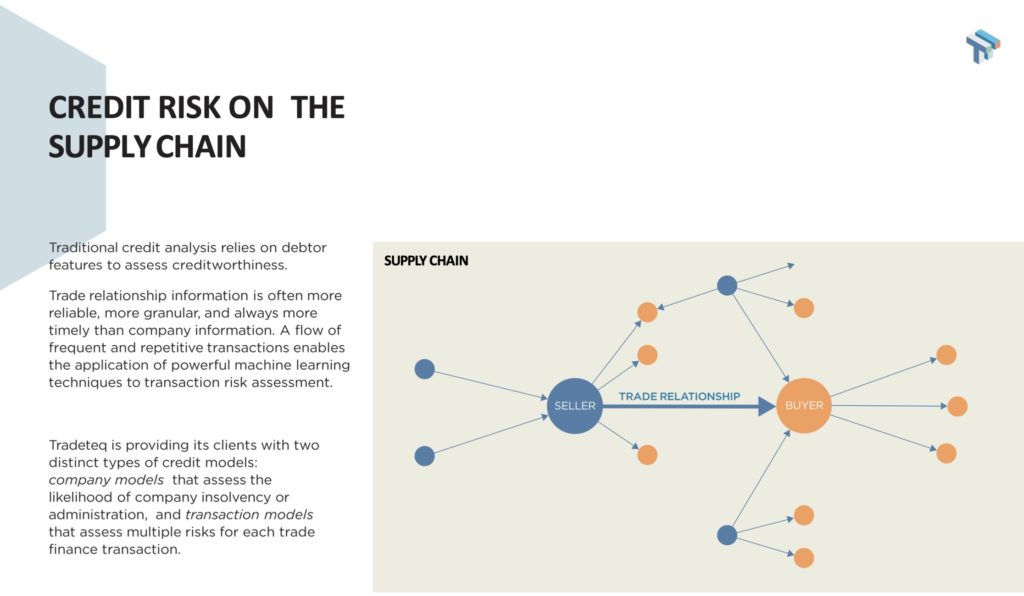

TFD Initiative webinar on quantum computing and credit scoring

The TFD Initiative webinar of June 23rd focused on what the future holds: developing Quantum Computing (QC) is part of the partnership established between the Singapore Management University and Tradeteq. Benefiting from strategic views from ITFA, ICC and WTO representatives, the webinar demonstrated how technology is increasing credit risk visibility in the SME financing space in order to facilitate funding. Given the masses of data required to calculate transaction-level credit scores, the processing power of quantum computing proves to be critical. Tradeteq is providing its clients with two distinct types of credit models: company models and transaction models.

Michael Boguslavsky, Head of AI, Tradeteq explained: “Tradeteq’s models have much wider coverage than the Z-score model versions tested… A combination of machine learning techniques with deep and broad data coverage allows the outperformance of traditional Z-sore and similar models even on pure registration data, without using any accounting inputs”.

Emmanuelle Ganne, Senior Analyst, Economic Research Department at WTO said: “The participation of micro, small and medium-sized enterprises (MSMEs) in international trade remains limited for a number of reasons, including lack of access to finance, in particular trade finance. The current crisis has exacerbated existing challenges faced by MSMEs and underlined the need for urgent action to be taken to support small businesses. Blockchain and data technologies are interesting avenues to explore. By increasing risk transparency, they can help extend financing to MSMEs.”

Take-away #4: Risk transparency is a key pillar in trade distribution, in particular as the trade industry wants to attract new institutional investors – technological developments such as AI and QC will make the difference

DNI Initiative webinar on regulatory advocacy efforts

The DNI Initiative webinar of June 30th outlined both technology integration and regulatory advocacy efforts initiated through the TERA task force. Both Levantor and Traydstream – two ITFA fintech members – outlined the importance of digitising negotiable instruments thanks to DLT-based document technology as offered by Enigio’s trace:original, and how this helps them enhance their own value propositions. As outlined below, digital documents integrate within Traydstream’s document processing system which enriches back-office processing as if document checkers would put “google glasses” on.

Take-away #5: Regulatory action is key now which is why ITFA launched a regulatory advocacy task force called Technology Experts for Regulatory Action (TERA) to promote DLT, cloud, digital assets and electronic signatures to regulators.

TFD Initiative webinar on launch of Tradeteq Connect

The TFD Initiative webinar of July 2nd introduced the additional distribution capabilities now offered by Tradeteq Connect. Members of the TFD Initiative can now benefit from a trial account to discover this new distribution module. With its 300+ members, ITFA is well placed to help banks attract new funders such as institutional investors to the trade industry which is what TFD Initiative aims to achieve. Nils Behling, CFO of Tradeteq said: “We see huge leaps forward in the technology for trade finance. These innovations are making transactions easier to conduct, more efficient, and less reliant on manual processes. But going even further, technology in trade finance is improving the perspectives of businesses across the globe.”

Take-away #6: TFD Initiative supports the complete set of trade distribution practices: syndication, credit insurance as well as notes issuance via the Trade Asset Securitisation Company (TASC).

Missed them? Replay is available …

We hope you enjoyed them as much as we did. The above webinars have been recorded and are accessible through the ITFA Member Area. We look forward to inviting you to our future sessions and wish you an enjoyable summer break.

Contact us

Reach out via LinkedIn messaging or email at acasterman@c-advisory.eu for more information on DNI Initiative, TERA task force and TFD Initiative.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio