-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

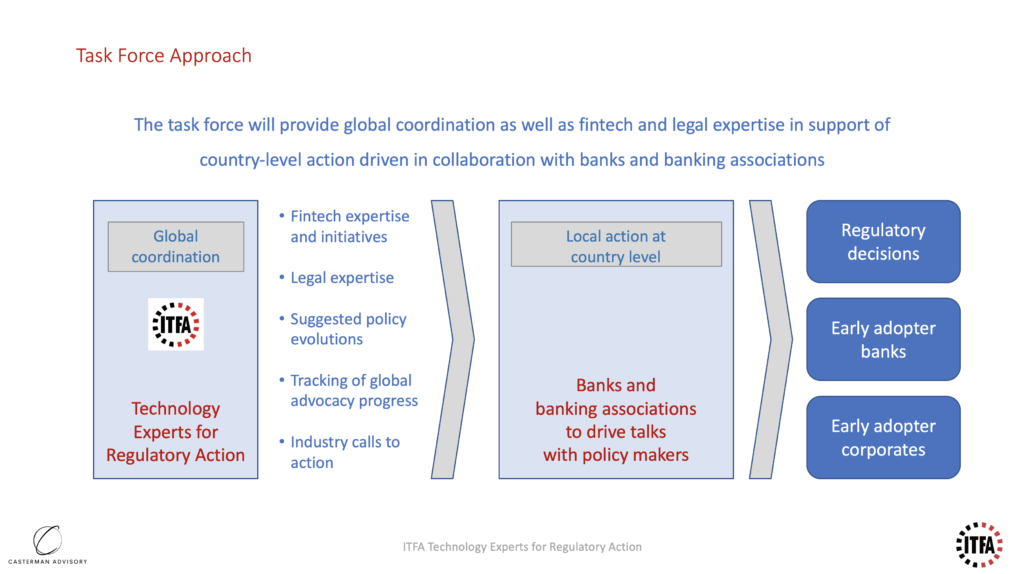

Following the pressing issues identified since the start of the lockdown period, ITFA is delighted to announce the formation of a new technology-centric advocacy task force: The Technology Experts for Regulatory Action (TERA) that will operate as part of our Fintech Committee.

The Trade Finance industry has remained largely paper based and manual and some of the laws that govern trade have not changed in decades, in some cases centuries. The industry needs a reset to a more digital framework that accelerates operational processes and practices, making them safer and more convenient for all. The experts comprising this committee will be tasked to work as a cross-industry center of expertise, galvanising key aspects of the business that need to change, collecting feedback from banks and fintechs around the world, and working closely with banks, banking associations, regulators and legislators to propose and implement the changes needed. Many of these changes are achievable very quickly once they have been identified and awareness raised. With its 300 members and a fast growing reach and connectivity, ITFA is an ideal forum to table and lead this charge on behalf of the Trade Industry.

TERA will be comprised of leading professionals in the Trade Finance Industry both from banks and fintechs. The core team embarked on this journey over the last two months focusing primarily on the operational issues related to digital trade processes, as well as on liquidity issues. It identified the need to act as a global center of expertise in order to help banks and banking associations around the world initiate and lead policy-related decisions within their own domestic market. The core team will coordinate a wide group of fintechs, banks and banking associations focusing on 5 key areas:

The founding members of this group who form the core team are:

The industry challenge is to action policy changes in a pragmatic way to deliver short-term results. Whilst each country has updated policies in different ways, it is imperative to drive policy changes through local banks and banking associations as priorities will clearly differ. TERA will provide guidance to win short-term policy decisions, building on the recent launch of both fintech initiatives: Digital Negotiable Instruments (DNI) and Trade Finance Distribution (TFD) as well as additional technology developments such as use of cloud computing.

For more information, please refer to our dedicated Fintech Initiatives page on the ITFA web site.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio