-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Is your data house in order?

Long considered a pure technical function, archiving transaction data was a topic for the IT people to take care of. The need to access those archives was fairly limited and mostly linked to ad-hoc operational needs. Over the last decade though, regulatory requirements increased the importance of this function, and accessing transaction archives suddenly got on the compliance officers’ priority list. Subsequently, the need for on-line access to transaction data – whether archived or in production – emerged.

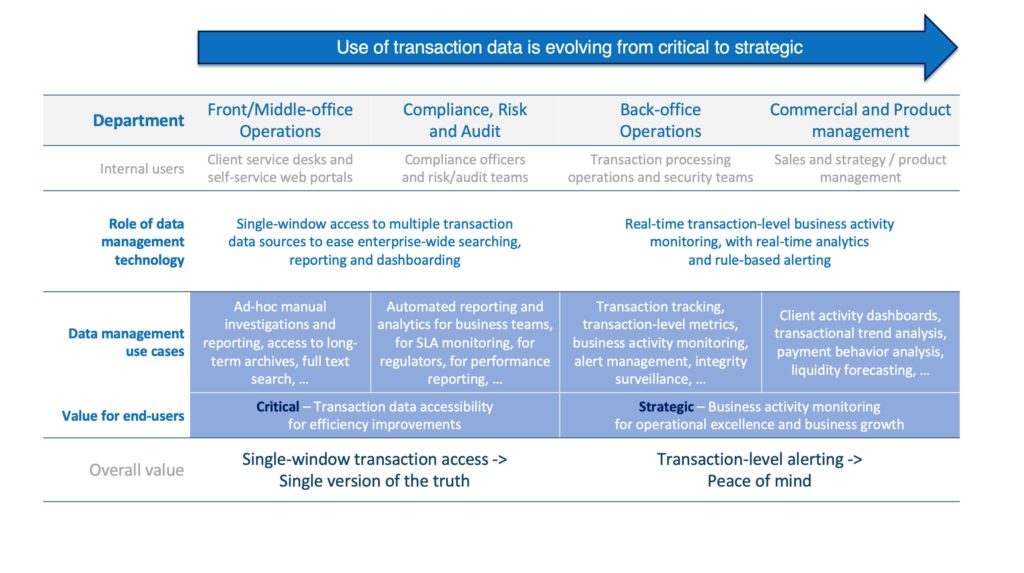

“Accessing transaction data is critical for client service and compliance teams, and it is becoming strategic as more automated processes rely on transaction details to support both operational and market-level decision making”, André Casterman, ITFA

This ability is now raising even more interest within financial institutions as it holds the key to unlock the power of automated processes such as those enabled by advanced transaction-level analytics. Are your transaction data sources accessible? Are you ready to feed automated processes with all expected transaction details?

“Forget about further automating and differentiating your banking services if you can’t access transaction details”, André Casterman, ITFA

Accessing transaction data is critical for operational efficiency

Accessing transaction details has always been a requirement expressed by front-office operations people to help them handle client requests. More recently, as a consequence of regulatory requirements, compliance teams have voiced similar needs as they carry out ad-hoc investigations on past and on-going transactions. The regulatory mandates (e.g., BCBS 239) have indeed made effective information management no longer optional. Accessing transactions quickly got flagged by compliance teams as critical.

“Many banks continue to face technical issues related to data visibility that full compliance requires. Also, a siloed approach to data management raises non-compliance risks”, André Casterman, ITFA

For both client service teams and compliance teams, access to transaction data is sustaining operational efficiency goals, and there is more on the data horizon.

Accessing transaction data is becoming strategic for competitive advantage

The emergence of real-time analytics have further increased the value offered by transaction data. Advanced use cases for back-office operations include transaction tracking, business activity monitoring, real-time rule-based alerting and integrity surveillance. For sales and product teams, access to aggregated analytics and granular transactions help increase insights into client activities and feeds key processes such as credit management and liquidity forecasting. Access to transaction data is becoming strategic hereas use cases underpin competitive differentiators such as operational excellence and business insights.

Big data and advanced analytics represent a new frontier for competitive differentiation. McKinsey & Company

As reported by Mc Kinsey & Company, “For most [non-financial and financial] companies, using data for competitive advantage requires a significant data management overhaul. That includes identifying and assessing the value of existing data, designing a scalable data platform, and developing a long-term data strategy to help the organization achieve impact at scale. It also takes sustained commitment on the part of management, a willingness to make the up-front investment needed, as well as skilled advisers with the experience and technical resources to help organisations design and implement their programs.”

The growing importance of transaction data and the variety of use cases can be summarised as follows:

Whatever one’s business, the realities of today’s marketplace mean that those with the best data systems and capabilities will win — and by an increasingly outsize margin. McKinsey & Company

Privacy Policy | Cookie Policy

Designed and produced by dna.studio