-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By André Casterman, ITFA Fintech Committee and Christoph Gugelmann, CEO, Tradeteq

On Thursday April 2nd, ITFA hosted a special webinar on COVID-19 impacts on supply chains. We report on the feedback shared and on the actionable solutions suggested by members of the Trade Finance Distribution initiative – financial institutions and technology providers – for businesses to remain afloat.

For centuries, trade financing has played a vital role in supporting the world economy. The current unprecedented crisis we all face makes this role even more crucial. How can banks and governments make use of established trade finance practices to support supply chains? How can distribution technology help the on-going relief efforts be more impactful and transparent?

With the ongoing global crisis threatening both small and large businesses, governments around the world want to support real businesses. Loans are a commonly-employed practice but there are other, potentially better initiatives which are both scalable, focused and automated – such as the processes developed through the TFD Initiative – which can help thousands of businesses across the globe.

Sean Edwards, Chair, ITFA who introduced the webinar noted: “The Government has already announced an unprecedented guarantee package for businesses to keep them afloat during the period of uncertainty. These guarantees will save many that are directly affected by the crisis. However, loan guarantees and additional liquidity lines granted by the Bank of England are often less effective to keep corporates’ supply chains moving than access to trade finance.”. Same applies in various other countries such as Germany where a new economic stabilization fund including EUR 100 billion to cover a loan for KfW and EUR 400 billion of state guarantees in order to underwrite debt affected by companies in turnmoil.

Gwen Mwaba, Director and Global Head of Trade Finance at Afreximbank outlined Afreximbank’s response to the pandemic during the session. Gwen Mwaba said: “The African Export Import Ban is creating a USD 3 billion credit facility to overcome the effects of the coronavirus pandemic. The Pandemic Trade Impact Mitigation Facility will help countries avoid trade payments defaults, support foreign exchange reserves and assist commodities exporters struggling with declining revenues”.

On the demand side, the ICC launched the “Save Our SMEs” global campaign to combat the economic repercussions of the COVID-19 pandemic. Olivier Paul, Director Finance for Development, ICC said: “The imperative to Save our SMEs cannot be understated: this agenda is of paramount importance to safeguard the current and future functioning of the global economy and the livelihoods of billions of workers throughout the world”. ICC has issued specific recommendations to governments to strengthen and focus their support to SMEs.

Outlining ways in which Trade Finance programs can be complementing corporate loan programs, Christoph Gugelmann, CEO of Tradeteq said: “Given the short-term tenor of trade finance, the program nominal amount can be deployed several times a year, and each time where it is most needed.”. He added: “Trade finance must be considered as a channel to extend financial relief to economic actors as this impact entire supply chains and keeps them moving.”. The comparison between corporate loans and trade finance programs was outlined as follows:

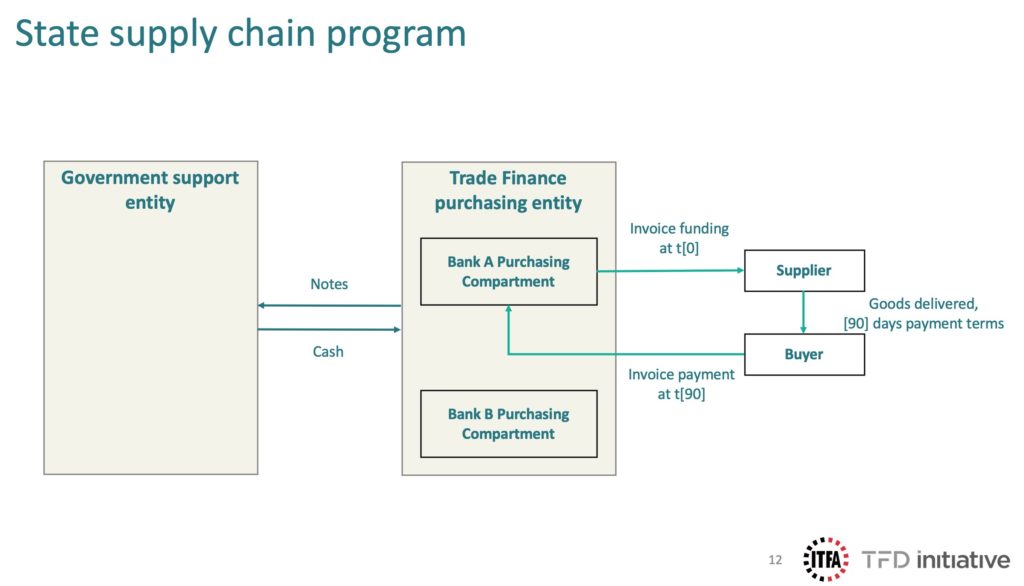

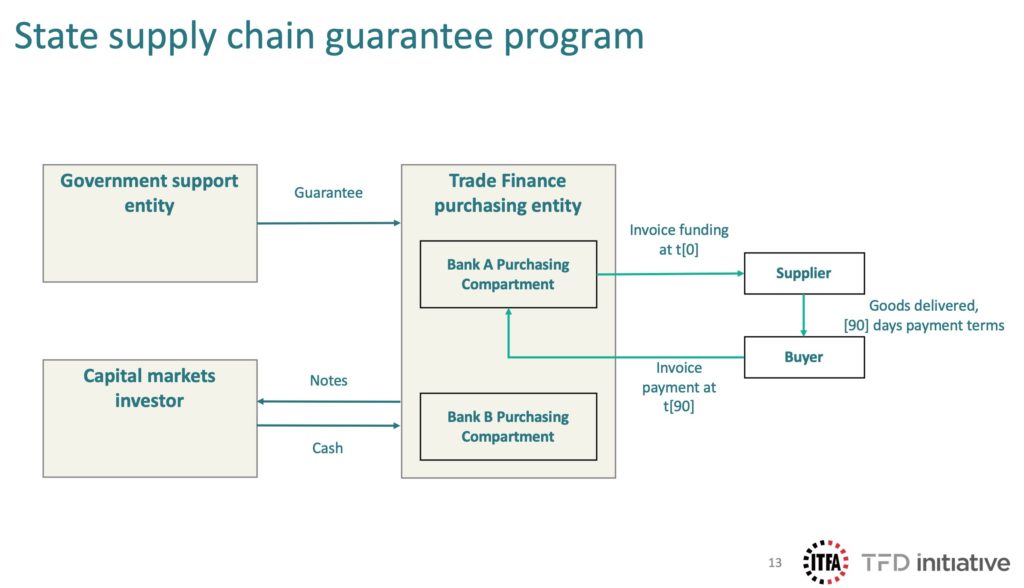

The two market practices outlined as part of TFD Initiative demonstrated (1) how a state supply chain program can be linked to banks’ trade finance origination activities through issuance of notes and delivery of funds to specific compartments of a dedicated purchasing entity, and (2) how a state guarantee program can be integrated as an add-on next to funds invested by capital market institutions. Both market practices are based on automated trade finance distribution mechanisms and described below :

Bhavna added: “On trade vs. loan, the visibility and transparency of use of funds, short-term tenor, often self-liquidating, low loss given default, all these attributes lead to a more favourable capital treatment. Banks can maintain their client relationship whilst not having to carry the burden of figuring out the whole end-to-end distribution mechanism; the ability to recycle capital through automated replenishment is key as well given the high volume of receivables and payables banks originate”.

Call to action

“Future decisions from Number 10 need to take into account alternative methods to ensure trade and commerce can continue.”. He continues: “Providing funds to banks, specifically for trade finance lending, will help support trade, retain jobs and maintain supply chains at a time when these areas are most at risk. To help exporters, I would urge the Government to explore the possibility of buying or guaranteeing banks’ trade finance exposure.”, concluded Christoph Gugelmann, CEO, Tradeteq – a member of ITFA and the TFD Initiative.

He added: “The British Business Bank, the state-owned development bank, is already coordinating a Coronavirus Business Interruption Loan Scheme for small and medium size enterprises. It relies on banks to extend credits to small business with lenders receiving a guaranty on 80% of the loans issued. A natural extension to trade finance instruments could be implemented along the same principles.”

Rebecca Harding, Independent economist, author and CEO, Coriolis Technologies: “We need to get our voice heard about such alternative options for the public sector to support SMEs and help banks be seen again as trusted advisors. We have to start making the noise and show how banks can help.”

Nils Behling, CFO, Tradeteq added: “If this initiative was enacted, banks would be in a better position to lend more freely to exporters – reassured that their exposure would be purchased by the Government. As low risk trade finance exposure is purchased, this would in turn free up further capital for lending. This scheme would provide exporters with the funds needed to sell their wares, keeping this essential part of the economy active through this period of uncertainty. The Government has pledged £330 billion, signaling its strong intent to support the economy and its workers during the outbreak. To ensure that this intent is carried to the entire economy, the Government has the potential to make a substantial difference to the number of exporters and jobs – both now and after this issue comes to an end.”

Bhavna Saraf, Lloyds concluded: “Providing funds to banks, specifically for trade finance lending, will help support trade, retain jobs and maintain supply chains at a time when these areas are most at risk. To help exporters, I would urge the Government to explore the possibility of buying or guaranteeing banks’ trade finance exposure.”

Gwen Mwaba, Afreximbank added: “We need to create awareness about such alternative means and start engaging with other financial institution intermediaries”.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio