-

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

ITFA represents the rights and interests of banks, financial institutions and service providers involved in trade risk and asset origination and distribution.Our Mission

This article was produced and published by HBL.

The recent change to suddenly move to a working-from-home model has really tested many organizational processes, practices and their general ability to operate. There is no denying that all organizations have been forced into an introspective view of their business operations and processes since the world has gone into an unprecedented lock down.

While documentary trade practices have continued to rely heavily on the exchange of paper documents and the manual process involved; transmitting documents in a timely manner continues to pose a real challenge. Additionally, the documents now need to get to the right destination – currently, the home of a document checker. All these challenges make current processes even more difficult and sometimes impossible.

The only logical solution for Trade to mitigate this risk is through technology and a digital approach to Trade Operations. We are now starting to witness a time when the global trade world is genuinely looking to change their current trade processes and move into a more digital world!

On Tuesday, June 02, 2020, HBL in collaboration with Traydstream and International Trade and Forfaiting Association (ITFA), hosted a webinar for trade clients, engaging approximately 400 participants, on “Managing Trade Digitally through COVID-19 and Beyond”.

The webinar provided customers with a global perspective from leading financial institutions and international Fintechs on how the adoption of digital trade finance initiatives/solutions can transform organizations by increasing efficiency, reducing working capital needs and providing a simple business continuity plan to ensure minimal disruption due to COVID-19.

Faisal Malik; Head, Transformation and Process Re-Engineering, HBL; while moderating the webinar quoted the Director General, Azevêdo, World Trade Organization: “If the pandemic is not brought under control, and governments fail to coordinate policy responses, world merchandise trade is set to drop by between 13% to 32% in 2020.”

The session commenced with an opening note from Muhammad Aurangzeb, President & CEO, HBL, who outlined the Bank’s response to the pandemic and its move from Wave 1- Crisis Management – towards Wave 2 – adoption of the New Normal- with an emphasis on Agility, Technology, Data-Driven decisions and AI to be effectively used to serve clients.

He emphasized that HBL is at the forefront of using the liquidity and funding assistance being provided by the central bank to help customers negotiate during this difficult time period. While elaborating upon the sudden move to digitization, he quoted Vladimir Lenin: “There are decades where nothing happens; and there are weeks where decades happen”.

The webinar created an emphasis on the need for legal and regulatory change, an issue which was advanced towards, Syed Irfan Ali, Executive Director, Banking Policy and Regulation Group, State Bank of Pakistan (SBP).

Mr. Irfan responded that while the presentation of physical original documents is still a regulatory requirement in many countries, including Pakistan, SBP fully supports digitalization in trade. He added that SBP is considering to review existing regulations to pave the way for electronic transmission of trade documents as well the usage of cloud services. He also invited the forum, especially banks, to share proposals in this regard through Pakistan Banking Association identifying the associated risks and their related controls.

Outlining HBL’s global reach and international clients, Faisal Lalani, Head- International Banking, HBL, pointed out that Pakistan’s geographical footprint makes it a very good enabler for facilitating trade and said: “What we’ve done is that we came up with a corridor strategy about a year and half ago in trying to connect all our international operations through Trade, and effectively grow our franchise using this strategy”.

He outlined the opportunities and elaborated the steps taken to make everyone accessible through technology not just in the wake of COVID-19, but also as we proceed ahead. He added: “Although we’re looking at the drop in global trade numbers [due to the pandemic], our belief is that basic trade finance will be the first asset class to make its revival which is something HBL is continued to remain prepared for and has effectively put all processes in place to make sure that when that revival comes through, we are there ready to process those transactions for the customers”.

André Casterman and Sean Edwards, the Advisory Board Member and the Chairman, respectively, at ITFA provided an update on Fintechs in Europe, a broad outline of the global market and stated views on electronic documents from legal perspective. André Casterman highlighted the various fintech innovations which help banks and their clients today: “Technology innovations aim to improve the user experience and to address the funding gap through digitization and automation of origination and distribution processes. The last 5 years have been very productive as fintechs embraced advanced technologies such as data management, distributed ledger, machine learning and natural language processing”. Sean Edwards stated: “When debating policy change, it is important to look at specific pain points and to deal with those with targeted legislation, rather than trying to pass broader legislation. ITFA is setting up a task force to provide pragmatic guidance in this area”.

Michael Vrontamitis, who co-chairs the Digitisation Committee for International Chamber of Commerce (ICC), shared his views on how the ICC expects changes to how documents can be digitized. Michael said: “Digitization of trade involves a complex set of stakeholders. Collaboration between stakeholders is critical to automate trade, to enable more inclusive access to finance, improve productivity and protect livelihoods.”

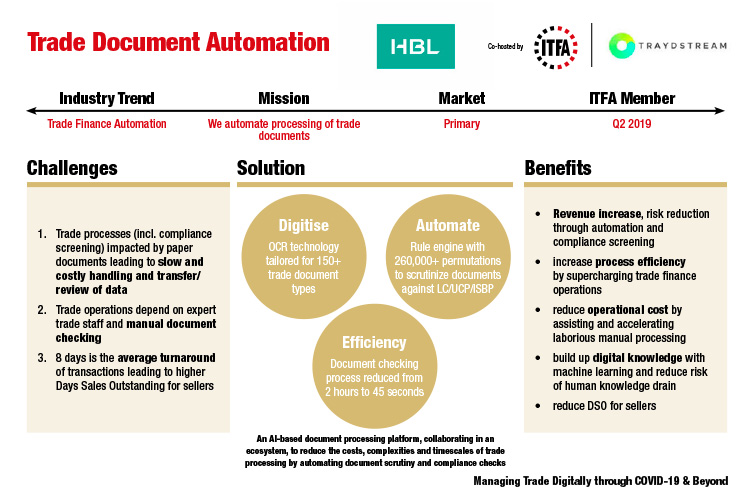

Uzair Bawany, the Chief Revenue Officer and Co-Founder of Traydstream, elaborated on integrated solutions and cost benefits of trade digitalization highlighting value addition through technology. He said: “Digitization ten years ago was probably not even possible, however AI that we adopted have revolutionized over the last 5 years to a point where it has become scalable. There is very clear business case value in digitization which also has a huge upside in terms of the value it digitization can bring to a company, not only from a cost but from a revenue perspective as well.”

He elaborated that while trade has remained a very manually intensive process which requires continued serial approach, a lot of thought has been put into how can this be immediately changed without necessarily having to have everyone impacted in the supply chain, and further described the mechanism:

The webinar ended with Mushtaq Panjwani, Head, HBL trade Operations emphasizing that digital trade/paperless trade is not ‘nice-to-have’ anymore, but has shifted to a ‘must-have’ solution to enable a convenient flow of trade. He further mentioned the initiatives taken by HBL, such as providing WeBoc Services throughout the week and created a designated help-desk to facilitate trade clients by the use of technology. Taking a hybrid approach, he mentioned that HBL is sending advices etc. back to customers via their inbox, without having to have the customer physically come to the branch, along with soon launching a new interface for all trade customers to process multiple transactions digitally, at their convenience.

Three different polls were conducted during the webinar encouraging participants to share their immediate views regarding the promotion of digital/electronic transmission of trade documents and adoption of cloud based solution trade digitization, where around 98 % of the participants were in favor.

Privacy Policy | Cookie Policy

Designed and produced by dna.studio