-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By André Casterman, Founder, Casterman Advisory

This article was published by TFG on March 6th.

DLT offers the financial services industry a new piece of infrastructure to push the boundaries of Open Banking. But it doesn’t come without its challenges. TFG heard from tradetech expert André Casterman on future use cases for blockchain in assets, trade and transaction banking.

DLT enables financial institutions to share a common understanding of assets and transactions with their clients and counterparties, embedding interoperability in any transactional process whilst complying with data privacy regulations.

I first heard about the new disruptive technologies (DLT and blockchains) in 2015, and I was not convinced by all the hype back then.

Neither did I understand the need for a new database technology, nor could I accept the need for financial institutions to communicate differently.

The use of the Internet and encryption technologies was established, the use of cloud applications was growing, and application programming interfaces (APIs) started to make their mark, particularly in payments following ambitious open banking regulations (e.g., the second payment services directive).

How could DLT help?

Was building trade consortia the right step forward?

When banks set up the initial trade-focused consortia in 2016/2017, I wondered why such excitement would only be used as a new messaging infrastructure, albeit decentralised.

It appeared as if those consortia applied a 21st-century technology (i.e., DLT and blockchains) on a 20th-century business idea (i.e., to build closed platforms).

The consortia got it right when it came to embracing DLT, but the latter, using the new technology to build proprietary ecosystems, has been the main issue the industry has seen.

Using DLT to support new closed ecosystems is shortsighted, as DLT offers us the opportunity to push the boundaries of open banking and engage with interoperable transactions.

Lesson learned #1 – DLT is a 21st-century innovation that needs to be embraced with a 21st-century open banking mindset; that’s where most trade-focused consortia have failed so far (not only the bankrupt ones).

DLT extends open banking to risk mitigation

The value of DLT lies far beyond acting as a decentralized communications infrastructure.

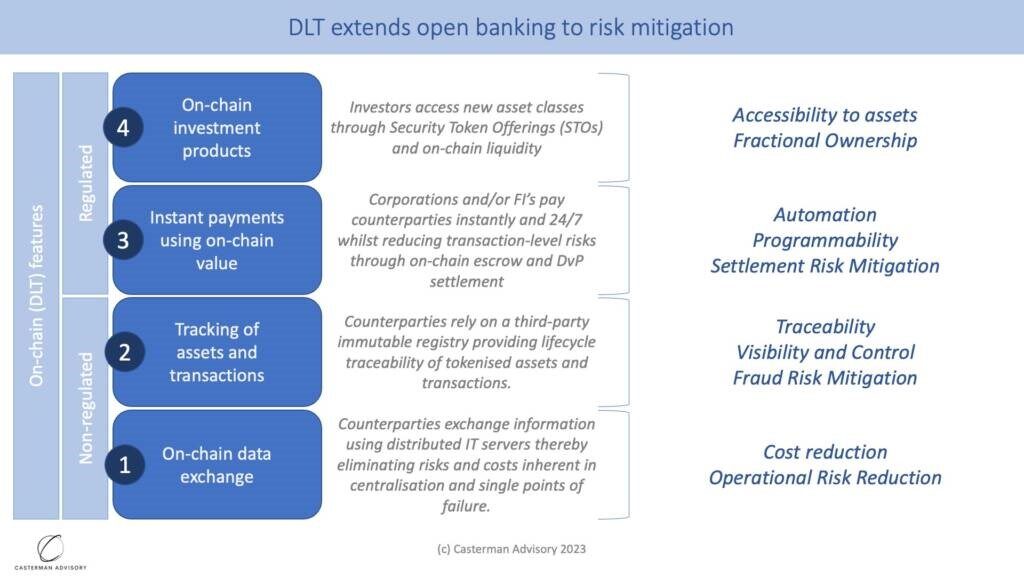

DLT introduces a set of advanced risk mitigation features that is outlined in the diagram below in order of increasing importance:

The first two features (1 & 2) are not expected to be regulated whilst the next 2 (3 and 4) are subject to regulatory approval.

Figure 1. DLT extends open banking to risk mitigation. Regulated and non-regulated on-chain DLT features. Source: Casterman Advisory.

Using DLT purely as a communications infrastructure (feature 1) is quite limiting and unimaginative, as the technology offers several advanced features (features 2 to 4) that legacy technologies (e.g., including SaaS platforms) cannot offer in the same open and interoperable way, at least not on their own.

The benefits of those 4 features – when compared to traditional rails – include reduced cost, increased traceability, visibility and control, embedded automation and programmability which reduce operational, fraud and settlement risks.

Lesson learned #2 – The trade industry will benefit from DLT through the adoption of its most differentiating features embedding risk mitigation (i.e., features 2 to 4).

DLT supports major industry innovations

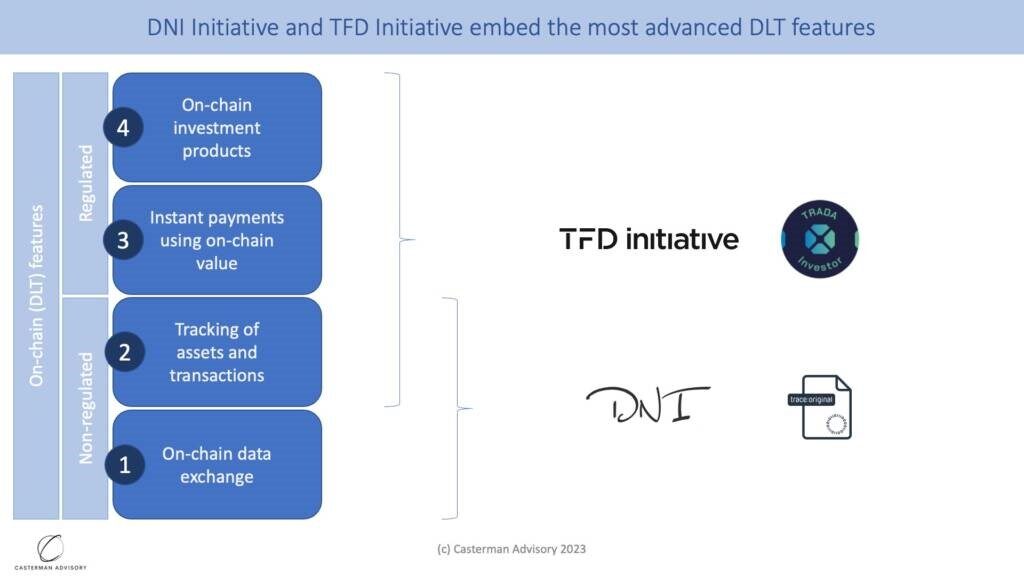

In 2019, as part of the trade-focused Fintech Committee that I chair, the committee set up two collaborative initiatives to drive technology-driven market innovations.

Both initiatives are taking advantage of DLT in very targeted ways, and aim to increase interoperability and foster open banking in trade finance.

Whilst DNI Initiative concentrates on digital origination, TFD Initiative addresses gaps in expanding distribution to institutional, and retail, investors.

Lesson learned #3 – DLT will have far-reaching impacts in financial services – new asset classes will be accessible to retail investors (e.g., illiquid ones such as trade finance and instant global payments will be the norm and almost free to use).

Figure 2. An overview of the DNI Initiative and the TFD Initiative. Source: Casterman Advisory.

Lesson learned #4 – Specialisation on specific segments and features has been the approach used when setting up the ITFA DNI Initiative and TFD Initiative. Both focus on inserting new Tradetech components in the trade ecosystem. The recipe works very well as we introduce superior open banking / interoperability features.

Consortia are dead, long live consortia!

Bank consortia are critical as they enable the industry to own and govern a market infrastructure.

This approach has been very successful in European payments (e.g., EBA Clearing which is owned by 48 banks) and the trade market could also take advantage of such ownership and governance models.

Over the last 5 decades, banks have successfully set up a series of financial market infrastructures (FMIs) to address collaborative ambitions. Examples include Euroclear, SWIFT, EBA Clearing, P27, most Automatic Clearing Houses (ACHs).

However, in trade finance, the approach has not delivered the expected result as banks took the development risks on their own shoulders by designing new value propositions and building new technologies from scratch.

A lower risk approach suggests scaling proven technologies (e.g., those demonstrated by the DNI and TFD initiatives) through a bank-owned and bank-governed scheme.

Effectively wrapping existing technology solutions by expanding the delivery scope to the one a financial market infrastructure can offer (e.g., embedding more regulated functions). This way, banks avoid taking the initial delivery and market adoption risks, whilst focusing on expanding the value propositions beyond technology.

Lesson learned #5 – Bank consortia are not dead, they have been relevant mainly in payments and securities so far; trade banks just need to embrace proven (i.e., delivered and adopted) technology innovations when building consortia, thereby eliminating the delivery and market adoption risks.

From pitfall to promise

I, therefore, believe that consortia offer a strategic option to banks to pursue strategic trade innovations.

They just need to be re-imagined based on partnerships with hand-picked technologies and vendors.

The hard lessons learned throughout 2016-2023 will help banks avoid some pitfalls.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio