-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Contributed by Alexander Peatzold, COO Trade Technologies & MD Trade Technologies, Germany GmbH

MLETR has been a milestone in trade digitalization, providing the much-needed legal framework for digital negotiable instruments (DNIs) and electronic trade documents. However, while regulatory progress is essential, it does not automatically translate into seamless execution. True digital trade finance must go beyond policy, ensuring that structured, accurate, and compliant documents and data are integrated into end-to-end workflows that work for Corporates and Banks alike.

Despite the progress made in trade digitalization, the transition to a fully paperless trade ecosystem remains complex. From a holistic point of view several key challenges continue to hinder adoption:

What can be stated is that progress was made in several distinct areas of the above-mentioned categories with MLETR being one of the main drivers for change and progress. Having the legal framework in place for paperless trade almost automatically drives technical adoption to benefit from this paperless approach and then in turn impacts the relevant workflows as well.

Even if digital exchange of documents and data is fully implemented, a key question remains: how structured, accurate, and compliant are the shared trade documents? Without high-quality, standardized output, digitization alone cannot solve the inefficiencies in trade finance execution.

The Importance of including a Data Translator in any data ecosystem for Paperless Trade

To gain the efficiency and other benefits of automated and paperless trade, Corporates and Banks need to ensure that the data they exchange is understood in the same manner on each side of the exchange. Since there is not a common agreed language of trade meaning an agreed data definition and format for trade transactions, every corporate, bank, logistics and other counterparty system has been free to define and format data fields in any manner to meet their own business needs. The result is that every system speaks its own trade language and there is no set of data fields in one system that matches exactly with fields in any other system. Disconnects range from date formats, to address structures, to missing fields and fields with wildly different definitions. Historically, these data disconnects have been resolved by using people to review documents and provide a structure for a meeting of minds on the meaning of each data point.

But challenges arise when moving to only data driven transactions. For example:

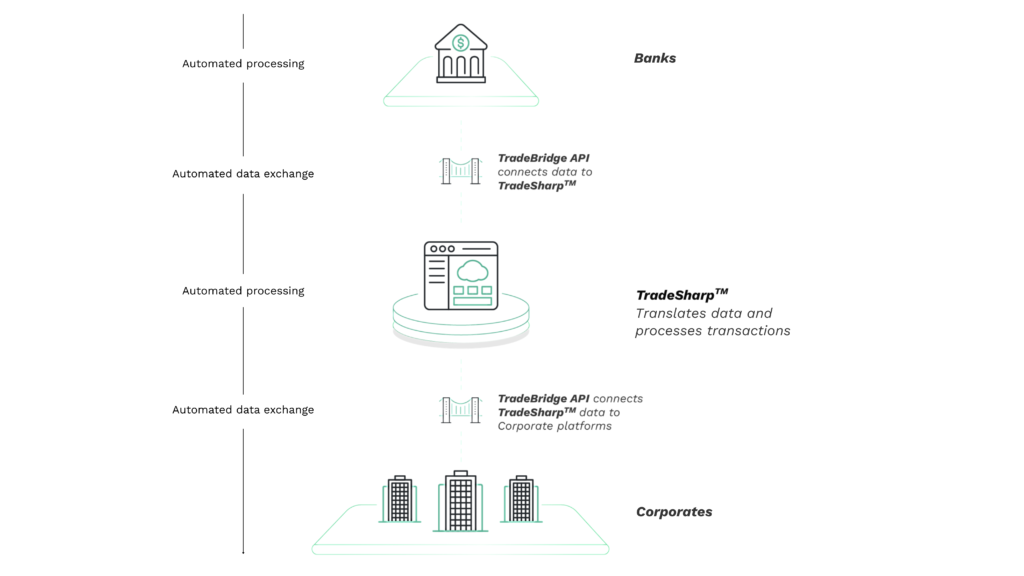

This is where a Data Translator / Data Transmitter comes in. Instead of leaving Corporates and Banks to manually handle these complexities of structuring data in an digestible format, an intermediary can ensure that all trade data and meta data is structured in a way that is immediately processable by financial institutions and their backend systems and vice-versa.

The more counterparties and channels this Data Translator / Data Transmitter can support for the inbound and outbound communication, i.e. paper originals, mail attachments, API etc., the greater the benefits for all players that are connected to this specific player. Ultimately, it is not only about the connectivity within the distinct own network of the Data Translator / Data Transmitter but also about the interoperability with other players and their ecosystems in the market.

The Capabilities of TradeBridgeAPI Bank as Data Translator / Data Transmitter

For more than 20 years, Trade Technologies has played a critical role in bridging the gap between Corporates, Banks, and trade finance ecosystems. Today, our global network enables seamless, structured trade documentation processing, ensuring accuracy and compliance from the moment documents are created to their presentation at banks.

Our impact in 2024:

By acting as a Data Translator and Transmitter, Trade Technologies not only provides seamless, secure connectivity for all parties in its ecosystem but also ensures that trade data is structured and validated to deliver the intended result at the bank systems at its intended destination—helping corporates and banks execute transactions faster, more cost effectively and with greater accuracy.

This role is especially critical as the data standards emerging from initiatives like the ICC’s Digital Standards Initiative (DSI) begin to build the framework for data translation in trade finance. Without a solution like TradeBridge API to translate and structure data across systems, the adoption of these standards would require extensive updates to legacy infrastructure on both the corporate and bank sides. By acting as the connective layer, TradeBridge helps ensure that the transition to digital trade can actually take hold in practice, not just in theory.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio