-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

By: Charlotte Prior, Trade Finance Analyst at GIB Asset Management

Contents

• What is trade finance?

• What is ESG and how is it incorporated into investments?

• Why trade finance suits the ESG philosophy

• The challenges associated with the integration of ESG within trade finance

• View of the future – trade finance to widen adoption and the positive impact of ESG

• Blending ESG with trade finance – a force for better returns and a better world

• GIB AM’s approach to incorporating ESG into trade finance investments – a case study

Trade finance has an undeniable role to play in the development of a more sustainable world. The incorporation of Environmental, Social and Governance (ESG) considerations in trade finance brings widespread benefits to the goods’ and services’ supply chains.

Focusing on ESG factors also strengthens the trade finance sector. Their incorporation into investment decisions enables a more comprehensive review of the risks and opportunities that specific activities or products bring to a portfolio.

However, many challenges lie ahead due to the widespread and concurrent intricacies of:

• the management of ESG factors; in particular the scarcity of data, and the relative infancy of techniques to identify, measure and analyse material factors

• existing limitations of the trade finance asset class – no benchmark index, a fragmented market, multiple stakeholders and the need to overcome technical hurdles

Nevertheless, there is significant scope for trade finance to help achieve sustainability targets, such as the UN’s Sustainable Development Goals (SDGs), and to provide impactful results where most needed and problematic.

What is trade finance?

Trade finance solves the most common trade dilemma. When engaging in the sale and purchase of goods and services, especially at an international level, sellers demand payment before shipping their goods. In contrast, as buyers want to only pay when they receive the goods. This uncertainty around payment and receipt of goods is an inherent risk associated with trade. Trade finance resolves the uncertainty by bridging the gap between working capital cash flows.

By financing the trade cycle at various points of the transaction, trade finance precisely reconciles buyers’ and sellers’ needs. It also enhances participants’ management of the capital required for trade, while mitigating or reducing the risks involved in an international trade deal. It is an essential part of the global economy. Some 80% to 90% of world trade relies on trade finance.(1)

What is ESG and how is it incorporated into investments?

ESG refers to the three central factors (ESG Factors) used to measure the sustainability and ethical impact of an investment. This measurement includes the companies and countries involved within the underlying transaction.

The data collected using these three factors can be integrated into the investment decision-making process.

In its earliest forms, ESG typically used exclusionary criteria. For example, the avoidance of controversial industries such as tobacco and weapons.

As highlighted later, ESG is no longer about avoiding companies in these industries, although that remains a common approach. Instead, it is more focused on engaging with these companies to ensure they conduct their business in a sustainable and responsible manner. ESG has considerably developed over the past 5 years, and as considered below, different asset managers integrate sustainability into their decision-making process via different methods.

ESG is especially being driven by millennials – the next generation of investors. The mind-sets and priorities of this generation are very different to previous generations.

Millennials prefer to invest in a similar way to the way they live. According to a study by Schroders (2017), 86% of millennials stated that sustainable investing was important to them versus 67% of baby-boomers (2).

The role of ESG in modern day portfolio management cannot be downplayed. Doing nothing is no longer the default option for asset managers and owners alike.

Asset owners recognise the risks and opportunities of ESG considerations in their investments. Increasingly, they emphasise the importance of factoring in those considerations across their portfolios. The asset management industry, in turn, has become highly motivated to address investors’ sustainability demands.

Institutional investors typically implement ESG considerations in a number of ways:

• Negative screening or exclusion of certain products, such as cluster munitions;

• Integrating ESG factors into investment buy/sell/ hold considerations;

• Stewardship or active ownership – engaging

• actively with the boards and/or management of investee companies;

• Engaging in less formal dialogue with regulators and other standard-setting corporations to help

• standardise the integration of ESG factors into the investment decision-making process.

Different institutions take different approaches. They blend the three elements above in different ways, to reflect their different investment styles.

Many interchangeable terms have emerged in the lexicon of ESG. A limited list includes responsible investment, ethical investing, socially responsible investing (SRI) and thematic investing. Although the term ‘impact investing’ can also be used, it is important not to confuse this with the other terms described above. As ESG becomes more mainstream, efforts are being made to standardise its different meanings.

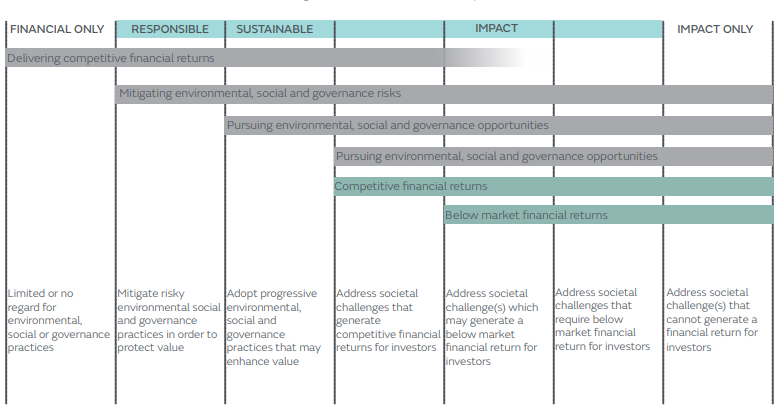

The following chart highlights the conceptual differences between the different approaches.

(1) https://voxeu.org/article/challenges-trade-financing

(2) https://www.schroders.com/en/insights/global-investor-study/2017findings/sustainability/

Figure 1: ESG investment styles

‘’We are in a world of finite resources, which we are consuming at an unsustainable rate. We have to drastically change our behaviour and steer ourselves down the path of sustainability.’’ Tony Cripps – Group General Manager and Chief Executive Officer, Singapore, HSBC

The UN’s Sustainable Development Goals SDGs have catalysed the expansion of ESG considerations within the financial industry, with SDG 17 highlighting the need for the global community to get on-board.

‘’The journey towards sustainable development will only be successful if we all play our own part.’’ Roy Teo, Executive Director and Head, Financial Centre Development Department, Monetary Authority of Singapore.

There is no doubt that financial institutions and businesses have a key role to play in the transition towards a sustainable economy. The UN’s Declaration on financing for development specifically identified short-term trade finance as an important means to achieve the SDGs, in particular SDG 1 (no poverty) and SDG 8 (decent work and economic growth).

‘’Trade finance plays a key role in helping developing countries participate in global trade. Easing the supply of credit in regions where trade potential is greatest could have a big impact in helping small businesses grow and in supporting the development of the poorest countries. The availability of finance is also essential for a healthy trading system. Source: World Trade Organisation (3)’’

Why trade finance suits the ESG philosophy

According to the World Trade Organisation, “trade can play an important role in boosting economic growth and supporting poverty reduction”.(4)

At its simplest, trade finance is a funding mechanism to finance and facilitate trade. It finances the supply chain for goods and services. Ten years ago, international banks dominated trade finance. The 2008 financial crisis drove a tightening of regulations. Banks adopted enhanced financial controls, elevated due diligence requirements and stricter risk assessments. The adoption of Basel II and Basel III also led to increased capital requirements.

The inherent risks involved with cross-border trade made traditional lenders reluctant to finance some companies, especially SMEs. This reluctance has created a wealth of opportunities for specialist fund managers as the trade finance gap grows.

Through active engagement, trade finance drives the implementation of ESG

Trade finance has a direct impact on the real economy. Through both direct and indirect lending, trade finance providers such as funds, merchant companies and banks are able to build relationships on the ground in key commodity markets. This provides “invaluable insight and market intelligence, which [in turn] leads to better lending decisions”(5) , therefore meaning “better returns and fewer losses for underlying investors”(6).

Through these relationships, lenders are able to engage actively with borrowers, especially with the smaller SMEs.

Practitioners of trade finance can drive the implementation of ESG at the operating level through active engagement. Asian and African trade involves the highest usage of trade finance. African and Asian countries also have the highest need for ESG investment. Trade finance practitioners are in a prime position to provide funding where it is most needed. They can influence corporate governance and transparency, help eradicate child and slave labour, and improve gender equality. Trade finance can be a significant contributor towards meeting the UN SDGs.

Active engagement between lenders and borrowers is already driving positive change. Lenders are incentivising borrowers with reduced lending rates if they achieve certain ESG related milestones. Recently, some revolving facilities provided by large banks, have offered tranches enjoying preferential pricing if lenders meet “green components” or “reduced carbon” targets

In April 2019, HSBC and Walmart joined forces to roll-out a sustainable supply chain finance programme. The programme pegs a supplier’s financing rate to its performance against sustainability targets (7).

The global programme allows Walmart’s suppliers, demonstrating progress in Walmart’s Project Gigaton or Sustainability Index Program, to apply for improved financing from HSBC.

In another example, Rabobank have set specific ESG KPIs for their borrowers. They will then monitor the progress of these KPIs over a year and, if on target, the borrower will receive a reduced financing rate. On the other hand, if the borrower does not meet the KPIs they will increase the financing rate.

‘’ Sustainable supply chain finance is an unrealised opportunity to improve supply chains while also achieving sustainability goals. Business for a Better World (BSR)”. (8)

(3 & 4) https://www.wto.org/english/res_e/booksp_e/sdg_e.pdf

(8) https://www.bsr.org/reports/BSR_The_Sustainable_Supply_Chain_Finance_Opportunity.pdf

Blockchain technologies

Technology within trade finance is capable of supporting smaller businesses in their capacity to export.

According to the WTO, around 58% of SMEs’ financing requests are rejected. This compares to only 10% of requests by multinationals. (9)

This is especially the case in Africa and developing Asia. In part, this disparity is linked to the high costs of initial KYC checks required to on-board new customers in these geographies. The size of these costs penalises smaller transactions. Adoption of blockchain technologies could reduce the costs related to identification documents. Customer data is also easier to share securely on block chain platforms.

Just one example of these blockchain systems is Halotrade. When piloting their idea, Halotrade tested it out on tea farmers in Malawi. They gathered information on the individual farmers and were able to create accounts for each farmer. This meant that Sainsbury’s and Unilever (the buyers) were able to trace exactly where their tea had come from. Halotrade were then able to trigger payment to the farmers once they had delivered their tea to the warehouse, speeding up the payment cycle for all parties using blockchain technology.

This meant that cost savings were achieved in the supply chain for Unilever and Sainsbury’s. Once the cost savings had been identified and quantified, Sainsbury’s and Unilever both agreed to use these savings for further education, training and other social services. Instead of the funds being directly returned to the farmers, they are used to help farmers attend classes and training, enabling them to improve their businesses as well as employing sustainable practices.

Over-turning gender biases

Gender issues are pervasive within the asset class. A 2017 survey found that female-owned firms “were 2.5 times more likely to have 100% of their trade finance proposals rejected by banks than male-owned firms.” (10)

The ADB report stresses that those rejections stem from KYC concerns (29%), the need for more collateral or information (21%) and lower profit margins for banks (15%).

Trade finance funds or alternative investors could have a direct impact on addressing the gender imbalance at play. Through collaboration with local organisations and development banks, smaller financiers are able to provide financial services to SME’s and female owned firms.

The challenges associated with the integration of ESG within trade finance

Some of the challenges to the adoption of ESG within the trade finance industry are common to many other asset classes. However, trade finance exacerbates these challenges, and brings its own unique ones. Key amongst these are a scarcity of data, a lack of standardisation of approach, an ESG knowledge gap and few common measures to compare performance.

Insufficient ESG data

As there is no public ESG data available to Trade Finance parties, the methodology used in gathering such information is critical to ensure an adequate and meaningful incorporation into their impact analysis. It also determines the impact associated with their investments. This differs materially from manager to manager, and points to the need for heightened diligence when selecting a Portfolio Manager able to meet the objectives of an investment mandate.

The growth of ESG indices has supported the development of ESG in other asset classes. The first ESG equity index was launched in 1990 followed by a global ESG equity index in 1999. The first ESG fixed income index launched in 2013. The availability of indices and their data is important. They help to set standards for categorising ESG factors and provide benchmarks for performance analysis. However, trade finance is a highly qualitative business. No ESG trade finance indices exist due to the lack of data, lack of standardisation and lower amount of regulation in the sector.

Hurdles to a standardised approach

One of the most active challenges within ESG investment is identifying specific issues that are genuinely material to a sector and company.

There are substantial differences between sectors. There are also differences between what is most material to individual companies within a single sector, given the specificities of their business model, operations and geographical exposure.

Many companies are now thinking about implementation of ESG into their decision-making process.

Investors are increasingly looking at incorporating ESG policies into their portfolio companies, especially given the increased focus on climate change. Complicating matters, investors use a number of different sustainable investment styles, including negative screening and positive screening. Negative screening is the act of rejecting stock such as alcohol, tobacco or weapons.

A positive screen would be to select companies that set positive examples of environmentally friendly products and socially responsible business practices. Impact investing or thematic investing are among some other sustainable investment styles. Companies are also using very different methodologies as they try to address the varying ESG demands of asset owners.

Although the lack of standardisation and common framework is a challenge across all asset classes, investment managers exposed to public securities and larger issuers can rely on a wider set of data points. Many use the services of ESG research providers such as MSCI or Sustainalytics.

Once again, there is no harmonised approach across these providers. They use different methodologies to determine the issues that are material for each sector.

To read more about these data indiscretions, please visit our previous thought piece entitled “A Sanity Check on Practicality”

(9) https://www.wto.org/english/res_e/booksp_e/sdg_e.pdf

(10) ADB’s trade finance Gaps, Growth, and Jobs study of 2017

Additional impact of light regulation

The light touch regulation applied to the trade finance sector is an additional driver of the lack of standardisation. There is some standardisation across traditional trade finance transactions, via the use of Letters of Credit or other negotiable instruments.

However, the bulk of trade finance business is in Emerging Markets involving SMEs mainly than larger companies.

These jurisdictions often have lower levels of governance, and there are no specific trade finance regulators or designated exchanges to trade finance instruments.

Although trade finance instruments have been used for a long time, trade finance as an asset class is still recent, dating back around ten years. This means that existing trade finance Funds are not homogeneous and often only have a short track record.

Lack of transparency and reporting

There is no dedicated exchange for trade finance instruments. Nor are there ESG benchmarks against which asset owners can measure performance.

Asset owners’ concurrent requests for bespoke ESG reporting with greater transparency and standardised benchmarking creates difficulties for investment managers.

Whilst there may be a lack of transparency and reporting on ESG in other asset classes, there is a near absence of transparency and reporting in trade finance.

An ESG knowledge gap

With the negative consequences of ignoring ESG principles becoming increasingly obvious, ESG is more and more prevalent.

Many companies are implementing ESG in their decision-making processes. However, there is a scarcity of seasoned ESG professionals. Even though demand has skyrocketed, investment firms have found it hard to recruit professionals with both ESG knowledge and investment experience.

It is evident that sustainable banking practices and ESG considerations in trade finance are being largely driven by the European banks, such as Standard Chartered Bank, Rabobank, ABN Amro and ING.

Mismatched skill sets between ESG and investment professionals

The typical separation of ESG responsibilities and investment analysis within many Asset Managers can affect the integration of ESG issues into the investment process. The knowledge gap hampers the collaborative environment typically required.

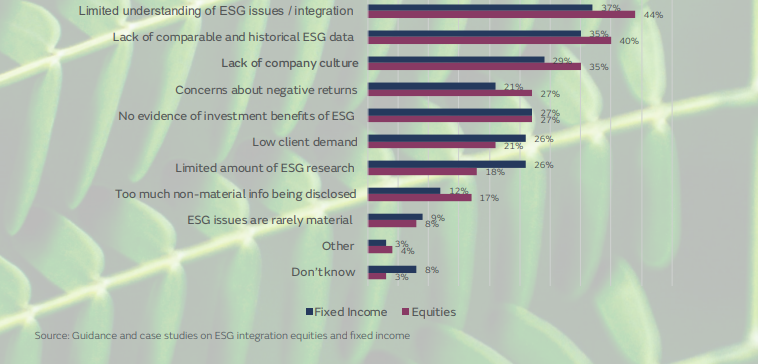

Historically, the focus of ESG roles has been on governance, engagement and voting. ESG professionals did not historically need an investment qualification or background. (11) According to recent reports published by the CFA Institute and the PRI, the main challenge of ESG integration is a limited understanding of ESG issues.

The lack of an ESG orientated company culture is also a major barrier.

However, we are in the middle of a transition. Ten years from now people won’t be having conversations about ESG as a separate discipline.

ESG will be part of how one does business in the investment world. (12) Whilst we make this transition, training of professionals is of paramount importance.

Whilst some training sessions and exams are slowly starting to emerge in the ESG space, these sessions and exams target the investment world primarily and not the banking world.

(12) Jane Ambachtsheer, Mercer Investments

Figure 2: ESG integration survey

The myth that ESG investment is a drag on returns

Typical investors’ lack of knowledge of ESG has also slowed its implementation. Compared to five years ago, 83% of advanced investors in Hong Kong said sustainable investing has become more important.

64% of them have increased their investments in sustainable investment funds as a result. In contrast, only 77% of less advanced investors had the same view with 53% of them increasing their sustainable investments.

This suggests that experienced investors better understand the benefit of integrating sustainability into their investment portfolio.

However, dispelling a key myth regarding ESG will support its validation by all investors. Some investors and investment managers still view ESG investment with deep scepticism.

That view follows the narrative that ESG incorporation will limit the universe of investments and therefore the potential performance opportunities.

Once again, better transparency and reporting would help close the investor knowledge gap around ESG and create a virtuous circle encouraging investors to integrate sustainability into their investment portfolio.

Historically, ESG investing has mostly focused on managing portfolio risks. One delegate at a UNPRI workshop stated that ESG professionals and investors alike tend to speak only about risk, and not opportunities. Changing this focus to ESG as a source of sustainable competitive advantage which can stimulate market outperformance is gaining momentum with investors.

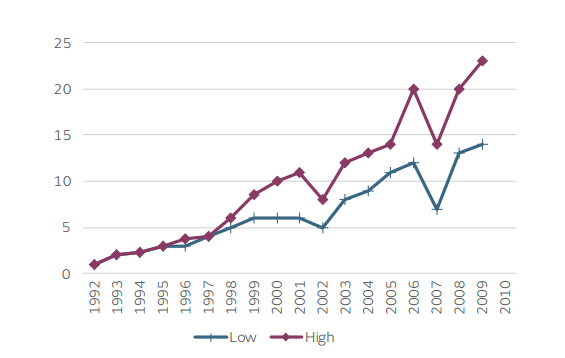

The Eccles et al (2012) study “The Impact of Corporate Sustainability on Organizational Processes” identified companies that had long-standing good practice in terms of sustainability (closely relevant to ESG).

It underlined that, “High sustainability companies significantly outperform their counterparts over the long-term, both in terms of stock market as well as accounting performance”. (13)

The graph below shows how stocks of sustainable companies tend to significantly outperform their less sustainable counterparts. It shows the evolution of $1 invested in the stock market in value-weighted portfolios. There are numerous studies documenting(14).

‘’ There is still a big part of the investment community concerned that ESG will jeopardise returns. That concern is based on old information.’’

Jane Ambachtsheer, Global Head of Sustainability BNP

There is however, criticism that ESG data does not go far back enough to provide complete historic and conclusive evidence. Therefore investors want further proof that ESG leads to opportunity rather than merely mitigating risks.

(13) https://www.nber.org/papers/w17950

(14) Shedding Light on Responsible Investment: Approaches, Returns and Impacts,” Mercer, November 2009.

View of the future – trade finance to widen adoption and the positive impact of ESG

The steady growth of ESG investing began accelerating around 2013 and 2014, when the first studies were published showing that good corporate sustainability performance, and especially sound corporate governance, is associated with solid financial results.

The idea that investors who integrate corporate ESG risks can improve returns is now spreading across capital markets on all continents. This has extended to some providers of trade finance and to trade finance funds. With the increasing evidence that ESG principles have a positive impact on long-term risk adjusted returns, investors welcome the addition of new asset classes and strategies. However some of the restraining factors already identified need to be better addressed.

The development of ESG indices and better reporting

As noted, the lack of indices measuring trade finance transactions causes a particular challenge for the trade finance asset class. The creation of trade finance indices will require some lateral thinking but is not insurmountable.

Better reporting, transparency, and the development of indices, will lead to improved access to information, meaning investor attitudes, values and beliefs will change.

Further spurred on by market pressures, investors will be able to take a better long-term view, strengthening their approaches to ESG investing, and helping solve the dilemma between the short-term and long-term benefits referenced above.

The rapid development of tradetech and fintech solutions will make reporting of ESG factors a lot easier for the trade finance industry.

The role of technology

Technological advances can also drive the standardisation of data and common standards across the trade finance industry.

There is huge potential for blockchain technology to provide industry solutions to improve trade efficiencies, reduce cost, reduce fraud and reduce compliance risks.

As already seen in the Australian speciality beef industry serving Chinese consumers, blockchain can also solve the problem of traceability and enable customers to trace the origins of products and the sustainability of the supply chain.

The Halotrade project, allowed Sainsbury’s and Unilever to trace which farmer their tea had come from in Malawi. Unilever then took this a step further, and printed the story of the farmer for specific tea on the bags sent out for consumer use.

Bridging the knowledge gap

Some trade finance practitioners have started to hold ESG conferences or sessions where they share their knowledge or approach. Transparency is key to overcoming this challenge. Sessions like this will really help the trade finance industry overcome the knowledge gap surrounding ESG. Smaller Trade Finance funds also have a part to play.

They engage with SME’s on a day-to-day basis through their work stream, allowing the sharing of ESG knowledge across continents and throughout companies – again helping to close that knowledge gap. In this way, smaller borrowers can be encouraged to improve their governance, improve gender equality or develop the skills of their workforce.

Blending ESG with trade finance – a force for better returns and a better world

There is huge potential for the trade finance industry to play a large role in delivering the UN SDG’s with active engagement and on-going monitoring

Finding a harmonious way for ESG investing and trade finance to function together faces several challenges. These challenges are surmountable and their resolution opens a huge opportunity and potential for the trade finance industry to contribute to the UN SDGs.

The growth potential of the asset class may accelerate as banks securitise pools of trade finance assets to provide a more liquid debt instrument to institutional investors. Within this context and the growing consideration of ESG factors for asset owners, there is an avenue for them to demand the incorporation of ESG considerations or clearly defined ESG outcomes into those securities.

Sustainability is relevant to all companies as it helps to ensure their long-term viability. It establishes a triple bottom line that seeks to improve social and environmental value along with financial return. We believe that sustainability does not inhibit—in fact, it improves— a company’s ability to create value.

By actively engaging with counterparties and other companies that make up the supply chain, trade finance participants can encourage many environmental, social and governance changes throughout the industries that they fund.

As ESG gains momentum in trade finance, sector and country indices will be developed, allowing benchmarks to be created. ESG in trade finance will then become more transparent, with participants reporting more. These advances will change the attitude, values and beliefs of smaller investors when considering ESG linked trade finance. They will be encouraged to take a long term approach with commensurate benefits to the ESG investment industry and corporate behaviour.

There is a clear business case for sustainability and superior ESG practices. They lead to superior operational performance and lower cost of capital. Investing in ESG products is not enough. Participants need to engage and work together to help create sustainable markets for all. The trade finance sector is very well positioned to create a virtuous circle between the adoption of ESG principles by companies, their short term financing and the provision of longer term investment capital to drive attractive, sustainable growth.

GIB AM’s approach to incorporating ESG into trade finance investments – a case study

At GIB AM, sustainable investment forms part of our philosophy. We began by merging the Saudi Vision 2030 and the UN SDGs to develop the pillars that were most important to us.

The pillars of our framework are as follows:

This framework is then filtered down across the different asset classes. The Trade Finance team adopts a double-tiered approach.

First we look at our Counterparties, and ask them to fill out our Counterparty Sustainability Questionnaire.

The questionnaire provides non-exhaustive questions, based on the pillars of our overarching framework that are used to assess how a counterparty incorporates ESG and conducts its business in a sustainable and responsible manner.

Secondly, we look at each transaction and obligor. As we do not lend directly, we are often undisclosed to the obligors and so onsite visits of obligors is often difficult. We therefore encourage counterparties to assess ESG factors during their due diligence onsite visits. We also request that counterparties fill out our Transaction Sustainability Questionnaire, on behalf of the obligors.

The questions in the Transaction Sustainability Questionnaire are also based upon the pillars in our overarching framework.

Whilst many trade finance transactions are short-term, we aim to build long-term relationships with our counterparties.

This enables us to continue our engagement with the counterparties over a medium to long-term basis. We look to engage actively with our counterparties to support them throughout our relationship, encouraging them to conduct business in a more sustainable manner.

Through engagement with our counterparties, we hope for a ripple effect further into the supply chain. With our encouragement, counterparties work closer on the ground with obligors, especially the smaller enterprises, in developing countries to help develop and guide those obligors to conduct their business in a sustainable manner.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio