-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

How can trade banks digitise original documents such as bank guarantees and bills of exchange? How can the use of paper originals be avoided to widen the financing window and to avoid delivery via postal services? How can digital originals be exchanged through banks’ own portals? What are the dDOC specifications? Is DLT finally helping trade banks?

By André Casterman, Founder Casterman Advisory and Chair ITFA Fintech Committee

ITFA kicked off the DNI Initiative in Q3 2019 in order to address an ambitious industry need: digitising negotiable instruments. At the start of this process, the members of the initiative researched the fintech market for an appropriate digital document technology. One first technology provider was found with Enigio, and effective design work could start. The initiative is obviously open to multiple technology providers, and has already attracted various fintechs such as Finastra, Traydstream, China Systems, Levantor, XinFin Network, …

The objective of the DNI Initiative is to deliver new technology and legal options to digitise negotiable instruments whilst the underlying technology can be applied to any documentary flow (e.g., bank guarantees). This follows an approach which is similar to the one applicable for Bitcoin where the underlying blockchain technical infrastructure is able to support various digital assets such as ETH, XDC, XRP, IOTA, …

During Q1 2020, we finalised the first phase of the project and published the “Manual of Digital Negotiable Instruments – Issues and Implementation” in April 2020 which includes two key specifications:

(1) first, the technology specifications for managing digital original documents in the most interoperable way following collaboration with the fintech members and advisors involved in the DNI Initiative, and;

(2) second, the definition of the electronic payment undertaking – known as ePU – to be used under contract law; this unconditional and irrevocable payment instrument was defined following collaboration with Sullivan. I covered this brand-new legal option in an earlier blog.

The second phase of the DNI Initiative is already on-going through the TERA initiative which aims to integrate digital negotiable instruments as part of common law (i.e., Bill of Exchange Act 1882 in the UK). I will report on that separately.

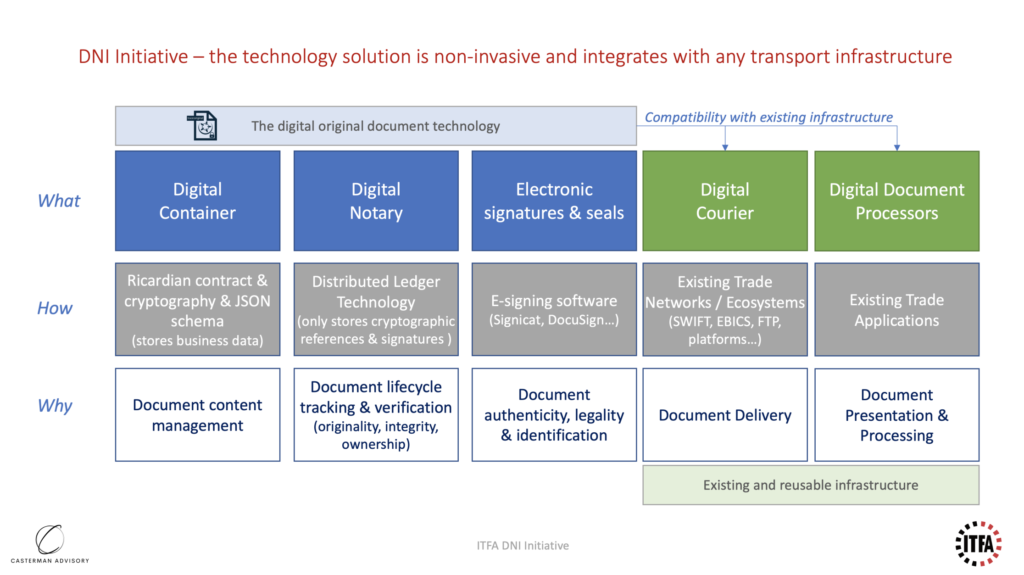

The technology requirements – referred to as the dDOC specifications – describe how to leverage advanced document technology to produce, manage and share digital original documents, i.e. digitally native originals that are portable amongst financial institutions, their correspondent banks, their clients and any third-party platform they wish to use for value-added processing (e.g., bill of lading platform). Those specifications were developed with an “open banking” mindset leveraging hybrid blockchain technologies.

“Hybrid Blockchain combines the strengths of both Public and Private State of the blockchain. This ensures that every transaction is private but still verifiable by an immutable record on the public state of blockchain.” André Casterman

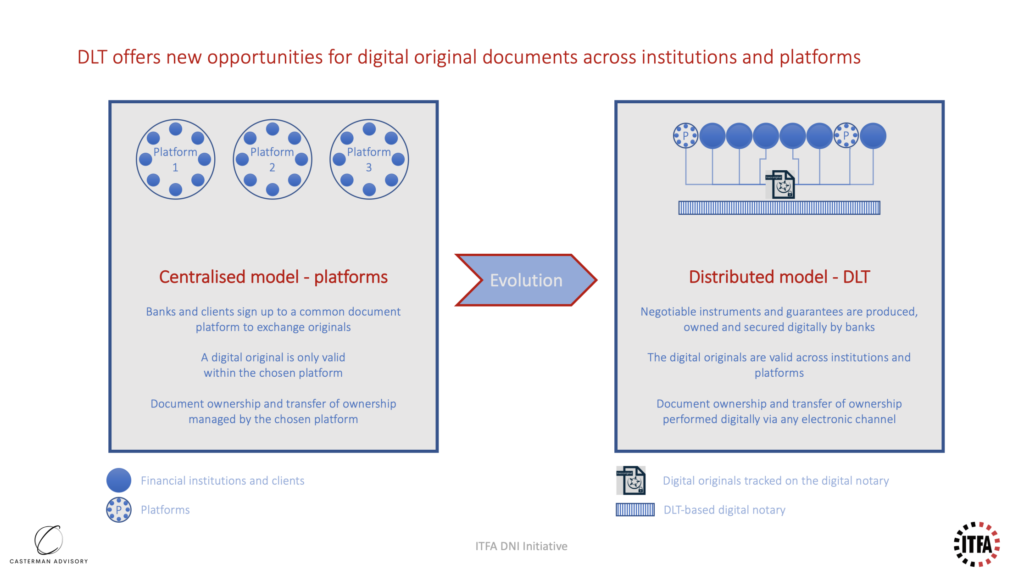

In essence, we want to leverage blockchain to support production, ownership of original documents and transfer of ownership amongst financial institutions and any type of counter-parties whilst securing business data. Decentralising operations is an evolution of the platform-based model as depicted below. This trend is witnessed in another use cases such as digital assets.

The dDOC specifications are vendor-agnostic which means that ITFA expects various technology solution providers to apply and demonstrate compliance. At this early stage, both Enigio and China Systems have done so whilst other members of the DNI Initiative are busy working on it.

“Banks need technologies that integrate seamlessly with existing ones such as back-office applications, front-office portals and communication channels. This is what Enigio brings with hybrid blockchain applied to digital original documents.” André Casterman

The next few sections describe the dDOC specifications. They have been designed with the following interoperability and portability principles in mind. The underlying document technology should demonstrate:

The dDOC specifications enable banks to benefit from recent technological developments such as JSON, e-signatures, DLT, hybrid (private / public) blockchain, … and are meant to help progress trade digitisation in a distributed and therefore scalable way.

“SMEs prefer to adopt technologies brought to them by their chosen bank(s). A low-hanging fruit for SME-focused originators is to digitise bills of exchange and guarantees via their proprietary e-banking portals. Any dDOC-compliant technology provider will help achieve this in a white-label way.” André Casterman

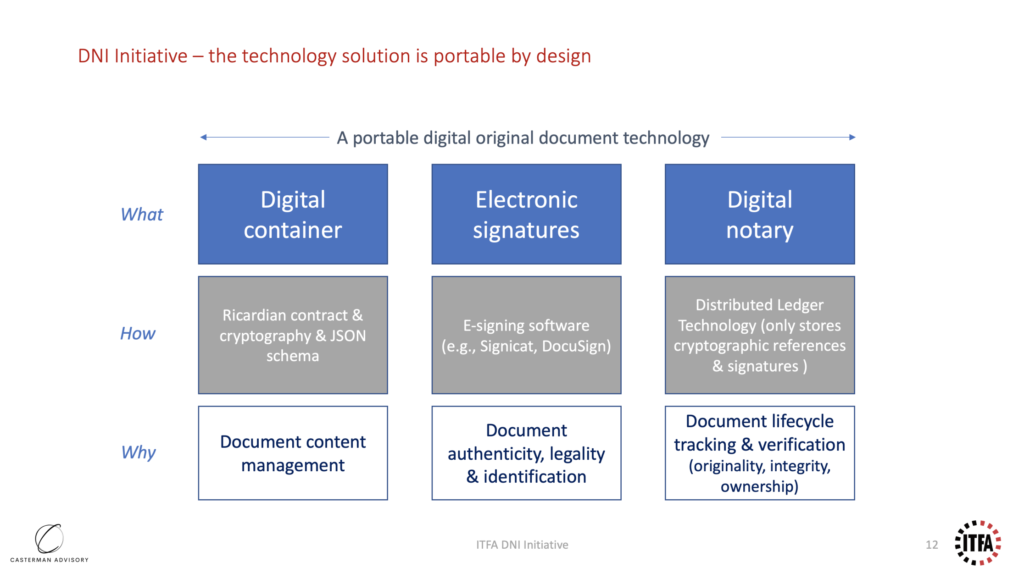

The dDOC specifications are designed around three building blocks:

(1) The digital container designed using “Ricardian” contracts and JavaScript Object Notation (JSON);

(2) the electronic signatures and stamps; and

(3) the shared public distributed ledger technology (DLT) acting as digital notary.

The combination of the above three pieces of technology produces portable documents, i.e., compatible with any existing or future software capability and transport mechanism.

First, the document embedding the digital original must be a cryptographically secured electronic document, that is (1) independent of any IT system or platform; and (2) linked to a public key (one of a cryptographic key pair, the other being private) evidenced in a distributed ledger (DL).

In addition:

In addition to the digital original, the distributed ledger (DL) evidencing the state and holder of the digital original must:

The document technology solution should also:

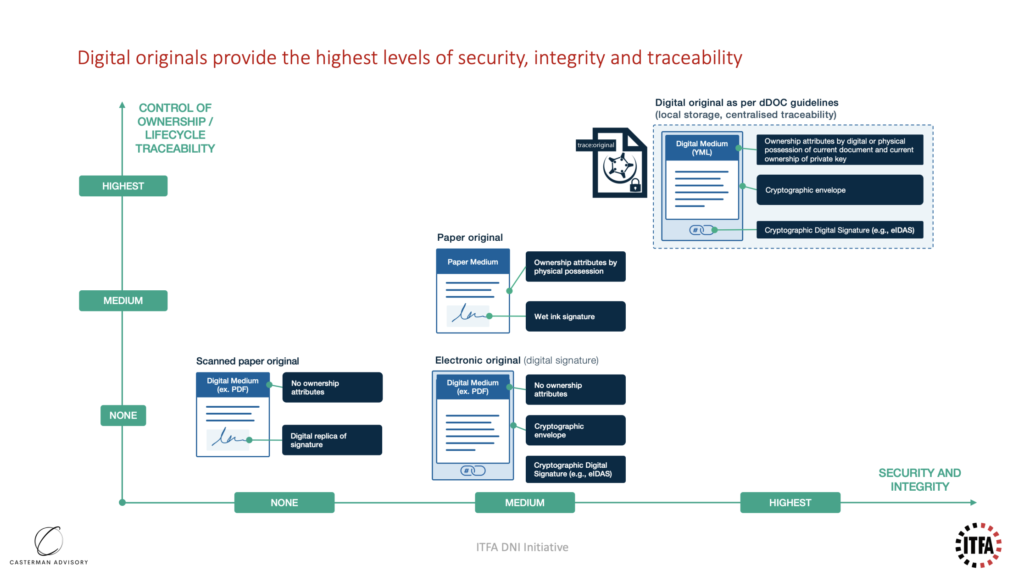

Digital original documents compare to signed copies as follows. The weaknesses of signed copies are (1) the absence of ownership attributes and (2) the inability to demonstrate the uniqueness of the document and (3) the inability to transfer ownership. Being able to demonstrate and to transfer ownership are key pre-requisites for digital originals to support negotiable instruments.

“DLT in action – Enigio uses blockchain technology only where it is needed, as proof of the truth and not to store business data” Göran Almgren, CEO, Enigio

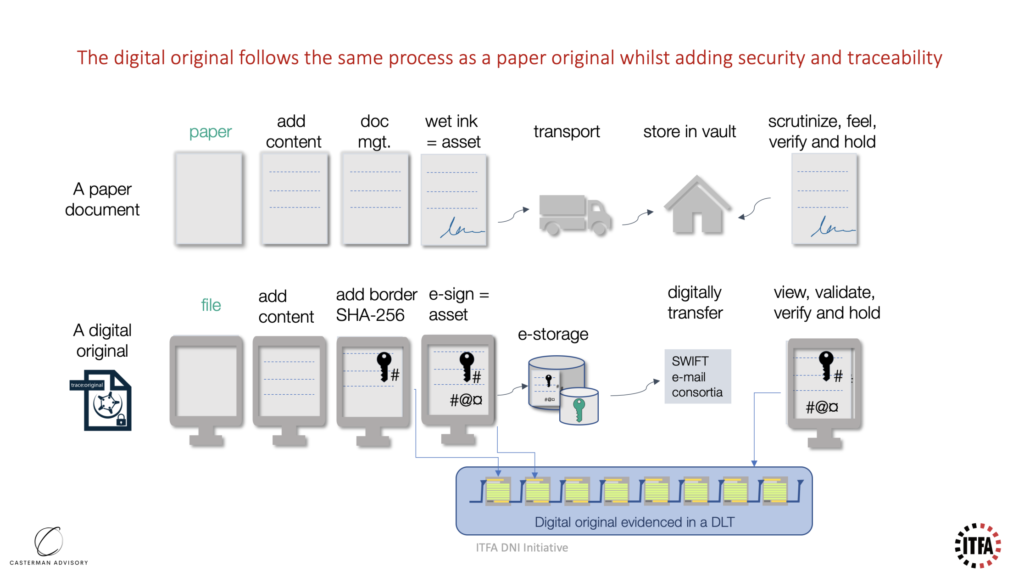

As depicted below, the dDOC specifications ensure that digital originals follow similar processes as paper originals. This means there is no need to externalise those documents to third-party platforms, unless specific value add and processing is expected from such platforms by document owners (e.g., a certificate management or bill of lading platform).

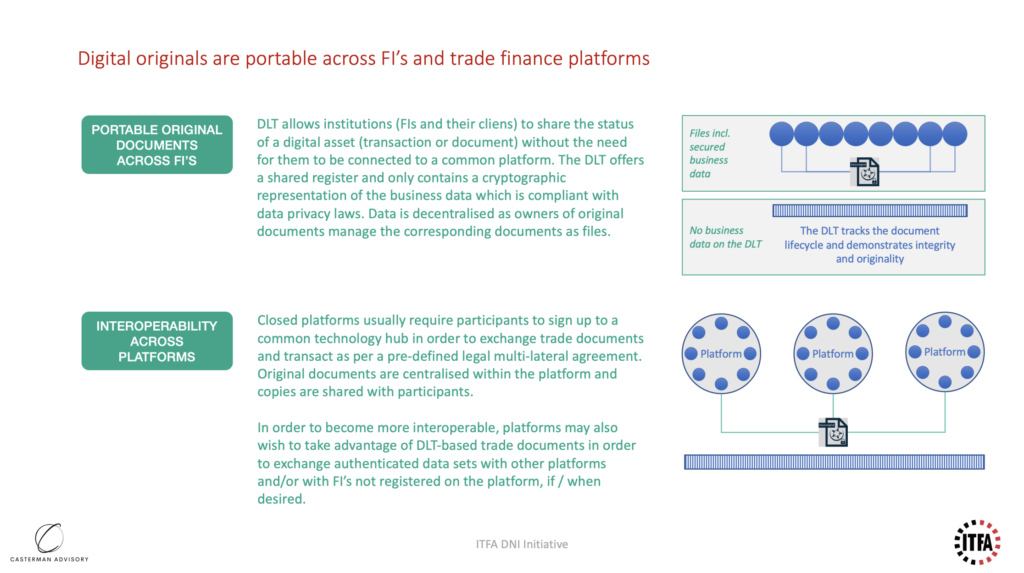

Digital original documents bring benefits to both financial institutions and the platforms they choose to use. Indeed as most platforms remain largely closed eco-systems, it is now possible for those islands to exchange digital documents – acting as authenticated data sets – with external parties (platforms or FI’s). This is depicted below:

Enigio’s trace:original is the first digital document technology that complies with the dDOC specifications.

“We are confident that our DLT-based trace:original solution provides the most effective upgrade path from physical documents to digital originals, as our technology not only mimics today’s physical document flows but also offers the highest levels of security, integrity and traceability. Similarly to paper, trace:original documents can be stored on any media and transmitted via any existing or future channel as the solution is open to all and doesn’t require participants to join an ecosystem or digital island.” Göran Almgren, CEO, Enigio

During the lockdown period, ITFA set up the Technology Experts for Regulatory Action (TERA) task force. ITFA’s goal is for TERA to act as a centre of coordination of regulatory advocacy work on priority topics such as digital negotiable instruments, digital bills of lading, use of cloud computing, use of electronic signatures and use of trade assets to channel public relief efforts.

Regulators are increasingly being approached by several segments of the financial industry (e.g., securities services, digital assets) with similar requests regarding use of distributed ledger technology for recognising ownership and transfer of intangible assets such as a DLT-based asset.

The dDOC specifications offer the opportunity for policy makers to refer to a vendor-agnostic industry-wide framework.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio