-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

First tangible result of the ITFA DNI initiative – complete and seamless creation of digital guarantees as initial use case of Enigio’s trace:original

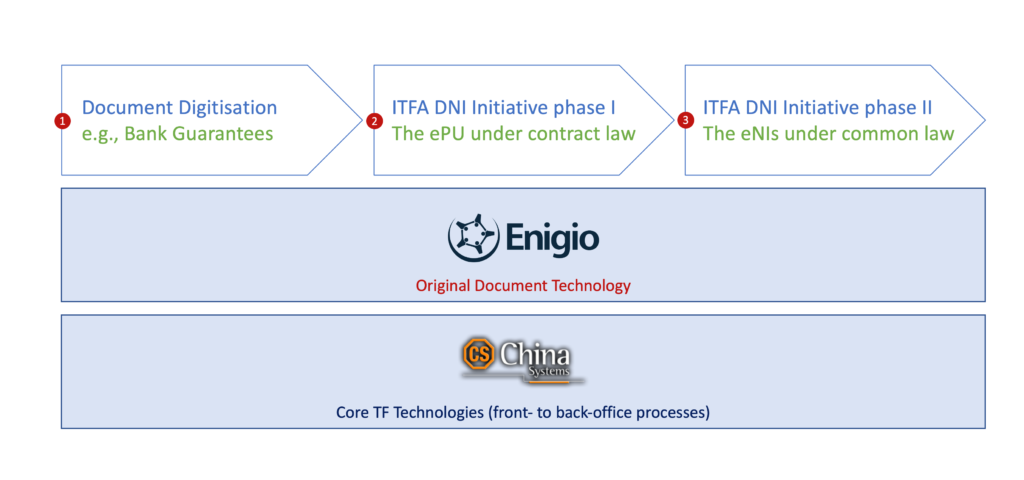

The ITFA Fintech Committee now regroups 26 technology companies who help the industry achieve digitisation and automation of origination and distribution processes in global trade and receivables finance. Following the establishment of the Digital Negotiable Instruments initiative (DNI) in September 2019, some of those highly specialised solution providers have been collaborating on specific use cases.

The first tangible outcome of such collaboration is brought to market by China Systems and Enigio which joined forces to digitalise key trade document flows. The partnership has resulted in the integration of Enigio’s patented digital original document technology – trace:original – with China Systems’ back-office platform Eximbills Enterprise.

“Document digitisation will not happen by expecting the whole banking and corporate community to sign up to a common platform – such 20th century models are not scalable. Digitising trade document requires open technology which integrates seamlessly within existing front- to back-office systems and communication channels”, says André Casterman, Founder, Casterman Advisory and Chair of Fintech Committee, ITFA.

“Electronic signatures and distributed ledger technology now enable participants to rely on a shared document tracking registry to authenticate digital original documents whilst avoiding externalising business data. This is what Enigio delivers with trace:original, and we expect such approach to be the optimal way to leverage DLT”, he adds.

The objective is to provide a future-proof solution which is open to multiple standards and allows secure exchange of digital documents and undertakings between Trade participants, irrespective of the trade processing infrastructure.

“There is a general consensus that physical documents and undertakings in a trade context should ultimately be replaced with digital trade datasets. However, it is unrealistic to aim for a global consensus on digital trade standards in the short to medium term. We need a future-proof approach that works in a dynamic and hybrid environment which can be implemented today. This interoperability requirement is the main reason why we believe that our integration with trace:original meets today’s digital trade document and payment undertaking standards”, says Joel Schrevens, Solutions Director at China Systems.

He adds: “The printing and sending by courier are replaced with a seamless digital document creation and transmission process, whereby trace:original provides a public notary service ensuring originality, data integrity and ownership of the document. It leaves the business processing to the trade platforms and networks, which will facilitate adoption. The first instrument we have implemented, and are able to demonstrate today, is a Direct Digital Guarantee, which allows us to substitute a paper-based transaction with a fast and secure digital document exchange, using the same processing flows and capabilities as our SWIFT and paper-based Guarantees. We believe this is especially useful for the processing of Domestic Guarantees”.

“We are confident that our DLT-based trace:original solution provides the most effective upgrade path from physical documents to digital originals, as our technology not only mimics today’s physical document flows but also offers the highest levels of security, integrity and traceability”, said Göran Almgren, CEO at Enigio.

He adds: “The main differentiator, as compared to other digital initiatives, is that only the creator of the digital original document needs to run a Full Node; after creation, the digital original document can be securely exchanged using existing infrastructure or secure e-mail between participants. The solution is both channel and data standard agnostic, i.e. it can be used not only by, but also between different trade processing platforms and it does not require parties to be on-boarded onto a specific platform. The trace:original notary service has no knowledge of any business content in any document; it only takes care of audit, integrity, immutable traceability and notarisation regarding what is a current original or a current owner.”

“The ease and speed with which our team has integrated the trace:original solution within our existing trade processing flows has been impressive. Now that we have the APIs between our solutions in place, we can easily create, validate and manage the ownership of any type of digital document or undertaking. Using our existing connectors, both digital documents and undertaking records can securely be transferred via our own back-office and portal solution, SWIFTNet and other Trade networks” said Filipe Moreira, Head of Professional Services and Innovation Lead at China Systems.

The ITFA Fintech Committee recently ran a series of webinars on the DNI Initiative which are accessible via the ITFA Member Area. The introduction webinar features both Sean Edwards, Chair, ITFA and Geoffrey Wynne, Partner, Sullivan outlining the industry ambition and the legal options whilst Joel Schrevens, Solutions Director at China Systems demoed the integration of Enigio’s trace:original within Eximbills Enterprise during the technology integration webinar. Also, feel free to consult our blog “ITFA fintechs joining forces to digitise negotiable instruments using advanced document technology”.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio