-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Written by Pete Kienlen, Sales Director at Raistone

Companies across the global supply chain are faced with trade challenges. There are solutions that can help importers ease the pressures that come with unpredictable tariffs and duty fees.

The Trump administration’s tariff implementation plan has evolved since the initial announcements and updates earlier this year, but it seems that the use of tariffs as a negotiation tactic will continue for the foreseeable future. While tariff levels and targets shift over time, one constant is the impact they have on businesses’ working capital. Companies around the globe are struggling to plan for nebulous additional costs.

Navigating the evolving tariff landscape and difficult-to-forecast duty payments require increased operational agility and financial flexibility. Alternative financing can help importers tackle the precarious task of planning for the unknown. With rising costs, unpredictable timelines, and tightening capital, managing duty payments strategically can become a key lever for preserving liquidity.

Stay agile in an unpredictable market

While the headlines often focus on major policy moves, such as new tariff schedules or trade negotiations between major economies, the on-the-ground impact is most keenly felt by importers left scrambling to cover costs they didn’t forecast. From consumer goods to critical components, every delayed shipment or unexpected fee can squeeze margins and strain working capital.

Unfortunately, the challenges extend beyond tariffs alone. Broader headwinds from inflation to foreign exchange fluctuations are converging to erode importer profitability.

Tariffs and tight credit conditions strain working capital

Recent economic commentary confirms that ongoing tariff volatility is placing additional strain on corporate liquidity. Central banks such as the U.S. Federal Reserve are maintaining a cautious stance, largely due to inflation risks tied to escalating import duties and unpredictable tariff schedules.

Global financial markets are also reacting to the uncertainty. Equity market volatility has surged, with investors increasingly shifting toward safer assets as trade policy unpredictability intensifies.

Meanwhile, a Goldman Sachs survey found that 36% of U.S. small businesses are already impacted by tariffs, while another 38% expect to feel the impacts soon. Of those respondents, more than two-thirds cite policy uncertainty as their primary concern, highlighting widespread stress surrounding global trade.

With central banks hesitant to signal relief and businesses already paying more at the border, the need to preserve working capital has never been more acute for importers.

In response, companies are pursuing a mix of strategies, such as reengineering supply chains, negotiating new payment terms, or reshoring production. Yet for many, near-term liquidity remains a constraint. One increasingly important yet underutilized strategy is the deferral of duty payments.

The financial impact of tariffs on importers

Importers continue to bring goods into the U.S. even as they face shifting costs and duties. If a business misjudges its tariff exposure or lacks the capital cushion to absorb a sudden increase, cash flow can quickly tighten. Extending duty payments by 60 to 90 days could alleviate those pressures and help keep additional capital on hand.

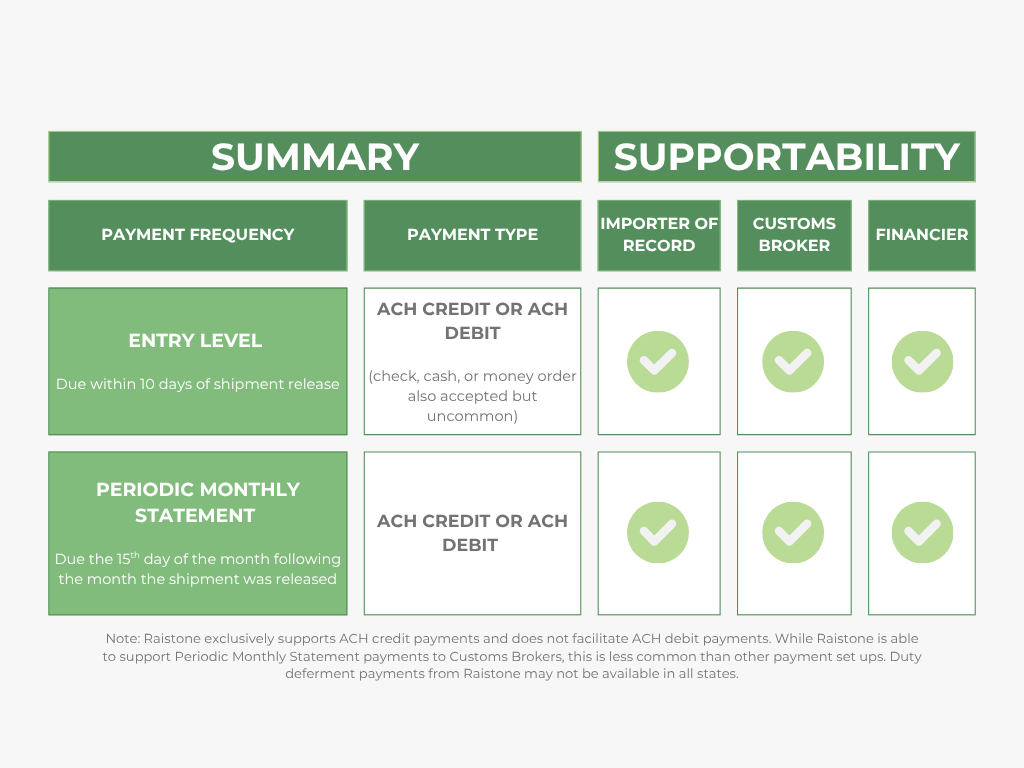

Duties in the U.S. can be paid either per shipment (Entry Level) or through a Periodic Monthly Statement. Importers who rely on customs brokers or pay directly to the U.S. Customs and Border Protection (CBP) may not realize they have flexibility in timing their payments. Optimizing this aspect of your payment schedule can improve visibility and planning.

Many organizations are exploring alternative financing arrangements to manage these duty payment schedules without drawing down existing lines of credit or using internal cash reserves. This approach offers agility in uncertain markets, enabling businesses to adapt without compromising supplier relationships or delaying imports.

Duty Deferment on Increased Tariffs

One potential option for importers is to have a third-party, like Raistone, process their duty payments, providing up to 90 days for repayment. This enables businesses to keep goods moving through Customs without needing to immediately draw on internal cash reserves, freeing up capital for production, payroll, or other investments.

For Entry Level payments, third-party financiers would process an ACH credit within 10 business days of the shipment’s release. For a Periodic Monthly Statement, they would process an ACH credit for the statement prior to the 15th day of the following month. Facilitating payments to Customs Brokers if the importer of record does not process duty payments directly to CBP could also be an option.

Related Topics

Insights, Accounts Receivable Finance, Supply Chain Finance, Blogs

Privacy Policy | Cookie Policy

Designed and produced by dna.studio