-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

Since our last detailed update during the virtual AGM in December 2020, the Insurance Committee (“IC”) has continued its regulatory work in order to defend the interest of the ITFA members in view of the proposed implementation of the BCBS recommendations for the adaptation of the Basel rules in European law (so called Basel 4 or Finalised Basel 3). The impacts of these proposed recommendations could have significant ramifications for our financial institution members, both banks and insurers.

IC regulatory working group activity Dec 20 – June 21

The IC had several meetings with the European Commission and other legislators in Europe but also with different regulatory bodies such as the European Banking Authority (EBA), the European Insurance and Occupational Pensions Authority (EIOPA) and local regulators such as Bafin in Germany and PRA in the UK. These efforts were supported by advocacy efforts from our members and here we would like to thank AIG in particular who organised several meetings with senior members of European entities. The aim of these meetings was to obtain the support of high ranking officials for the work ITFA did on a technical level with Hume Brophy.

In January we submitted to the European Commission a presentation including all findings we had gathered on an adequate level of LGD for insurance cover. This presentation is available for all ITFA members on our website.

In March 2021, the IC responded to the Opinion of EBA on the treatment of credit insurance in the prudential framework. This document is also available on our website. In this response ITFA addressed four main points put forward in the EBA Opinion:

In April ITFA reacted to the PRA letter on CRR and explained our position in more detail in a meeting with PRA in May.

Besides our discussion with the European Commission and EBA, in order to bring forward our advocacy to a successful next step, ITFA had various meetings with the following European and UK authorities and institutions:

All the above meetings resulted in ITFA submitting in May to the European Commission a proposal to insert an enabling clause in the CRD6 wording to be issued this autumn to implement Finalised Basel III. This enabling clause would allow the EBA, in cooperation with EIOPA, to set up provisions under which conditions and the extent to which insurance cover may benefit from a more risk sensitive application of LGD.

If such an enabling clause is accepted by the legislator and included in CRD6, then ITFA would have to cooperate with EBA and EIOPA in particular to show that the bank-insurance market has evolved, that it is possible to standardise some of the products to ensure comparability and facilitate supervisory scrutiny. Further, ITFA needs to produce data to demonstrate that insurance of credit risk is actually leading to risk reduction and to quantify to which extend this is the case.

ITFA is confident that the market is already moving in this direction and that the data we have collected will show a more risk sensitive approach is merited. Our conversations with Member States have shown a similar support and EIOPA was supportive.

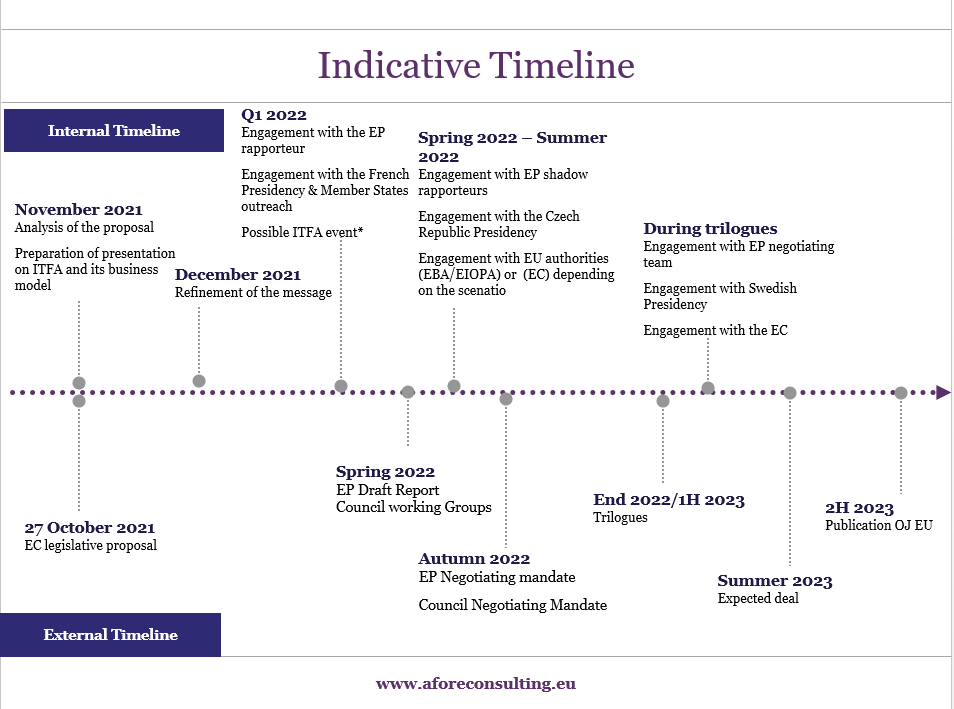

Now that the technical base of advocacy has been establish by ITFA with the support of Hume Brophy, for this next stage, ITFA will be supported by Afore, an influential European public affairs consultancy with a core area of expertise in financial services, regulation and policy who have deep experience in particular with enabling clauses and the strategic efforts now required for this next stage of influence. Hume Brophy has supported ITFA effectively over the past two years and we would like to thank the team and in particular Lucie Binova for their excellent work. Thanks to this cooperation the ITFA IC regulatory working group learned how to find its way through the jungle of the European legislative system in Brussels and our name became better known to all the key stakeholders.

We would especially like to thank our IC sponsors who have helped to co-finance this more intensive work with Afore. We believe the benefits to the wider ITFA members will be critical. You may find more detailed information on the Afore website: https://www.aforeconsulting.eu/. Afore is specialised in the field we need support in, and has excellent connections to all key stakeholders.

Outlook: what happens in the next 12 months?

Our action in the next few months depends on whether the Enabling Clause is included in the European Commission proposal. If it is, then our work will be to defend and even improve the clause during the legislative process in the European Parliament and in the Council and to start to work with the EU Authorities (such as EBA, EIOPA and ECB) on the implementation of the clause. In case the Enabling Clause is not included, then ITFA will work on obtaining amendments through the European Parliament or the Council.

Other work of the IC

Besides the regulatory work, the Insurance Committee has also worked hard in other fields to support ITFA’s members in the field of bank-insurance:

Slides and recordings of webinars are available for our members on our website.

ITFA’s release of a genesis or template version of a harmonized Basel III policy wording (for English law) will breathe transparency into policy documentation with the aim of moving the market to an acceptable standardised starting point for negotiations. This harmonized wording will make policy negotiations more efficient thus reducing cost, increasing margin and most importantly help lead to more rapid negotiations between the bank and the insurer(s).

Don’t miss the launch of this wording at the ITFA Conference in Bristol where Scott Ettien from WTW and Hannah Fearn from Sullivan, will present the new policy in detail in a session on Friday 8.10.2021.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio