-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Bringing negotiable instruments into the digital world

By André Casterman, Founder and Managing Director, Casterman Advisory and Chair of Fintech Committee, ITFA

The need for more and better technology has never been clearer. The fragility of supply chains, SME finance and world trade has never been more exposed which is why as an association, we – ITFA – continue to foster improved market practices and regulatory developments. The technological progress is of vital importance as we experience in our personal and professional lives, impacted by COVID-19. Adopting the most recent technologies is one of the most effective ways to deliver improved market practices.

“As an association that began in the forfaiting markets of the 1990s but has since expanded its scope to cover a wide variety of forms of origination and risk distribution and which, more recently, has joined forces with the best of the new financial technology companies, we – ITFA – are well placed to understand what the market requires and how to bring it about.” Sean Edwards, Chair, ITFA

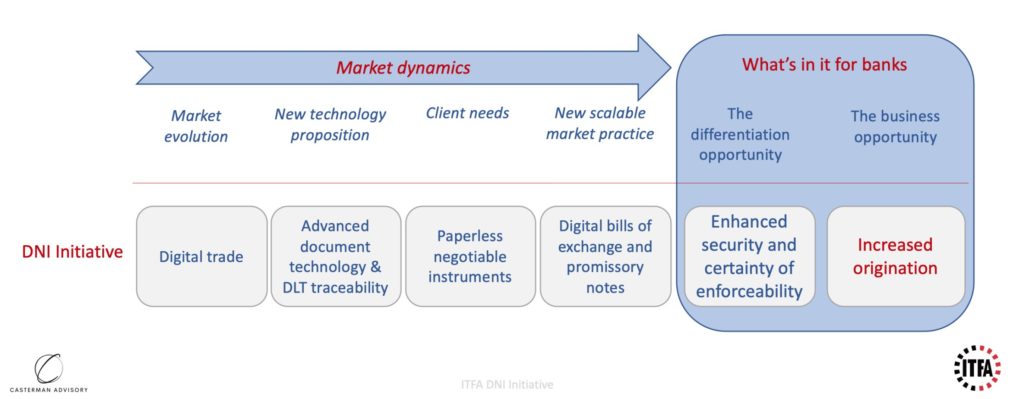

The market and technological evolutions as well as new client needs lead us to conclude that the opportunity for incumbents and new entrants is to benefit from enhanced security and certainty of enforceability which help originators increase client satisfaction and, ultimately, origination:

“The aim of the ITFA DNI Initiative is to fully digitise bills of exchange (B/E) and promissory notes (PN). In order to achieve this, we identified the need to combine advanced document technology with electronic signatures and distributed ledger technology (DLT) whilst developing the appropriate contractual schemes, and where needed, lobby to change the law.” André Casterman, Chair, ITFA Fintech Committee

The principal obstacles we have encountered have been legal and not technical. It is unlikely that digital negotiable instruments (DNI) would be valid under the current English law. ITFA has therefore lobbied the UK Government for a change in the law and is working with the Law Commission and ICC UK to achieve this. As a practical, but hopefully only interim, solution we have therefore, working with our legal advisers, Sullivan, created digital equivalents of the Bill of Exchange and Promissory Note that operate as a functional equivalent of the same instruments under the English Bills of Exchange Act 1882.

“We are delighted to see innovative evolution in this sector as digital bills of exchange will provide huge benefits for Sales Finance. DNI will facilitate faster processing and an even more seamless experience for vendors and their customers and distributors, as well as for the banks that fund these flows. We are keen to benefit from the ITFA DNI Initiative once the UK common law will recognise use of digital documents.” David Frye, CEO, Levantor Capital

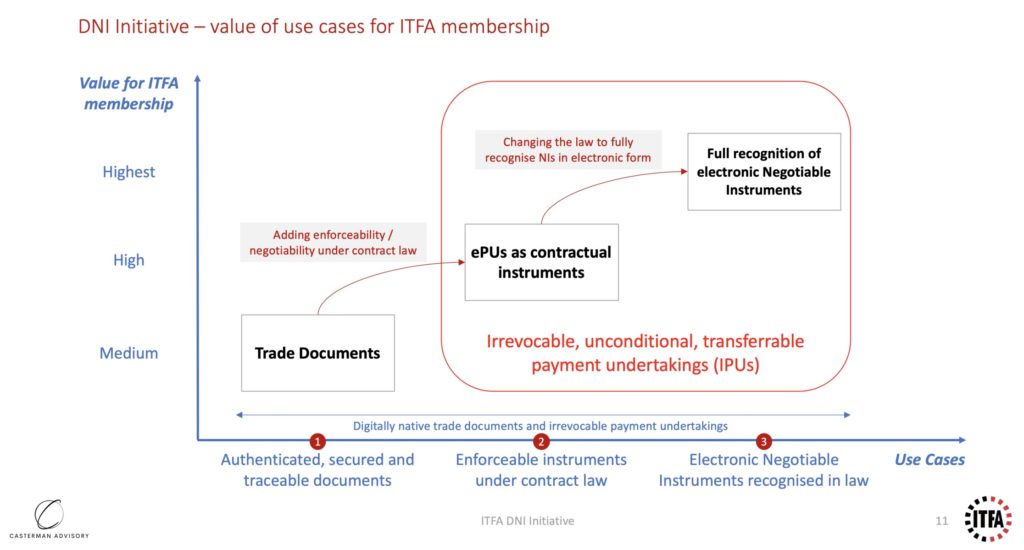

Our approach is therefore phased in order to ensure the same technology can be applied for trade documents (e.g., bank guarantees), for negotiable instruments under contract law (e.g., ePU) as well as under common law (e.g., Bill of Exchange Act). This is outlined below:

The solution, referred to as an electronic payment undertaking (ePU), is an important step towards achieving full applicability of the 1882 Bill of Exchange act. The ePU delivers a digitally native irrevocable, unconditional and independent payment undertaking that fulfils all requirements of a traditional negotiable instrument albeit subject to contract law rather than common law. The technology set-up integrates easily within existing processes, systems (e.g., front-to-back systems) and channels (e.g., SWIFT).

“The forced disruption to Trade and the difficulties being experienced in the handling of paper documents as the world fights Covid- 19, highlights more than ever the need for digitalisation in our industry. Being involved first- hand with a number of the participants in the DNI initiative, we see the pragmatic approach that ITFA is taking and we will continue to play our part in supporting our clients and the sector in achieving the goals set out in this initiative.” Lionel Taylor, MD, Trade Advisory Network

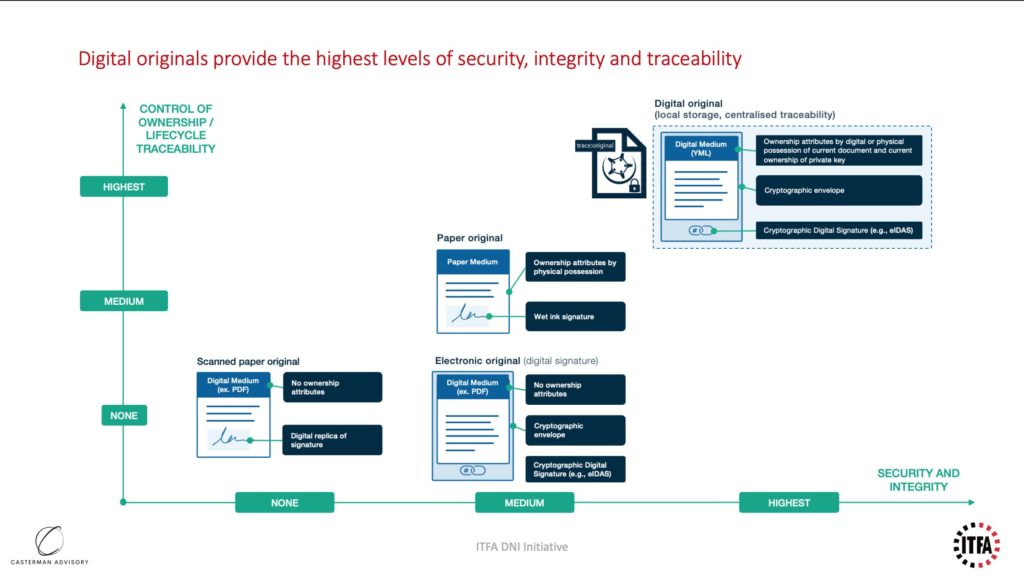

The digital original technology – as provided by Enigio with trace:original – provides superior levels of traceability, integrity and security versus using paper documents or digital signatures on scanned documents. This is outlined on below chart:

“We are confident that our DLT-based trace:original solution provides the most effective upgrade path from physical documents to digital originals, as our technology not only mimics today’s physical document flows but also offers the highest levels of security, integrity and traceability. Similarly to paper, trace:original documents can be stored on any media and transmitted via any existing or future channel as the solution is open to all and doesn’t require participants to join an ecosystem or digital island.” Göran Almgren, CEO, Enigio

Ronan Daly, Head of Product – Lending, Ebury: “Ebury is dedicated to digitalising our clients’ entire user journey including that of our Trade Finance products. We continuously seek new technology to create the best experience for our clients and welcome any technology and policy developments, especially in the area of negotiable instruments, which are key to our product. We find a lot of value in participating in the ITFA DNI Initiative and are exploring extending the new digital option – the ePU – to our clients.”

Merisa Lee Gimpel, Head of Trade Innovation, Lloyds Bank: “At the forefront of our minds is the need to identify, define and deliver efficient, fast and secure digital solutions that help mitigate risks between UK companies and their trading counterparties. Today, documentary trade processing remains highly paper-intensive, time consuming and reliant on human intervention. This complexity remains because paper has been the tried, tested and widely accepted way to bridge the gap of trust between two companies trading with each other − despite the apparent inefficiencies crying out for change and recent disruptions faced by companies worldwide. As an industry we’ve progressed significantly on the technological front, and I look forward to positive development in both the legal framework and shipping industry with regard to the acceptance of digital negotiable documents”

We asked our legal advisers, Sullivan, to consider the position of purely electronic negotiable instrument under English law.

Geoffrey Wynne, partner in London and head of the trade and emerging market practice at Sullivan explains: “When ITFA presented us with the challenge of finding a digital solution to overcome the problem of not being able to create digital bills of exchange or promissory notes under the Bills of Exchange Act 1882 (not surprising given its age) we put our thinking caps on. This meant taking apart what it actually meant to have a bill of exchange or promissory note. We knew its features were really important to trade finance. The need for a solution has been accelerated by Covid-19 although the solution is important in the increasingly digital world. We looked at what was needed and then rebuilt the solution into a set of instruments that would achieve the substantive equivalent effect from a legal point of view. We then handed this over to the techies to create a technical solution. We suspected that a DLT-based solution would have to be found for security reasons. It is important that the ePU (as it is being called) exists only in the digital world – with no paper original. We now hope that the combined solution facilitates trade. This is in all our DNAs!”

The DNI Initiative fosters collaboration amongst technology players. Here is early feedback from ITFA fintechs that are helping financial institutions benefit from digital trade solutions:

Joel Schrevens, Solutions Director, China Systems: “The first instrument we have implemented, and are able to demonstrate today, is a Digital Guarantee, which allows us to substitute a paper based transaction with a fast and secure digital document exchange between the different Guarantee parties, using exactly the same processing flows and capabilities defined for SWIFT and paper based Guarantees. We can now reuse the framework to provide support for the ePU and replace the printing and physical exchange of other trade documents with a fully digital process, irrespective of business content, standard or network.”

Anastasia McAlpine, Principal Product Manager, Trade and Supply Chain Finance, Finastra: “Trade and Supply Chain Finance is changing at an unprecedented rate, and we see an acceleration in regards digitalization. Great new tools and solutions are emerging, helping the industry to overcome, for instance, paper-based processing and manual handling. This is of particular relevance now, due to the restrictions placed on organisations and individuals as a result of COVID-19. At Finastra, we are delivering innovative solutions to address these and other challenges by partnering with fintechs through our FusionFabric.Cloud platform, helping our clients drive their business and global trade forward.”

Asif Ali, Product Head, Traydstream: “Traydstream has a cutting-edge AI/ML-based Trade processor which combines synergistically with digital documents. We foresee a ‘Paperless’ world of trade finance, where documents are shared digitally, processed automatically, with settlements possible in real time between parties based on data alone. The ITFA led DNI initiative is a significant step in that direction and we are excited to be a part of it.”

Michel Kilzi, Partner, Fineon Exchange: “We see further strategic evolution of trade finance digitisation, especially for digital native Promissory Notes and Bill of Exchange ensuring full traceability transferability of such assets within the export finance arena. Through Fineon Exchange Export Finance data enrichment platform, investors shall have fluid access to short-term quality assets.”

The paper ITFA issued in April 2020 entitled “A Manual of Digital Negotiable Instruments – Issues and Implementation” is available in the Member Area of the ITFA web site. Contact me at acasterman AT c-advisory.eu to get the overview presentation on the DNI Initiative.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio