-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By the ITFA Insurance Committee

Executive summary

We are aware of recent concerns raised about the payables finance market and related-insurance cover in respect of the bankruptcy of Greensill. Greensill’s activities are not representative of the market. Payables finance is a valuable tool to support the real economy when used properly, and insurance is a reliable partner to the financial institutions involved in this activity. It is a very safe product with low default rates. The Greensill situation is not a systemic issue, rather an isolated case of shadow banking using these financing products incorrectly. Thus, it is imperative to consider the nuances of the Greensill situation to avoid unwarranted contagion into the wider legitimate market which is so critical to pandemic recovery and trade generally. The partnerships of strong global banks and insurers with corporates on payables finance diversifies risk and stabilises the economy across supply chains, and thus should not be penalised under the Basel Framework.

Part 1 of this document sets out how the traditional payables finance product and market works, the critical role of trade credit insurance and the importance of large financial institutions to this market and the economy.

Part 2 of this document sets out why Greensill is an outlier that was not following the traditional payables finance techniques nor the usual banking practices with respect to such risks and insurance

Part 1

Payables finance product and definition

Payables finance plays an important role in providing working capital to corporates enabling trade by allowing a strong buyer to leverage its strength to provide early discount options to its, often smaller, suppliers by way of receivables discount. It strengthens supply chains. Payables finance is defined in the Global Supply Chain Finance Forum’s “Standard Definitions for Techniques of Supply Chain Finance” produced by the International Trade and Forfaiting Association (ITFA) with other industry associations as follows:

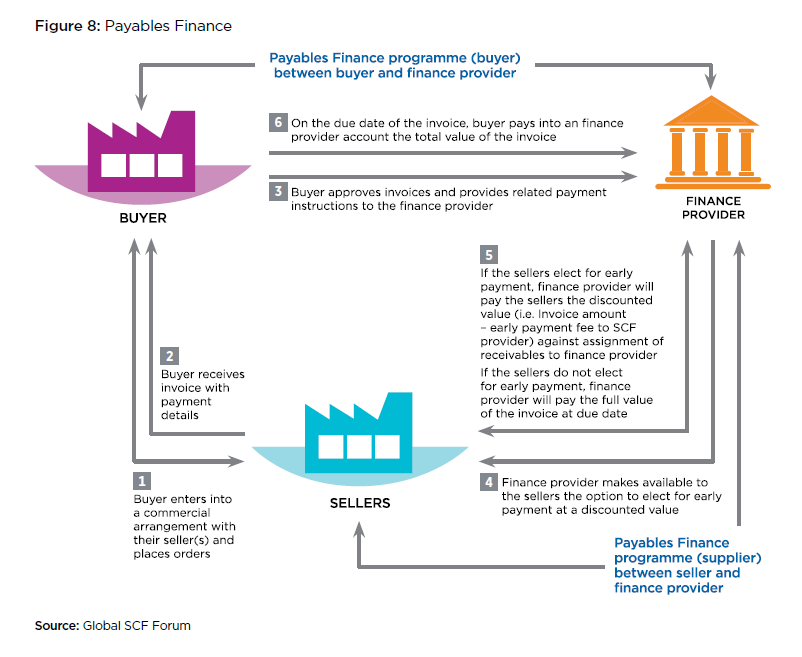

Payables Finance is provided through a buyer-led programme within which sellers in the buyer’s supply chain are able to access finance by means of Receivables Purchase. The technique provides a seller of goods and services with the option of receiving the discounted value of receivables (represented by outstanding invoices) prior to their actual due date and typically at a financial cost aligned with the credit risk of the buyer. The payable continues to be due by the Buyer until its due date.

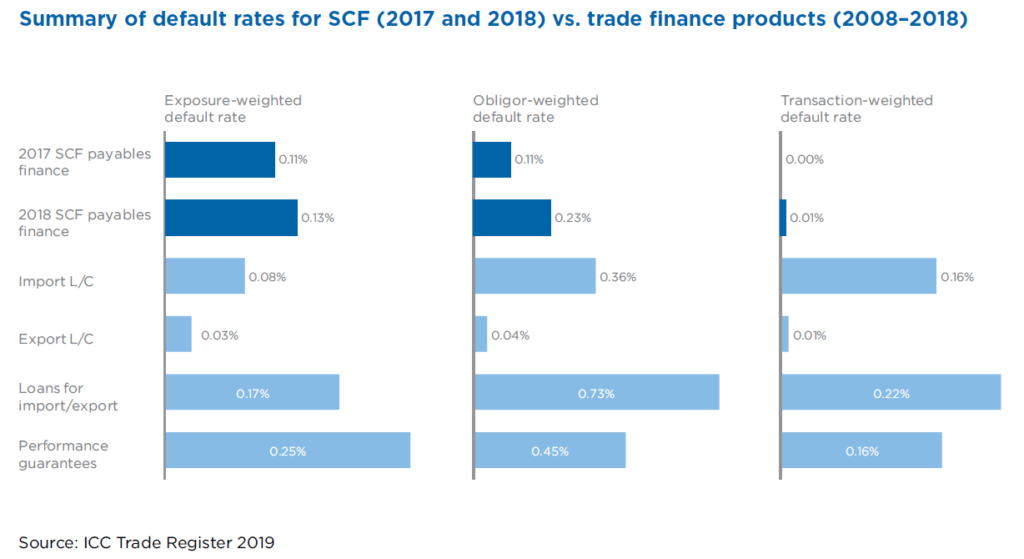

See Diagram 1 below for a graphic on how the payables product traditionally works. Typically, the tenors for payables finance transactions are anywhere from 30 day invoices to about 180 days, with the maximum usually being 360 days or less. Payables finance is a legitimate and safe working capital financing product led by global banks for largely investment grade obligors. The product has low market default rates according to ICC data. Exposure-weighted default rates for SCF in 2018 were 0.13% and 0.11% in 2017; comparable to other trade finance products. Obligor-weighted default rates were 0.11% in 2017 and 0.23% in 2018; coming in below all documentary trade finance products in 2019. This data comes from ICC’s published review of $133 billion in exposures and 2.4 million individual facilities. See below Diagram 2 for a summary of default rates for SCF and wider Trade Finance for comparative purposes. The ICC estimates the market of payables finance to be $50-75 billion per year showing its impact. The product performed well during the Covid-19 pandemic with many programmes expanding both in size and scope of supplier capture to reinforce suppliers in need of working capital cycle support.

Short background to credit insurance

There are two types of credit insurance that are typically employed in relation to trade transactions. The first is trade credit insurance that is aligned to short term revolving trade such as payables and receivables. These underlying finance products are usually cancellable by the bank or other funder as noted above. Therefore, the insurance will typically be risk-attaching to invoices already financed, but often have some form of cancellability often on notice, or one- year reviews given the revolving cancellable nature of this form of financing. This also supports the efficient pricing of the product. The second is non-payment insurance connected to a specific loan (trade-related or otherwise) whereby the insurance will be non-cancellable and co-terminus with the loan. Both types of credit insurance are capable of being structured as Basel-compliant and supporting finance with certainty. Under Greensill’s model, trade credit insurance was believed to be employed.

Why large global financial institutions are critical partners to corporates for payables finance

As it is a buyer-led trade finance product, which provides greater access to finance for suppliers hinging on the strength of the buyer, its traditional use is with strong multinational buyers as obligor. It is also traditionally an uncommitted product which allows for flexibility and optimal pricing. It is not an appropriate tool to be used for obligors with deep liquidity issues or those without other sources of stable financing given its uncommitted nature. It is effective for aligning working capital cycles for the obligor, and then providing suppliers with options for early payment to match their own working capital cycles.

Given the large size of the traditional suitable obligors for the payables product, and the extent of their supplier bases that can run to the hundreds of thousands, these programs can be very large (up to billions of dollars). For this reason, liquidity and stability of the financier is key to sustainability, so large global financial institutions, supported successfully by other large financial institutions (whether by insurance or through participations to other banks and investors and even the capital markets) are critical partners. Non-banks often with technology advantages have successfully arranged many programmes, but these have mostly been funded by traditional banking institutions as well. Large global banks for example have the benefit of vast and stable liquidity as well as extensive relationships with the obligors across multiple other products. They benefit from strong procedures and resources to screen and on-board suppliers again driving compliance and stability. In fact, the resolution to the Greensill situation for the traditional strong obligor payables programs that Greensill did have, has been for the large financial institutions to provide payables programmes to replace those lost due to the Greensill insolvency.

It is critical to enable large financial institutions, both banks and their insurance partners, to be able to continue to support payables finance and other forms of trade finance, as it ensures the strongest players are due diligencing, structuring and monitoring the risks and providing stable liquidity. Appropriate Basel treatment is critical given it is for large lines for strong obligors, so high Loss Given Default floors would, in particular, penalise this kind of critical safe business.

Part 2

Short background to the outlier Greensill

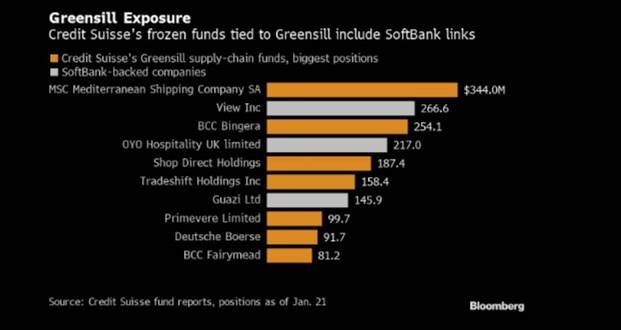

Greensill was a company aiming to revolutionise the payables finance space by bringing payables finance to the masses via an unusual business model. Greensill’s clients were a mix between usual low margin large multinational corporates, and unusual high margin weak obligors including start-ups, traditionally not recipients of payables finance. For liquidity, Greensill leveraged a small deposit-taking German-bank and the capital markets via Greensill Capital (named by the Financial Times as “a sizeable shadow bank”) with key funds arranged by a large global financial services firm (arranging about $10bn of assets according to the Financial Times) and a smaller asset manager (arranging about $842m of assets according to the Wall Street Journal) at the time of bankruptcy. Certain large institutional banks also financed Greensill, usually in respect of segregated payables programs for that large bank’s specific existing clients. These were often packaged up into notes using capital markets technology. Such note repackagings had not previously been used for this asset class to any great extent and, whilst innovative, were not particularly unusual unlike some aspects of the funds. Greensill’s core investors were a large conglomerate holding company (with a large technology-focused venture capital fund) and a global growth equity investor. Greensill was also said to have leading SCF technology, but it is alleged that this was largely provided by third parties.

Trade Credit insurance, covering obligor payment defaults connected to trade, was critical to much of Greensill’s model being a requirement of much of the capital markets funding. Following market losses, concerns about quality of obligors and the general sustainability of the Greensill model, insurers began to exit cover at renewal dates, with plenty of warning, but the lack of replacements ultimately brought Greensill’s liquidity to a halt. It is also noted that many insurers did not ever support Greensill’s model, particularly the capital markets model, noting it was non-standard use of credit insurance as well. At the time of Greensill’s insolvency, a large Asian insurer is reported to have had the most significant risk profile with about $4.6bn, notably connected to a rogue underwriter. This large concentration of cover from one insurer is also notable as financial institutions have strong controls around risk partner aggregations, but Greensill and its funds did not. Most European insurers are believed to have exited the Greensill relationship during 2020, and others prior to that, hence that insurer was the last meaningful insurance provider.

What was unusual about what Greensill was doing

The Greensill structures and practices were reported by the Financial Times and Wall Street Journal, amongst others, to be unusual in many cases. The below are all examples of activity that would not be construed as appropriate by most expert practitioners for payables finance transactions or in fact any financial transactions in some cases. Any large major global bank would deem the below to be red flags and would have compliance structures that avoided such practices:

General lessons learned from earlier non-traditional uses of SCF

Following two other non-traditional uses of payables finance uncovered, ITFA issued in 2018 a response highlighting how payables finance works and what to look out for in terms of non-traditional use of the product. This aligns to the frameworks used by large global banks and other expert practitioners in the payables finance arena. The red flags highlighted here continue to be relevant in addition to adhering to the intended product use described above. Many of the below red flags appear to have been part of the Greensill tactics:

Red flags to be discouraged in payables programs:

Conclusion

Payables finance will continue to be a sustainable form of financing trade supporting corporates across their supply chains, and insurance will continue to be a critical tool in supporting such transactions. Greensill is an outlier that was not following usual practice in respect of payables finance nor insurance. The Bank-Insurance relationship has been built up over years. Banks using insurance for their SCF activities know that insurers – just like the banks themselves – are subject to strict credit and compliance processes. Both industries are complementary as they have different ways to manage and provide for risk. Thanks to this know-how and relationship of mutual trust, working capital needs of corporate clients can be supported consistently and efficiently through difficult cycles. The Greensill situation is not a systemic issue, rather an isolated case of shadow banking using these financing products incorrectly. Thus, it was imperative to consider the nuances of the Greensill situation to avoid unwarranted contagion into the wider legitimate market which is so critical to pandemic recovery and trade generally. The partnerships of strong global banks and insurers with corporates on payables finance diversifies risk and stabilises the economy across supply chains, and thus should not be penalised under the Basel Framework.

DIAGRAM 1:

DIAGRAM 2:

DIAGRAM 3:

Privacy Policy | Cookie Policy

Designed and produced by dna.studio