-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Contributed by Bilal Bassiouni, Head of Risk Forcasting, Pangea Risk

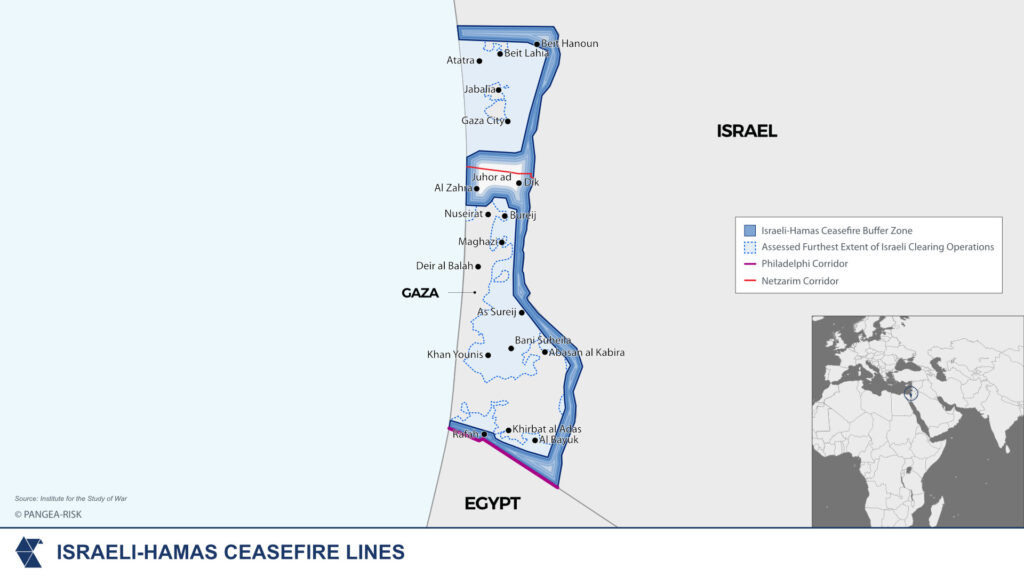

The 15 January 2025 ceasefire agreement between Israel and Hamas represents a pivotal, though fragile, attempt to halt the broader conflict across the Middle East that has persisted since October 2023. Structured in three phases, the agreement begins with an exchange of prisoners and redeployment of Israeli forces to buffer zones, followed by the gradual return of displaced civilians to northern Gaza and, ultimately, the transfer of Gaza’s governance to a transitional authority.

While this phased approach holds the promise of easing the humanitarian crisis and limiting further violence, numerous spoilers could threaten the agreement’s sustainability. Beyond the immediate context of Israel and Gaza, the ceasefire also carries broader implications for the Middle East, influencing regional security dynamics, trade, and economic recovery.

Bilal Bassiouni, Head of Risk Forecasting at specialist intelligence advisory Pangea-Risk, assesses the ceasefire agreement between Israel and Hamas and its implications for regional stability and trade recovery.

A precarious path forward

The phased approach, while structured, leaves critical gaps that could undermine its durability. The most glaring issue is the absence of a clear governance framework for Gaza in the final phase. Competing proposals, ranging from Palestinian Authority (PA) oversight to an internationally administered body, lack the political consensus needed for implementation. This ambiguity creates opportunities for opposing factions to exploit the transition period, undermining both the ceasefire and broader regional stability.

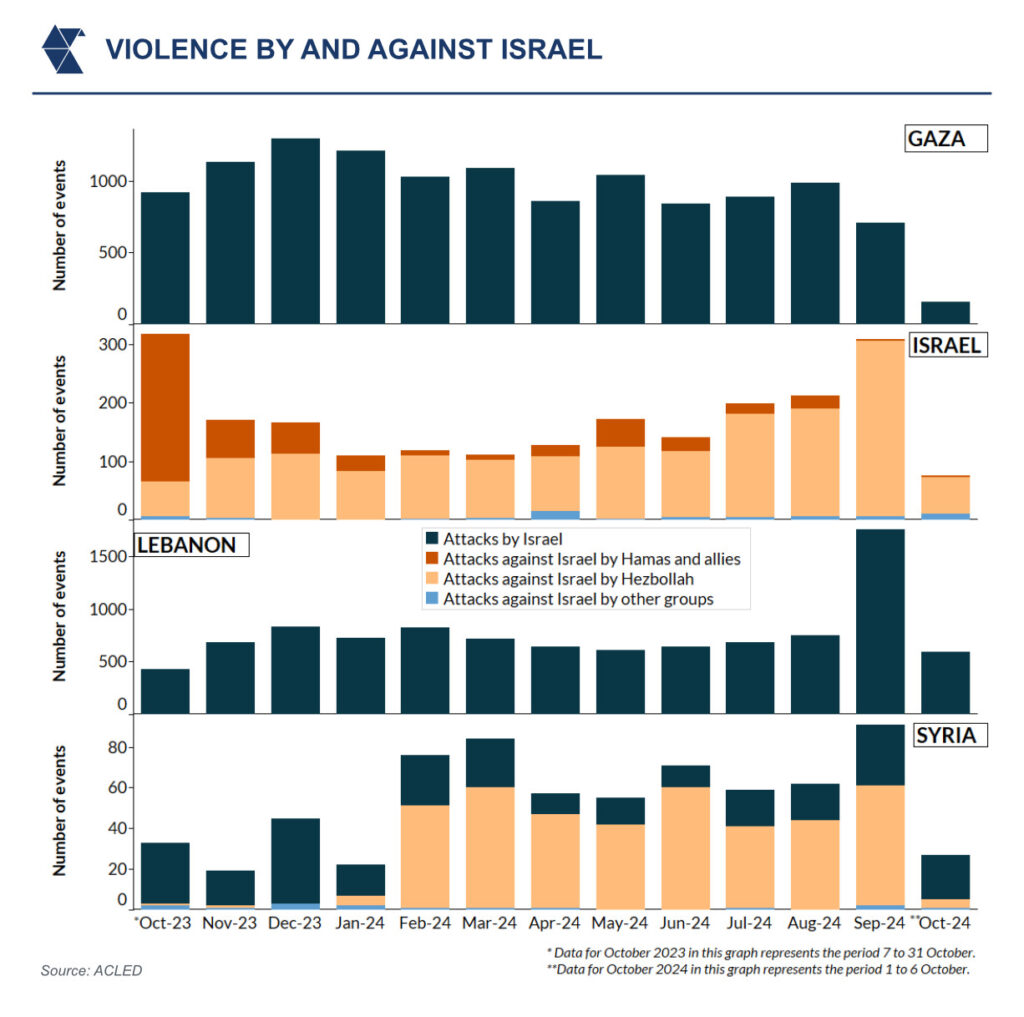

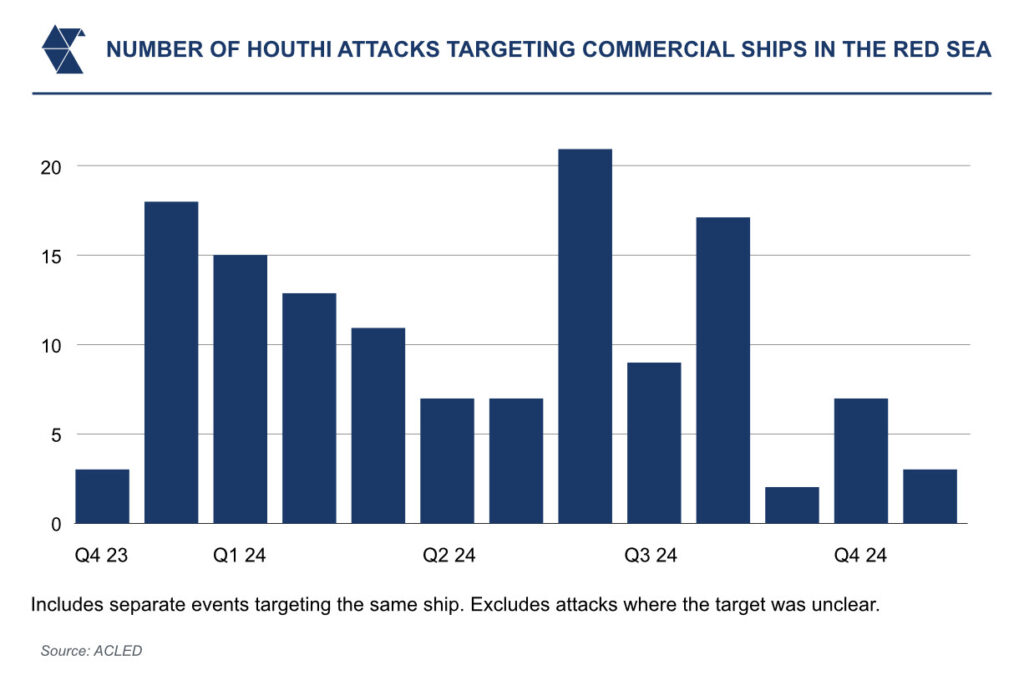

While not directly involved in the ceasefire negotiations, Iran remains a wildcard. The agreement diminishes Iran’s immediate justification for supporting militant activity in Gaza, but it does not eliminate the broader strategic rivalry between Iran and Israel. Hezbollah in Lebanon and the Houthis in Yemen, both key members of the so-called “Axis of Resistance,” have slowed their activities in response to the agreement. Hezbollah, facing setbacks from Israel’s targeted strikes, has maintained its truce with Israel since late November 2024, and the Houthis have announced a pause in Red Sea attacks, albeit with conditional language. The Houthis’ missile and drone capabilities remain intact, and their leadership has warned they are prepared to resume attacks if Israel is perceived to violate the ceasefire.

In the broader geopolitical landscape, the ceasefire also faces challenges from shifting United States (US) foreign policy under the newly inaugurated Donald Trump administration. While the US played a critical role in brokering the agreement, its strategic focus will likely shift towards countering China and addressing domestic priorities. Reduced US engagement in the Middle East could create a vacuum, emboldening actors such as Russia and Türkiye to assert greater regional influence.

Trade and logistics

The conflict has imposed severe disruptions on global trade, particularly in the Red Sea corridor, which serves as a vital artery for oil, LNG, and general cargo shipments. The Bab Al Mandab Strait, through which approximately 10 percent of global oil exports pass, has been heavily impacted by the prolonged hostilities. Since late 2023, the majority of shipping companies have rerouted vessels via the Cape of Good Hope, incurring substantial additional costs. For instance, long-range oil tankers travelling this alternative route face average cost increases of USD 200,000 per voyage, while delays of up to 10 days have strained supply chains.

The prolonged closure of Red Sea routes has forced exporters in Qatar, the UAE, and Oman to divert shipments, adding logistical inefficiencies to an already strained market. With LNG day rates standing at historically low levels – ranging between USD 9,000 and USD 12,000 – further disruptions in the region risk exacerbating imbalances between supply and demand. Japanese and South Korean firms, including NYK Line and Korea Gas Corp, have indicated that they will not resume Red Sea navigation until credible guarantees of safety are established.

The ceasefire has created a cautious opening for the resumption of shipping activity, but insurers remain wary. The Joint War Committee of Lloyd’s continues to categorise the Red Sea as a high-risk area, meaning war risk premiums remain elevated. This hesitancy reflects the broader uncertainty surrounding the ceasefire’s long-term viability. Spoilers such as the Houthis retain the capability to target shipping, ensuring that maritime operators adopt a wait-and-see approach before re-engaging with the region’s key trade routes.

Broader stabilisation effects

While global oil prices have remained relatively unaffected by the ceasefire announcement – Brent crude currently trades at USD 81.8 per barrel – the reopening of Red Sea shipping routes would likely lower transportation costs for Middle Eastern exporters. Key producers such as Saudi Arabia, the UAE, and Qatar stand to benefit from a calmer geopolitical environment, which would facilitate uninterrupted energy trade. However, until the ceasefire demonstrates durability, the full restoration of these routes remains out of reach.

Gaza’s infrastructure, nearly 70 percent of which have been destroyed or severely damaged, requires an estimated USD 10 billion for rebuilding. Key facilities such as power plants, water infrastructure, and healthcare systems must be restored before any semblance of normalcy can return. International donors, including Qatar and the European Union, have pledged conditional support for reconstruction, contingent on the establishment of a credible governance framework. However, this remains the agreement’s most precarious element.

For Israel, the ceasefire presents an opportunity to reduce the financial burden of prolonged conflict. Military operations in Gaza have cost the Israeli government an estimated USD 10 billion over the past 15 months, straining public finances and diverting resources from critical domestic priorities. However, political instability within Prime Minister Benjamin Netanyahu’s coalition threatens to derail efforts to capitalise on the ceasefire’s economic dividends. The potential for early elections before 2027 remains a possibility, adding further uncertainty to Israel’s post-conflict recovery.

Regionally, the ceasefire offers a potential platform for regional stabilisation. Saudi Arabia, which has used the agreement as a stepping stone for re-engaging with Israel, views broader stability as essential for its economic transformation under Vision 2030. However, the Kingdom’s continued engagement hinges on the resolution of Palestinian statehood issues, which remain politically sensitive. Egypt, meanwhile, has prioritised border security and refugee containment, leveraging its role as a mediator to strengthen its regional position.

These stabilisation effects remain contingent on the ceasefire’s durability. Should it fail, the resulting instability would have cascading effects, disrupting trade, energy markets, and regional diplomatic initiatives. The coming months will determine whether the ceasefire can serve as a foundation for recovery or whether it will collapse under the weight of its inherent fragilities.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio