-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

by ITFA’s Emerging Leaders Committee

The economic ties between UK and India have come a long way since 1991 when, India liberalized her economy. After Brexit, the UK is focused on developing engagement with non-European economies. The EU-India FTA negotiation is stuck in limbo with limited chances of revival. India-UK economic ties will hedge bets for both countries.

UK and India are roughly of the same economic size with nominal GDPs of around $2.6 trillion, after the contractions post-Covid-19. The per capita GDP of UK is much higher at ~7x to India’s per capita GDP. While India is focused on value-added exports to the UK, the UK’s financial services sector would find the fast-growing Indian economy attractive.

What is most intriguing is that the service sector contributes ~73% and 54% to GDP of the UK and India, respectively. The UK is the 2nd largest exporter of commercial services with financial services exports contributing ~30%. On the other hand, India is 8th largest exporter of commercial services with ICT contributing 40%. The government of India has liberalized investments in the financial services sector providing significant opportunities to the UK’s financial services sector. Despite service orientation, economies of India and UK do complement each other. The bilateral engagement in financial services and ICT-related software exports can increase multi-fold with a reduction in non-tariff barriers under the FTA.

India’s experience with FTAs has not been the best. The trade deficit ballooned up after FTAs were signed with ASEAN countries. India’s interest lies in balanced growth in trade while ensuring improvement in the competence of domestic industry.

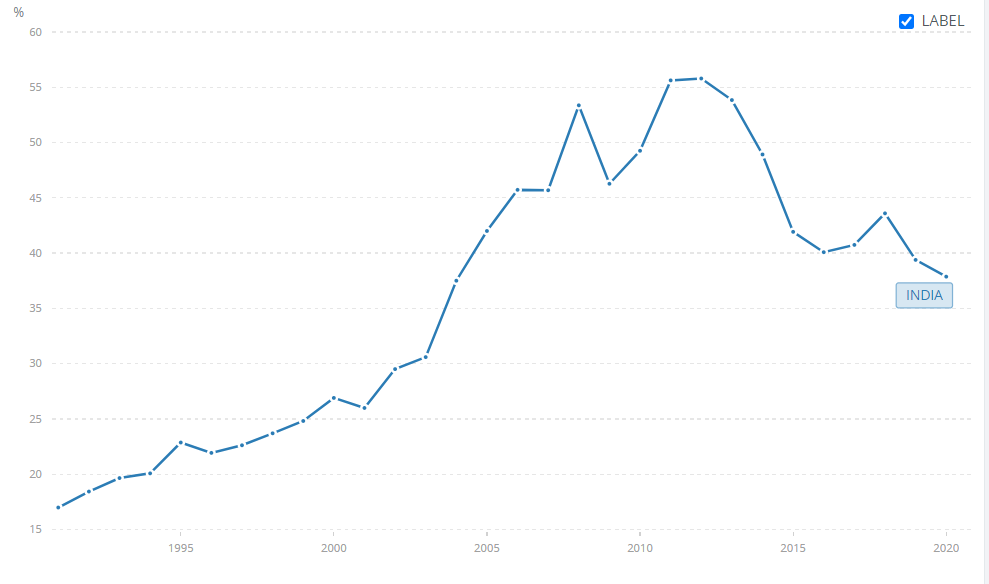

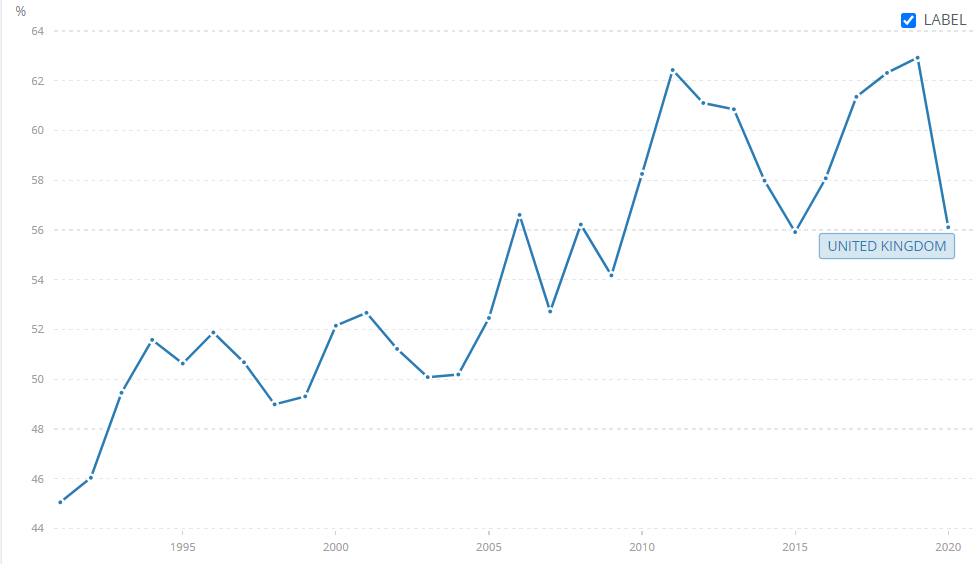

UK is keen to sign FTAs with major trading partners. This is justified by the significant contribution of trade to their GDP. Trade contributes ~55% to UK’s GDP. FTA will reduce tariff and non-tariff barriers reducing costs and improving the competitiveness of businesses in both countries.

The UK exports £5.35 billion worth of goods annually to India. The services exports amount to £3.2 billion. India’s burgeoning middle class is expected to double by 2030, creating huge opportunities for British firms.

India is expected to be a beneficiary of China’s + 1 sourcing strategy. Not many countries other than India can provide the scale and skilled personnel to position itself as a reliable manufacturing hub. Indian policymakers understand this quite well. The government has offered production-linked incentive schemes & tax incentives for new manufacturing units to attract investments in manufacturing. Government’s significant outlay for infrastructure projects will bring in efficiencies and reduce costs.

If successful, FTA will bring benefits to consumers, producers, and society at large. The trade finance community should pay close attention to the growing economic ties between the two countries.

Sources: World Bank, Department for International Trade UK

Privacy Policy | Cookie Policy

Designed and produced by dna.studio